Introduction

The rise of Central Bank Digital Currencies (CBDCs) potentially represents a profound threat to economic freedoms and civil liberties around the world.

Designed to provide a ‘cash-like’ digital currency issued by central banks, their implementation risks handing sweeping powers to state actors, eradicating financial privacy and giving governments the capacity to control the ability of individual citizens to share, spend, and save their hard-earned money.

Though answering a legitimate need to adapt national currencies to a digital age, CBDC proposals must be treated with the utmost caution.

What is a CBDC, and why do they exist

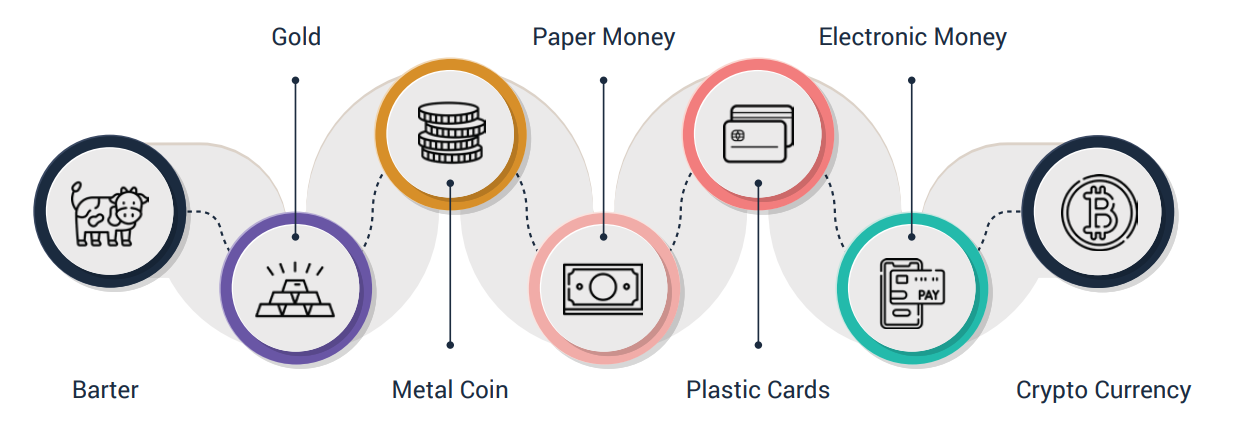

Cash use is in free fall across the world. From 2017 to 2022, cash use collapsed across major economies. In the US, it fell from 31% to 18% of transactions; in the UK it went from 34% to 14% of transactions. In China the transition was even more rapid - cash point of sale transactions fell from 21% to just 8% in the same period. By 2022, two in five Americans reported using no cash for their weekly needs. Such trends can be expected to deepen as 2024 progresses.

Central to the collapse of cash is the rise of the digital economy. An ever higher proportion of transactions are now conducted online, either in the form of digital cash - digitized versions of fiat currency - or cryptocurrencies. In the eyes of government policy makers, both create risk.

Controlled by private actors, digital cash is held and managed by banks and other financial institutions, meaning that governments increasingly rely on these third parties to ensure money circulates around the economy.

Cryptocurrencies, meanwhile, represent forms of value that lie outside of both direct state control and that of 3rd party intermediary institutions. Borderless, decentralised, and highly volatile, cryptocurrencies highlight both the promise of the digital economy and - for some regulators - a set of long term policy problems. Used by millions around the world, their adoption especially prevalent in emerging economies possessed of unstable currencies, some regulators see cryptocurrencies as promoting financial crime, tax evasion, and a worrying ‘cryptoization’ of the economy - a scenario in which cryptocurrencies come to be the primary medium of exchange within local economies, eroding the ability of central banks to enact monetary policy.

CBDCs represent state-led responses to these changes. Although often discussed alongside cryptocurrencies, CBDCs generally represent an explicitly centralized response to the development of digital commerce. The clue is in the name - in Central Bank Digital Currencies, central banks have responsibility for issuing digital currency, fixing its value so that it is equal to their fiat equivalent. CBDCs fundamentally alter the relationship between central banks, private financial institutions, and ordinary consumers. Depending on the design of a CBDC system, central banks can use this to exercise sweeping powers over the money supply.

