1. American Workhorse

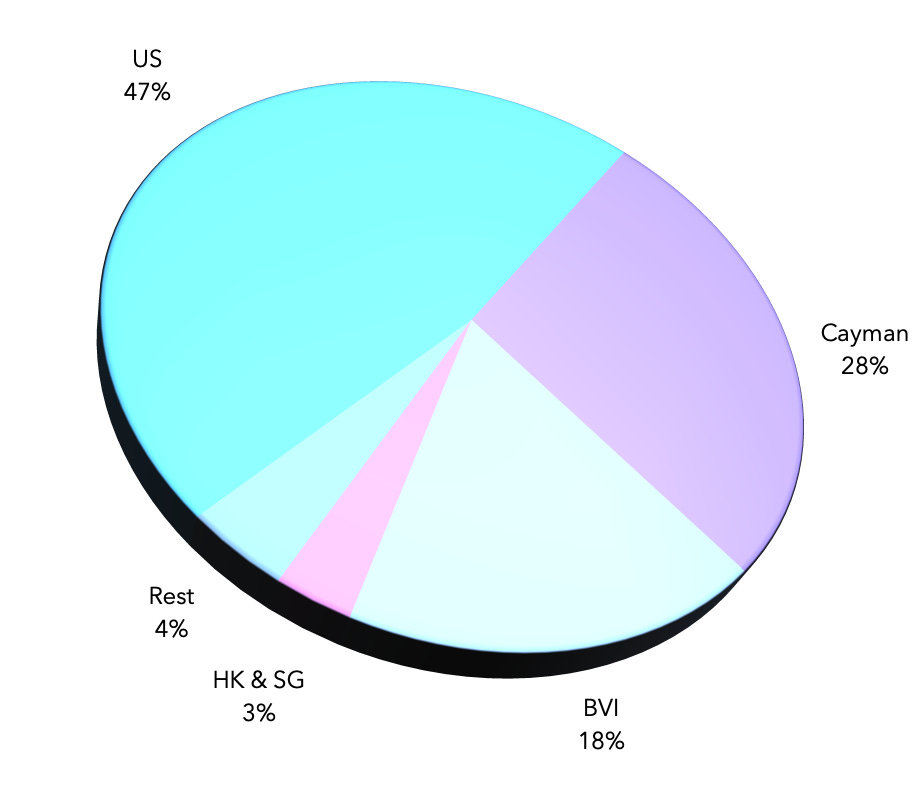

In terms of overall numbers, Limited Liability Companies (LLCs) in the United States come in highest: 47% of all companies we form are LLCs.

This number excludes the LLCs formed onchain using our otoco.io blockchain company assembler.

This result shows the LLC is the workhorse of the crypto company fleet: it’s a cheap, fast, and anonymous vehicle that lends itself to multiple use cases, from an instant Single Member holding entity to a U.S.-based crypto hedge fund.

The demand for LLCs has propelled the US to our top jurisdiction, despite many people’s misgivings about the U.S. as a place to set up a crypto business.

We take a more contrarian view, on the basis of the following observations:

Compared to other jurisdictions we work in, the U.S. LLC is easier and cheaper to set up, and is more anonymous:

Our onchain LLC costs USD 39 (payable in stablecoin or by card) to set up and maintain.

Our offchain LLC, which requires filing at Registry, is only a couple of hundred dollars. We can file in any State but Wyoming and Delaware have pulled way ahead of the peloton of other States.

Whilst we perform client Due Diligence internally, no disclosure of the identity of the Member(s) of the LLC to Registry is required. Annual filing too can be made anonymous.

Maintaining an LLC too is easier, as all corporate actions are a matter of internal record rather than requiring filing with Registry at every step. As a result, blockchains can be used as the “ledgers of truth” of an LLC (and also a C-Corp, see below).

