The launchpool idea

In our February Otonomist, we talked about “launchpools” and their potential to turn capital formation on its head by letting the community stake in a refundable pool which turns into committed capital at the end of a pre-sale period.

We have now turned this idea into a smart contract which, in its first deployment, will be used to build a book of prospective token buyers for our own OtoCo token pre-sale starting 24 June.

We designed it such that, in a next release, it can be used by OtoCo users and other issuers who want to automate their token pre-sale the same way.

Objective

The objective is for project Sponsor to initialize a smart contract that lets prospective token buyers stake crypto assets (in our case, DAI, USDC and USDT).

The contract then calculates the number of tokens corresponding to the amount staked, using a price per token that programmatically increases under a bonding curve in function of staker’s place in the queue at the moment of staking.

The slope of the bonding curve is set by Sponsor together with the token’s initial price when the contract is initialized, and cannot be changed once the smart contract is activated.

The end result is a transparent process that gives investors a better price the earlier they reserve tokens, but does not commit their capital until the contract goes is Finalized mode (see below).

Up to that point, they can unstake. Unstaking causes them to lose their place in the queue and forfeit the token price of the place they vacated.

If they want to rejoin the pre-sale process, they’ll have to join at the tail of the queue and pay a higher price.

Design and specifications

The product consists of a Factory Contract that deploys customized launchpools with different attributes.

Each launchpool is controlled by its Sponsor, who is responsible for setting its attributes and who takes decisions during the lifetime of the pool.

The Sponsor is likely to be the issuer of the tokens.

The main specifications are as follows1:

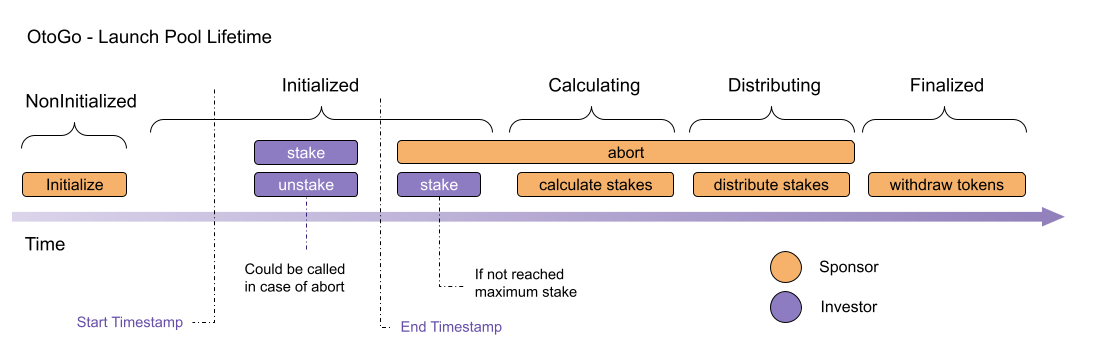

NonInitialized - This is the first stage of the launchpool before it is initialized. We use the "initialize" function of the new launchpool to set its parameters.

Initialized - Right after a Launchpool is initialized the

stake/unstakeis defined by values_startTimestampand_endTimestamp. If_startTimestampisn't reached, no action can be taken by stakers. Once_startTimestampis reached, stakers couldstakeandunstakefreely. Once_endTimestampis reached,stakecould only be called if there is still space for within the defined hard cap.Paused - Paused stage has to be triggered by the Sponsor in case any problem occurs. Once a launchpool is in

pause,stakeis no longer allowed but, following our code audit,unstakeis allowed.Calculating - Once

_endTimestampis reached, the Sponsor needs to calllockfunction. Once called,lockfunction will lead to Calculation stage. In this stage, Sponsor is allowed to triggercalculateSharesChunkto calculate how much shares each staker will receive in return for the amount staked. The tokens are calculated as long hasgasLeft> 100000 on the transaction. OncegasLeftfalls below 100000, the contract stops its calculation on the current index, and the function needs to be called again. This process is repeated until all stakers have their tokens calculated.Distributing - Once all tokens are calculated, the contract automatically triggers the stage Distributing. At this stage, Sponsor should trigger

distributeSharesChunkon the smart contract, which transfers all calculated tokens to the respective stakers. The process is identical to thecalculateSharesChunk:tokens are distributed as long as gasLeft > 100000 on the transaction. When gasLeft falls below 100000, the contract stops distributing on the current index, and the function needs to be called again. This process is repeated until all stakers receive their tokens.Finalized - Once the last tokens are distributed, the previous function automatically triggers Finalized stage. At this stage, the only function that could be triggered by the Sponsor is

withdrawStakes. This will allow Sponsor to withdraw all amounts staked by the investors, whose capital is now committed.Aborted - At any moment during the launch pool phase, Sponsor can call the

abortfunction. When aborted, the only function that stakers can call is theunstakefunction, which will let each investor retrieve their stakes.

Audit

The smart contract was audited by Coinspect LLC and a copy of the audit will be made available in our OtoCo Pre-Order Guide and FAQs to be released 24 June.

GitHub

All our code is freely available on OtoCo’s GitHub.

Join our official OtoCo Telegram group for all announcements related to our forthcoming token pre-sale!

Shares/tokens, as well as stakers/investors are used interchangeably here. ↩