Locus of returns

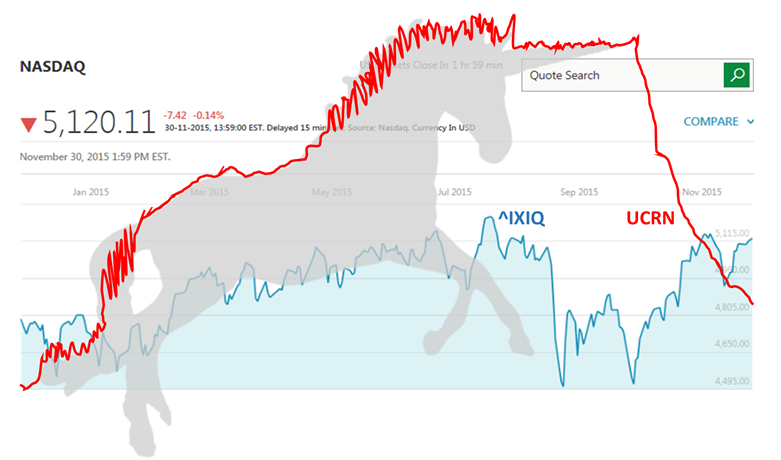

Over the last decades, the locus of returns in technology startups has gone from public to private.

The Microsofts, Oracles and even Amazons of this world created much more value for anybody who bought stock in or after their IPO than for their private investors.

However, more recent technology companies such as Facebook grew private returns significantly more than public ones.1

Tokens offered by what are now generally referred to as “Web3” projects are seeking to bring some of this locus of returns back to the public by allowing anyone to buy their utility token.

The instant liquidity of such offerings lets token holders decide when to capture their gains (or close out their losses…) which they can do at any point in time, rather than having to wait for the crumbs that fall off the table in an IPO after private investors feasted on fast growing companies.

In practice however, most tokens are snapped up early by the same investors who would traditionally have invested in equity.

Blame the projects themselves for this: most raise their very first funding by way of a Simple Agreement for Future Tokens (SAFT) or a SAFTE (which converts in tokens and/or equity).

Such SAFT(E) is, by its very nature, an investment contract and can therefore only be offered to “accredited investors” i.e. wealthy people (roughly 3% of American adults).

This limits broad participation from the general public and has resulted in “VC chains” or projects in which early token distribution is very heavily concentrated in the hands of a few crypto funds.

Depending on the project, these same investors often also take a stake in the development company by way of an equity investment.

In what follows, we examine why tokens may be superior to equity in Web3 projects, and when it makes sense to “double dip” and have exposure via both tokens and equity.

A rose is a rose

First, let’s agree on terminology.

In the below, when we refer to tokens we specifically exclude tokenized equity which in essence is a digital representation of stock on a distributed ledger.

Such tokens have all the rights and obligations of stockholders embedded in them.

Whilst there is a lot of innovation in tokenizing stock by using blockchains as the rails for the issuance and transfer of equity, most Web3 projects that offer a token are decidedly not looking to wrap their shares in a token format.

Rather, their tokens are either “paid API keys” required to access their service, a currency that can be earned from providing certain services to the project, or a voting card, or all of the above.

The primordial token soup

In the early days, it was thought that tokens would provide an alternative to raising money from selling shares in a company, especially for those projects that previously were deemed unfundable such as shared, open-source protocols.

Ethereum itself is a prime example of such public-good type infrastructure: It would not have paid to hold stock in Ethereum, Inc. (if such entity would have existed!).

A next iteration came from Automated Market Making (“AMM”) protocols which pay liquidity providers in their native token in return for the services they provide.

This liquidity allows for trading to take place on AMM-powered Decentralized Exchanges and any token to “IDO” (Initial Decentralized Exchange Offering), resulting in a veritable alphabet soup of tokens.

When properly designed, revenue from such DEXes should feed back in the price of the native token.

More generally, tokens allow projects to move from providing a service by a company to planning, engineering and maintaining an economy, with all value crystallizing in the native token.

Value leakage

But Web3 projects may develop pockets of value that isn't captured by the token price.

For instance, leads may operate out of a development company that holds project-related IP.

More substantially, value can leak out of a project when some or all of the revenue is booked elsewhere rather than sent back to token holders.

This is especially the case for marketplaces on blockchain, such as NFT platforms, which in many ways have more traditional revenue models.

These juicy morsels of cash flows, if they are replicable and scaleable, make equity investors drool.

As a result, they may want exposure beyond - and occasionally even without - investing in the project’s token.

Follow the money

As a general rule, the key to decide whether to invest in tokens or equity or both is to locate where value is crystallizing.

In this context, it is helpful to bear in mind that in most Web2 tech companies, an estimated 70% of value is driven by network effects.

For Web3 platforms, where it is all about community, loyalty and voice, this percentage is arguably much higher still.