An LLC with non-U.S.-based Members is considered a foreign entity for US tax purposes and therefore works particularly well for clients outside of the United States. Only when their LLC holds “U.S. source income” income does reporting at the US level kick in. There is a lot of nuance to this, but crypto held in wallets belonging to the LLC would not be considered generating U.S. source income if its Members are all non-US tax resident.

Also for US-based clients, the pass-through nature of the LLC means that they simply report the LLC’s profits on their personal tax form if they are individuals. In case of a holding LLC, a taxable event will only arise when a capital gain has been realized, making it an attractive vehicle for holding and trading crypto.

Finally, an LLC is a gateway to fiat offramping, with relatively easy and remote bank account opening in the U.S. even for LLCs controlled by non-U.S. Members, as long as they can show they have a business address there.

The downside some people perceive using an LLC is that it will drag them into the U.S. legal and regulatory field of gravity and its litigious culture.

This concern is valid, however there is also a lot of legal clarity about what you can do and not do in the U.S. Irrespective of where you stand on whether its securities laws are just or unjust, the way the SEC goes about enforcing them is pretty predictable.

That U.S. securities laws need a complete overhaul to be relevant to crypto is clear, but meantime it’s not difficult to figure out what you can do and what you can not do.

Despite the regulatory zeal, if U.S. crypto regs would be so stifling, it would be difficult to imagine how the US could be giving birth to listed centralized exchanges such as Coinbase (a world first), spawn new custodian banks in Wyoming or have banks such as Silvergate that cater specifically to crypto projects, and see the highest amount of investment flow into the crypto and blockchain space any country.

Fallen angel: The U.S. C-Corp

A Delaware C-Corp is the gold standard for a venture-funded project in which project Leads look to accept investors in return for equity.

However, in the case of most crypto and blockchain projects, value is no longer crystallizing at the entity level but rather reflected in the native token.

As a result, traditional equity investors including Venture Capital who would have insisted on a C-Corp are now content receiving tokens in a project.

We do still see some use of C-Corps when projects need a “real-world” development studio, however such companies are typically mere cost centers where no real revenue accrues and little or no IP is held, given the open-source nature of most code.

Their costs and working capital are then covered by way of grants out of a collectively-managed, decentralized Foundation, rather than out of revenue or funding at the C-Corp level.

2. Fabled Foundations

This brings us to the use of Foundations in the crypto and blockchain space.

Our Cayman Foundation product is our second best-selling products and helps secure a solid second spot for the Cayman Islands as a jurisdiction in the popularity rankings.

Cayman has a clear edge on other jurisdictions that offer a Foundation structure by allowing foundations to be set up without members and even without a founder.

This enables the set up of “faceless” foundations in which distance is created between the original projects Leads as individuals and the community of token holders as “undetermined” beneficiaries of the Foundation.

As beneficiaries, token holders do not have to be KYCd the way shareholders have to when appearing on a company’s capable.

In addition, if a Foundation is sufficiently decentralized in its governance, it can be argued that the value of the token is no longer depending on the efforts of a few but rather the collective coordination of the many, which helps eliminate one prong of the Howey test used to determine if the project’s token could be considered a security.

The way governance of a foundation can be decentralized is by making all major decisions subject to an onchain vote by a majority of the token holders.

The director of the foundation is then mandated to execute the onchain votes, typically a decision to grant funds out of the foundation to anybody around the world - individual or corporate - who helps further the foundation’s overall objectives.

Such granting power is immensely powerful: for the recipient, a grant out of foundation typically classifies as a gift and is therefore tax-neutral or tax beneficial compared to such recipient invoicing the foundation for services provided in what could then be categorized as revenue from sales.

For the foundation itself, grants are a very flexible mechanism to provide working capital to anybody deemed helpful in the furtherance of its objectives.

Care does have to be taken though that the grant cannot in any way be enforced by the recipient but effectively remains a non-enforceable gift.

Such gifting can and typically does include a development studio set up and owned by the project Leads as a stand-alone entity, e.g. as an LLC (see above), without the need to make such studio a subsidiary of the foundation.