The devil is in the detail: primary forms of CBDC

Retail vs wholesale

A key operational distinction between CBDCs is whether they are wholesale or retail.

Wholesale: Wholesale CBDCs are intended to work alongside the current banking system. Their primary use case lies in facilitating interbank settlements and cross-border payments. Indeed, some argue that wholesale CBDCs have effectively existed for decades; while not previously based on blockchain-related systems, central banks have been issuing digital currency to banks for many years.

Retail: Traditionally speaking, all physical money that circulates in an economy has been issued by a central bank. Retail CBDC projects are intended to provide a digital equivalent - central bank issued money that can be used by everyone. It is these retail CBDC projects that have the greatest potential to alter the financial system, disintermediating the role of private-sector banks in distributing or holding money, and creating a direct relationship between central banks and individual citizens.

Retail: four archetypes

Controversy mainly centers on proposals for retail CBDCs. BIS has identified 4 primary models within CBDC debates:

Direct CDBCs: In this model, individuals hold personal accounts with the central bank. Access to these accounts is contingent on identification of the account holder. Here, the central bank records all transactions, and has complete knowledge of retail balances.

Hybrid CBDC: The central bank provides the CBDC, but relies on private sector institutions like banks to maintain the accounts and wallets used by individuals for their CHDC holdings. The central bank would rely on private sector actors to identify and manage retail customers. In this model the central bank would periodically record all retail balances.

Intermediate CBDCs: The central bank provides the CBDC, but relies on private sector institutions like banks to maintain the accounts and wallets used by individuals for their CHDC holdings. The central bank would rely on private sector actors to identify and manage retail customers, and to execute retail payments. In this model, the central bank only processes wholesale payments made to the retail banks.

Indirect/ synthetic architectures: Here the CBDC is provided wholesale to private financial institutions like banks. In turn these handle retail transactions. It is these intermediaries, not individual members of the public, who hold claims on the central bank.

Centralised: Banks distribute digital money based on that provided to them wholesale by the central bank, and manage this money themselves.

DLT version: a blockchain-based CBDC-like coin issued by stablecoin institutions, backed by reserves held in the central bank. While not technically ‘CBDCs’, these DLT-based and government backed stablecoins offer many of the potential benefits of CBDCs without the accompanying risks that they pose to privacy.

Further considerations

Account vs token based: this is very important decision, and is central to how individuals access CBDCs and the risks CBDCs pose to privacy.

- In account-based CBDCs, users must identify themselves to CBDC accounts and make transactions.

- In token based CBDCs, access is via public keys. This allows more anonymity, but also greater risk of loss and crime.

CLT vs DLT: A CBDC could operate on a centralized database. If using decentralised ledger technology (DLT) based systems, considerations include whether to utilize a public or a private ledger.

- DLT based systems are generally seen as more privacy-centric and flexible for online use. However, this may be an incorrect assumption; In 2021 the Rikjsbank concluded that DLT systems have no more ability to offer cash-like anonymity and offline functionality than do centralised models.

- Despite this, token and DLT based CBDC systems have been identified as offering the most privacy.

Perceived Benefits

Cash 2.0: The basic operational justification for CBDCs is to provide a digital equivalent of cash - a universal and fungible means to exchange value, issued and controlled by the central bank.

Enhancing digitisation: By providing a reliable, government-backed form of digital cash, supporters of CBDCs believe that their implementation will further promote digitisation and digital efficiencies in the wider economy.

Streamlining payment systems: Some proponents of CBDCs argue that their implementation could reduce costs and increase speed within the banking system.

Financial inclusion: CBDCs potentially remove the need for individuals to have bank accounts. In any given society, a certain proportion of residents do not have access to banking facilities. This happens for a variety of reasons, but in a digitalised economy the net effect is the same - financial exclusion. By providing people with digital wallets managed by the central bank, some forms of proposed CBDC remove the need for individuals to have bank accounts in order to make digital payments; proponents of CBDCs argue that this will work to increase financial inclusion among marginalized or otherwise excluded groups.