Such networked projects are not always well served by equity investors, whose incentives are not closely aligned with those of users, builders and the community as a whole.

Essentially, equity investors expect “rake”, i.e. maximized profit per user, whilst users expect best price and the community expects a network that supports the project.

Tokens can redress this balance by creating a much larger area where incentives between builders, users and backers (investors) overlap.

Therefore, for projects that want to grow network effects and that do not have strong cashflows, buying the native token offers a better exposure to the value of what is being built compared to equity.

In such case, equity in the development company from where builders push code, contract help and employ staff is rather worthless, since such development companies are typically mere cost centers and don’t generate revenue. They’re not an investable proposition.

This is especially the case for projects that are largely decentralized, with their treasury managed by a DAO and governance conducted by onchain vote. Such projects typically use a Foundation to grant tokens or working capital to any member of the community who helps grow their platform, including “core unit” development companies.

Investors who’d have equity in these core units merely get their hands on grant money without visibility of any income stream or IP.

Best of both worlds or marriage of convenience?

However, for projects that do have revenue baked in and that seek to grow their network quickly, it may make sense to to also raise capital by giving up equity, in addition to offering tokens.2

Blockchain marketplaces and “dAppstores” are natural candidates for such a “double dip” in which backers gain exposure both as token- and shareholders, resp. via the token price and from the increase of their equity stake as the project grows.

In such setup, tokens add a meta-layer of invaluable network effects above the core product and could even lead to lower or no “rake”, with the shortfall in revenue compensated for by the growth of the platform and ultimately its token price.

By having larger backers hold both tokens and shares, some of the inherent tensions between token holders and equity investors can be defused.

Equity may also attract backers who would otherwise be scared off by the tenuous legal protections offered by tokens compared to equity.

For builders too, equity may prove more “patient” compared to tokens: Seeing your project marked-to-market every second of the day (and night) as a result of the hyper-liquidity of your token may be distracting and counter-productive longer-term.

Price volatility not only affects your project’s market cap, but also the price of tokens used as a means to access your platform, making it difficult for users to understand the actual cost of using the your product. Equity can smooth out some of this volatility and anchor the price in real revenue.

Pre-nup

Key to making a marriage between token holders and equity investors work is how the governance of the project is structured.

Equity investors will need to accept that any self-respecting decentralized project will want to put all major decisions onchain to be voted on by token holders.

Traditional protections such as preferred rights which effectively lock decisions at the operational company level may therefore no longer have the same teeth.

With so much decision making now at the onchain level, equity investors should load up on tokens to buy influence and have voting rights at the DAO level.

Such onchain vote could then percolate down to the operational company by appointing a Director drawn from the community who represents the token holders as a Board Member at the operational level, which is what OtoCo has in mind for its governance.

If such Director is subject to an onchain vote and equity investors as token holders can meaningfully participate in his/her appointment or removal, they effectively gain a Board seat.

More generally and perhaps ironically, equity investors may find their interests better represented when they have guaranteed voice at the DAO level vs. when they only have preferred rights as stockholders in the operational company.

At the end of the day, the only thing that sets equity investors apart from token holders is that they have a legally enforceable claim on the operational company’s equity (assets minus liabilities), including the sales proceeds at exit, which utility token holders will miss out on.

Any protections equity investors seek that go above and beyond the rights of token holders should therefore be justifiable in light of this claim.

For all other matters, they should receive no favors and vote with everybody else who holds tokens in the project.

Conclusion

Funding via a utility token sale can go hand-in-hand with equity investment in ventures with a strong cashflows and large financing needs, such as blockchain marketplaces and “dAppstores”.

In such setup, tokens add a meta-layer of invaluable network effects above the core product and could even lead to lower or no “rake”.

Investors then gain exposure both as token- and shareholders via the token price and from increase of their equity stake as the project grows.

The key battle lines in such hybrid model however will be related to governance: If all major decisions including the key commercial parameters of a project are voted on onchain, equity investors may want to make sure their equity investment in the project’s operational company comes with token warrants so they can table proposals and participate in voting at the DAO level together with all other token holders.

> Book a call now if you want us to work with you on your project’s governance design, including whether you should issue a token or raise equity or both.

In the case of Facebook, it grew private money 80,000 percent compared to 1,000 for public market investors. For it to match Microsoft’s public market returns, studies calculated it would need to be worth US$45 trillion, more than 80x from the US$552 billion it is as of today, 23 February ‘22 (see https://ben-evans.com/benedictevans/2015/6/15/us-tech-funding). ↩

Academic studies are starting to emerge that are looking closer at the optimal balance of cash flows and network effect to design tokens and equity of a project. E.g. https://doi.org/10.1016/j.jfineco.2021.05.004 which further distinguishes between platforms that require use of a native token to access their services and those that (also) allow use of other crypto incl. stablecoins and even fiat for internal transactions. ↩