As a result, such developments studio remains “clean” from a KYC perspective i.e. not owned by some offshore foundation of which ownership is difficult to establish. This will facilitate bank account opening and other operational necessities at the development studio level.

In a different section of this newsletter we have shared the various legal documents related to the OtoCo Foundation which us being set up as part of our OtoCo project and its forthcoming token distribution.

They include the draft Bylaws for a radically decentralized Cayman foundation and a Special Director Resolution as the legal mechanism to make sure the foundations’ Director is bound to execute the wishes of the community expressed through onchain voting.

Fallen angel II: The Swiss Foundation

Largely for historical reasons, a fair number of foundations for early blockchain projects, including Ethereum itself, have been set up in Switzerland.

Whatever compelling reasons existed at the time, we feel there is little to say in favor of a Swiss foundation for most crypto and DeFi projects, unless they seek to work with international organizations and/or need the cachet of neutrality for their use case.

Despite - or perhaps because of - their long history, Swiss foundations tend to be rather inflexible in their setup and day-to-day operations:

- First, you’ll need a local Director who is Swiss resident and Board meetings will need to be held in Switzerland.

- Second, the Foundation’s initial purpose has to be strictly adhered to for the Swiss foundation to retain its charitable status and changes to its purpose are basically impossible to make.

- Third, lots will still have to be translated back to German (for Zug-based Foundations) which adds to the cost, which is already quite high compared to other foundation jurisdictions, apart from the required minimum paid-up capital of CHF 20,000.

Whilst the “optics” of some projects may still sway the decision of incorporating their foundation in Switzerland, we feel that for most crypto and blockchain projects, other foundation jurisdictions especially the Cayman Islands have clear advantages.

3. The British Virgin Islands

In third place on our champion stage are the British Virgin Islands (BVI).

Traditionally majorly used as a placeholder jurisdiction to hold assets, the BVI Exempted Limited Company (“ELC”) has emerged as a strong runner-up as a vehicle for both token issuance and - in a more evolved permutation - crypto hedge funds.

Token Issuance Vehicle

In an optimized legal stack, the issuance of a token ought to be done from a special purpose vehicle (SPV). Such SPV’s sole raison d’être is to put a limited liability shield in place between the token creation and distribution event and the potential personal liability of the project’s Leads.

Once the token distribution event is completed, the SPV then pledges its assets, consisting of the balance of the tokens initially issued (if any) together with the proceeds of the token sale (if a sale took place) to a Foundation. If such Foundation already existed at the time of the formation of the BVI entity, the BVI’s assets can be dividended to the Foundation. If not, they can simply be pledged by the BVI to the Foundation.

Before the actual creation of the project’s tokens, the SPV can also be used as the counterparty to a Simple Agreement for Future Tokens (SAFT) as a way to raise some initial funding for the project. This funding is typically in crypto and can then be used to pay invoices raised by the Leads individually or their development studio. Alternatively, if the project Leads are shareholders in the BVI, they can receive funding by way of dividend out of the BVI.

In many instances, the SPV won’t make it to its first anniversary: It as preferable the entity ceases to exist once its assets are transferred to a Foundation, sealing of the potential toxic waste from a token sale which in the current regulatory environment is still surrounded with a lot of legal risk.

Whilst the winding up of the SPV would not shield its shareholders and directors from personal liability in case of fraud, it does remove a potential vulnerability for the project.

However there is a risk that a token issuance out of the BVI will be captured by the recently introduced Virtual Asset Services Provider (VASP) regime. The guidance is that utility tokens (which in BVI are broadly defined as virtual assets and virtual assets-related products used as a means of payment for goods and services which provide the purchaser with an ability to only purchase goods and services) are not subject to the new VASP regs since they are not considered an “investment”, merely a usage right.

Essentially the position seems to be that everything that is considered a means of payment or investment offchain and hence regulated under BVI’s legacy financial services laws will also be subject to the new VASP regulations when represented digitally, but it is not clear what makes a token an investment.

