Everyone who has registered an offshore company knows how tedious the form filling can get.

Otonomos now changed this process by letting you stage your new entity by inserting code logic into the process, making the activation of your new entity a more delightful, online workflow.

Our stages build on each other rather than duplicating information already provided, and info tips offer you guidance.

An interactive navigation menu on the right of the screen shows where you are in the process and makes it easy for you to cycle through the steps:

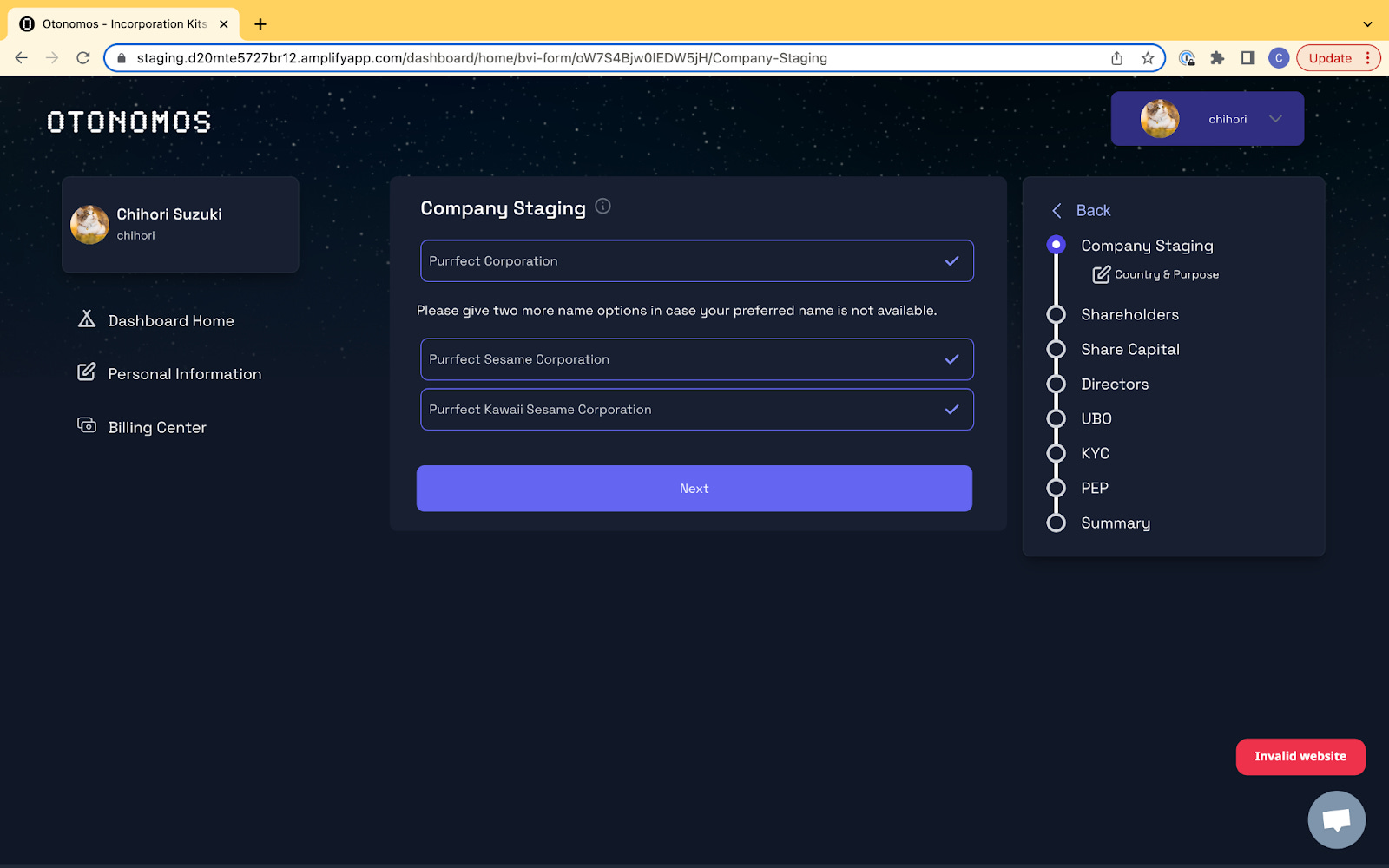

Company Staging

A first screen asks for your preferred company name along with two other name options. The info tip give tell you about the do’s and don’ts of company naming.