Local conditions: the attractions of CBDCs naturally vary with social and geographic conditions. Caribbean jurisdictions are notable pioneers of CBDCs, with the rise of the Bahamian Sand Dollar and the Eastern Caribbean Bank’s DCash project. Rollout of CBDCs in the Caribbean addresses issues of financial access contingent upon island conditions, and reduces the logistical costs of transporting cash between islands. It also addresses the phenomenon of financial de-risking, a process that has seen many international banks withdrawn from Caribbean nations, affecting local financial access.

Monetary, Fiscal, and Criminal Policy: The greatest attraction of CBDCs lies in their ability to enhance the monetary and fiscal powers of central banks.

Issues with CBDCs

Privacy, inefficiency, and security

Privacy: This is the central risk of CBDC implementation.

- Physical cash is anonymous and largely untraceable; exchanging cash for a product of service does not inherently create a record of the transaction. Most forms of CBDC, however, propose to record all transactions that an individual makes. This could give central banks and government complete visibility on the financial life of individual citizens, destroying an important part of their privacy and with it their liberty.

- Digital money is traceable money. Traceable money is both taxable, and controllable. While this may have various uses to policymakers - hindering crime, for instance, or extending the reach of monetary policy - it reduces the freedom of individuals to use their money as they wish.

Security: CBDCs have many potential vulnerabilities, and would represent a highly attractive target for cyber attacks. These could have devastating consequences.

A poor business case: The purported benefits of CBDCs in relation to speed and financial inclusion may be highly overstated. Many non-CBDC national finance systems now already offer near-instant transactions, obviating the need for a CBDC to improve this. Despite the much-touted benefits of CBDCs in improving financial inclusion, many of the unbanked may prefer the anonymity of cash, or be otherwise unable to use the new system.

A tool of tyranny: the role of state control

Central control: CBDCs give central bank policy makers more ways in which to reach and influence individual citizens. Although an avowed benefit of many CBDC programs, this risks providing central banks and governments with direct financial control over individuals. A developer found that Brazil’s proposed CBDC gave the central bank the ability to freeze and even alter the account balances of individual CBDC holders. Such functionality could be a major threat to the liberty and freedoms of citizens

Negative interest rates: The ability of central banks to control and manipulate the CBDC holdings of individual citizens means that they could choose to reduce these holdings in pursuit of wider policy goals. This could include the implementation of negative interest rates, a scenario which would destroy individual savings.

Programmable spending: This is a primary attraction of CBDCs to policymakers, and one of the greatest risks to liberty. CBDCs are potentially capable of being encoded with ‘rules’ governing what they can be spent on, whom they can be spent by, and how long they can be spent. Certain classes of people could be stopped from buying certain goods, or from buying them in certain areas.

- Geofencing: Citizens could be ‘geofenced’ into only spending their money in specific regions.

- Forbidden purchases: Benefits claimants could have their CBDC allocations programmed so that it can only be spent on approved items or in approved stores.

- Spending limits: Spending limits could be placed on certain accounts

- Capital controls: Controls could be placed on the ability of individuals and businesses to transfer or use money abroad

Conclusion: Cash is cash and digital payments do not need CBDCs

The concept of a CBDC has arisen as a result of declining use of physical cash, an increased use of electronic transactions, and the rise of cryptocurrencies. Although CBDCs may hope to replace physical cash as tools for daily transactions, they cannot replace the universality or anonymity of physical money. Replacing cash with CDBCs further isolates marginal & non-digitised members of society, ties society into a new set of technological vulnerabilities and dependencies, and are a critical long-term threat to individual liberty.

Above all, CBDCs are simply unnecessary to most societies; developed economies are functioning perfectly well with their current usage of digitised fiat currency

Insofar as CBDCs are legitimate and useful for certain contexts, we can only recommend the most decentralised models - tools that essentially function as government-backed stablecoins.

By James Kingston (©2024. All rights reserved). James is based London and helps Otonomos’ technology team, including its use of AI. He has a background in Growth and Strategy, Data and AI gained at i.a. Proton, Dataswift and CognitionX. James is on james.kingston@otonomos.com.

> Join the Otonomos official “Towards Full Otonomy” Telegram group to compare notes with other users and our wider community!