In practice, we still see most DeFi project use BVI as the location for their token issuance and distribution, perhaps until further guidance.

Incubator Fund

The second major use case for a BVI entity in the blockchain space is to launch a crypto hedge fund in a “reg-light” way (“light” in comparison to the Cayman Islands which has been the traditional base for hedge funds however more recent regulations have made Cayman a very expensive jurisdiction to set up a hedge fund and only funds with launch sizes of over USD 100MM should consider Cayman - see below).

Such BVI fund setup is perhaps rather misleadingly called an “incubator” fund, which may indicate that it only incubates VC-type equity deals, however the incubator fund is actually very suitable for a relatively quick and inexpensive launch of a liquid crypto hedge fund.

Essentially, to setup an Incubator Fund, the articles of a standard ELC are upfitted to cater to outside investors who get their own class of shares which gives them participation rights in the assets of the fund, whilst managers get their own share class which gives them voting rights and control without participation rights. If the manager(s) also invest(s) to have “skin in the game”, they get shares in both classes.

One key advantage of the BVI Incubator Fund is that it can be managed by its two Directors (the minimum) instead of a separate Manager entity. This shortcuts on the need for a license for a Management entity which will most likely apply irrespective of where it is based, since the Manager will be seen as providing investment advisory services which is a licensable activity in most jurisdictions.

In addition, until it has USD 20 million in assets, the BVI Incubator Fund does not need to appoint a fund administrator.

The investor dox too are relatively lightweight without the need for a private placement memorandum (“PPM”), allowing any budding crypto hedge fund manager to essentially get started with an extended term sheet and a subscription agreement.

Unfortunately, absurd as it may seem, local counsel in BVI generally refuses to advise on fund setups that take subscriptions in crypto, which they fear may put their regulatory license at risk, unless the Managers can prove they have the systems in place to vet the origin of the crypto used by investors who subscribe to the fund.

A further restriction is that the BVI Incubator Fund will need an external fund admin once it grows over USD 20 MM in assets under management (“AUM”), is limited to 20 investors and cannot grow above USD 100 MM in AUM unless it converts into a fully-fledged regulated fund. It also has a 2-year shelf life so essentially the structure provides a runway to aspiring crypto hedge fund managers to establish an initial track record, grow their assets to a critical size and then make up their mind about what to do next.

Fallen angel III: Cayman as a crypto hedge fund jurisdiction

Our overall sense is that the Cayman Islands only welcomes funds, crypto or otherwise (but preferably otherwise!) that launch with at least USD 100MM, which is still a large launch for most crypto hedge funds.

The economics of a fund setup in Cayman only really start working from USD 100MM launch size and up (giving management fees of USD 2MM p.a. at the standard 2%/20% fee structure).

Also, with so many legacy VC, PE and hedge funds launching with USD 500MM if not a couple of billion dollars, lawyers don’t really want to come out of bed for a small crypto fund run by managers without a track record and no institutional big pockets.

In short, whether by design or as an unintended side effect of the recent changes in Cayman fund laws, Cayman has lost its appeal as a place for budding crypto hedge fund managers who seek to establish a track record under a reg-light structure.

4. The runners-up

Bahamas

The Bahamas is coming up strongly vying for a podium place:

There’s banks in Bahamas that don’t reject crypto company bank account applications out of hand.

A Bahamas company also remains attractive as a holding entity including a proprietary crypto trading entity, since there is no income tax, capital gains tax and dividend tax, and no annual reporting requirements in the Bahamas. Its Registry is also a degree more transparent, which makes opening of crypto exchange accounts and KYC generally easier.

However with its recent Digital Assets and Registered Exchanges Act (“DARE law”), which came into force on 14 December 2020, Bahamas risks to have shot itself in the foot and will drive token issuers away, even though token drops that are not in exchange for money and initial token distributions that are not made to the public seem to be excluded.

Singapore

Whilst forming a company is not burdensome, maintaining a company there is often disappointing for those who bought into the Government of Singapore’s PR of being the most business friendly place in the world:

As soon as you have a corporate shareholder, you’ll need to audit your financials and your captable generally is visible on public record, including each shareholder’s address details.