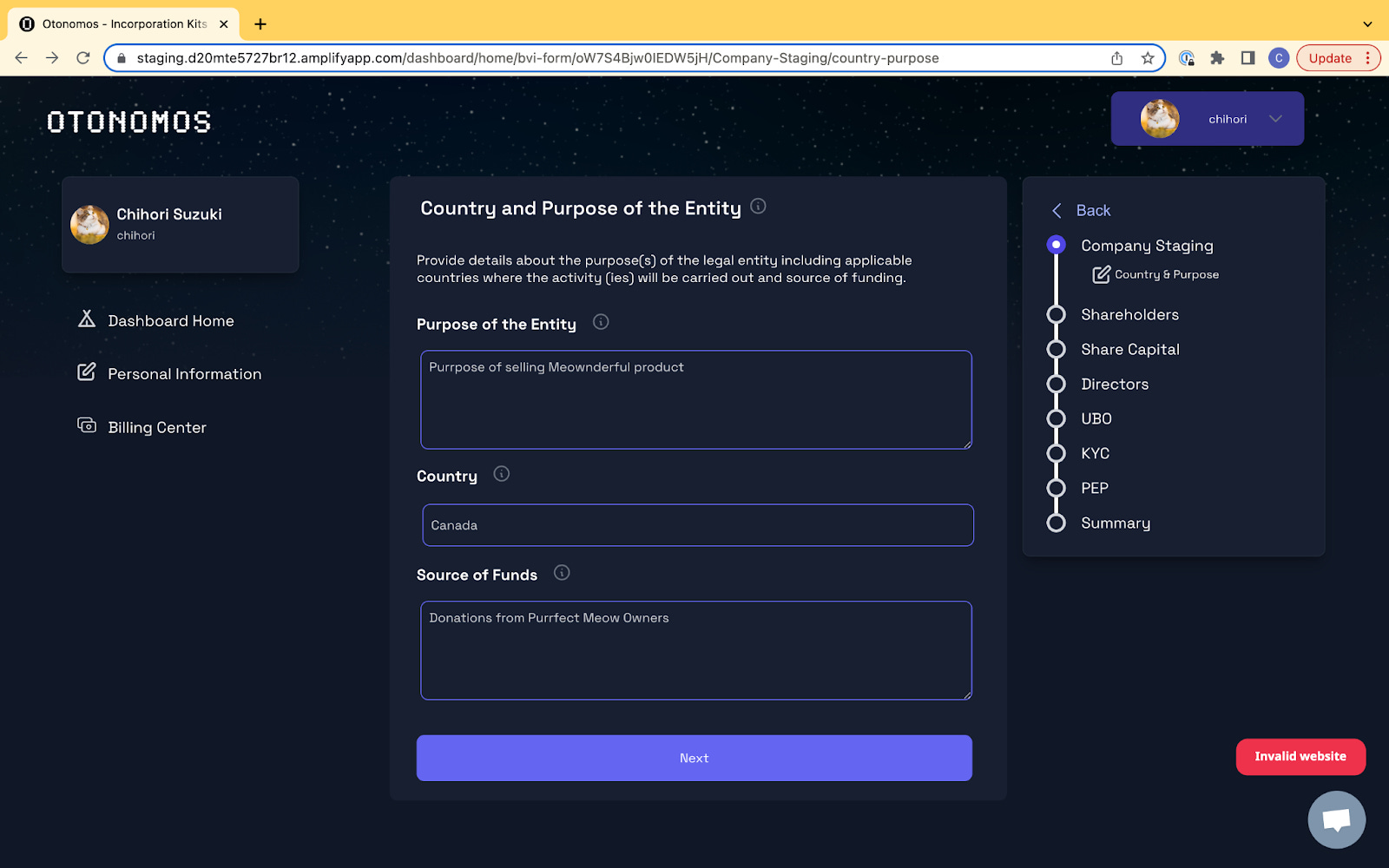

Country and Purpose of the Entity

In the next step, we require you to specify the purpose of your company and provide one or more locations where most of the business is conducted from. A declaration of the source of funds too is required before filing.