Also, you’ll need to have a local director so if you don’t know anybody there who’s willing to take on the heavy fiduciary duties, you’ll need to fish in the local director pool which is shallow and expensive, adding to the overall cost of forming a company there.

Finally, the crypto infrastructure is rather childish (you can typically only offramp 200 dollars per month into your local bank account from local crypto exchanges, yay) and banks don’t like crypto startups.

Still, Singapore is a runner-up mainly as a result of the business it is winning from Hong Kong, and because Singapore is one of the few “mid-shore” places where you can run a company as a holding and an operational company from the same entity.

Especially if you do business in the region, Singapore will likely become your local headquarters by default, and it is also making clear efforts to become the location of choice for family offices.

Panama

Panama’s Sociedad Anónima remains the vehicle of choice for our Spanish-speaking clients. It is also one of the last jurisdictions where companies can still issue bearer shares, though as agents there we are required to custody the share certificates and keep an internal ledger of who holds them at any given time.

Owning a Panama S.A. also grants residency to anybody who deposits USD 5,000 in their entity’s bank account there. This could be an interesting option from digital nomads who need to claim residency somewhere, since Panama’s tax system is purely territorial.

The Panama Foundation too is a good alternative to the Cayman Foundation however Panama is not an Anglo Saxon jurisdiction which means its formalism can be overbearing.

Panama has significantly cleaned up its act since the abuses of the eighties and nineties but there’s still a whiff of criminal money which, depending on your project, may affect the optics of owning a company or Foundation there.

5. The losers

Hong Kong

Even though nothing as such changed in the benefits and burdens of owning a Hong Kong company, the recent developments there, compounded by the zero-COVID approach to travel, has caused many to reconsider it as a base of operations.

Maintaining a company there is still shockingly analogue and often seems more of a government employment scheme for thousands of local paper pushers.

In addition, getting a work pass for foreign employees, which used to be relatively easy, is now nigh impossible: Hong Kong Immigration Authorities simply fail to understand the concept of a startup that wants to recruit talent from abroad.

Sadly, Hong Kong, despite its tradition of free wheeling and dealing, is at serious risk of degrading from Asia’s World City into just another mainland city.

Seychelles

Seychelles is not as sophisticated a jurisdiction compared to the main offshores (Cayman, BVI and Bahamas) and there’s been some erratic legislation related to crypto and tokens that make Seychelles look like it’s still making up its mind whether it wants to be welcoming to crypto or rather stay with more mainstream incorporations.

Switzerland

Our view on Switzerland has always been slightly contrarian. Some in the community applaud it for its advanced crypto regulation whilst we see it as over-regulated already: essentially, you need a permit for everything.

Bankers too have no interest in transaction banking, only in investing your funds: every banker is by nature a private banker in Switzerland.

Company formation is as such not heavy on KYC and client DD but the cultural rigidities make the formation and maintenance of a company - and especially a Foundation - a hard slog. This may help explain why Zug’s much-lauded “Crypto Valley” majorly consists of brass plates on imposing doors, with few teams actually working from there.

That said, Switzerland has some redeeming features, one of which is its Association (Stiftung), one of the few entities in the world with a separate legal persona and limited liability that can be formed purely contractually by its two initial members. As result, as Swiss Association lends itself well to be blockchainified and Otonomos will soon take an initiative in this direction.

Radical candor

We realize that the above ranking slightly caricatures some jurisdictions and we mean no offense.

However, our clients look at us to get the straight scoop when we share our observations about the jurisdictions we work in.

With over a dozen service offerings in 10 jurisdictions and more coming, we are not beholden to any specific place and our first and foremost concern is to do what is right for our clients.

Book a call with one of our jurisdiction specialists to guide you towards the best place to set up your crypto project. Calls are US$200 for an initial 30 mins which gets deducted from your first order with Otonomos.