Shareholders

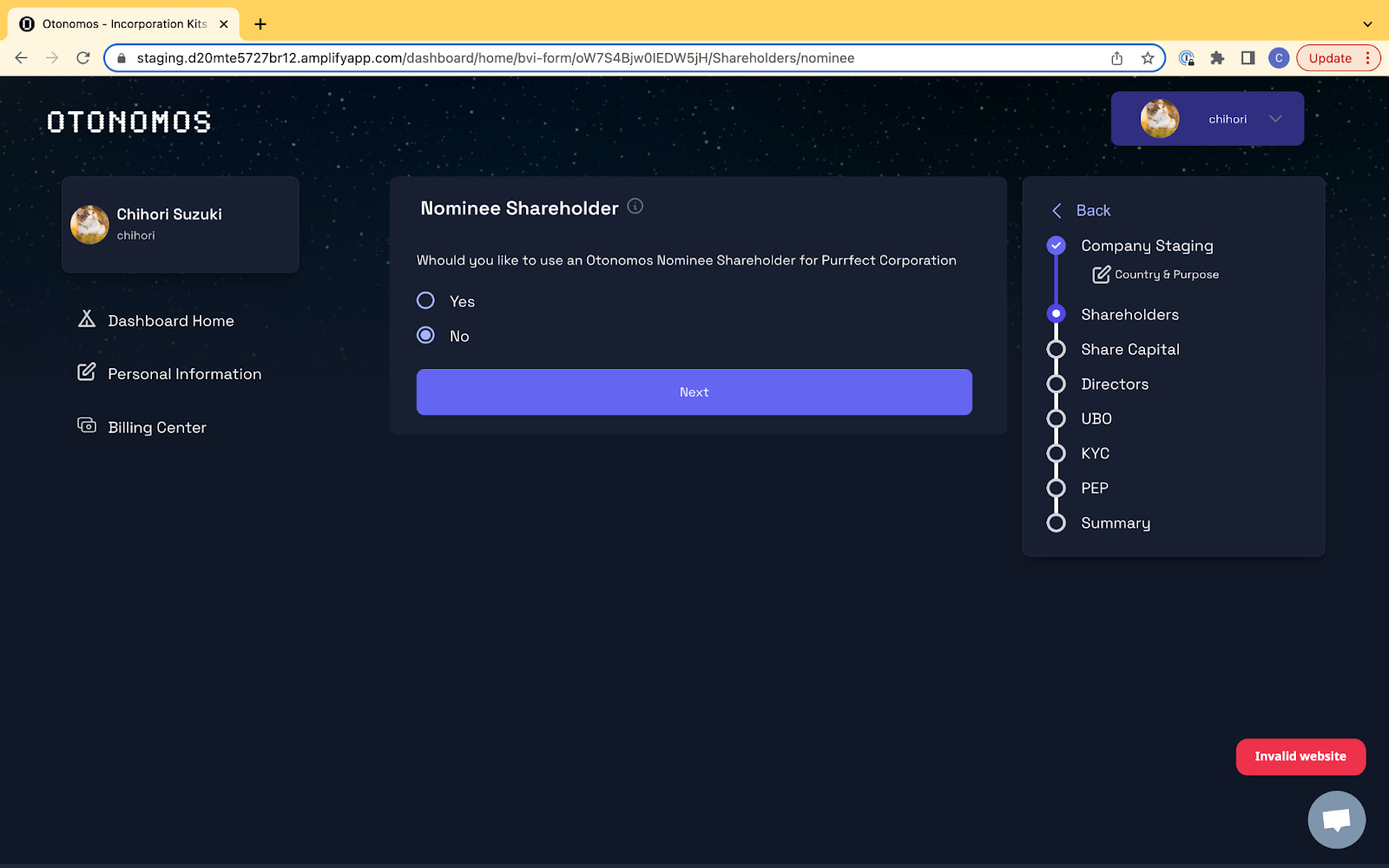

It is at the stage when we ask you to specify who your principals are that the code logic really kicks in.

First, the form will detect if you ordered a Nominee Shareholder as part of your order. If so, you will be directed to the authorized shares section.

If not, you can still add a Nominee at this stage, for which you can make payment then and there.

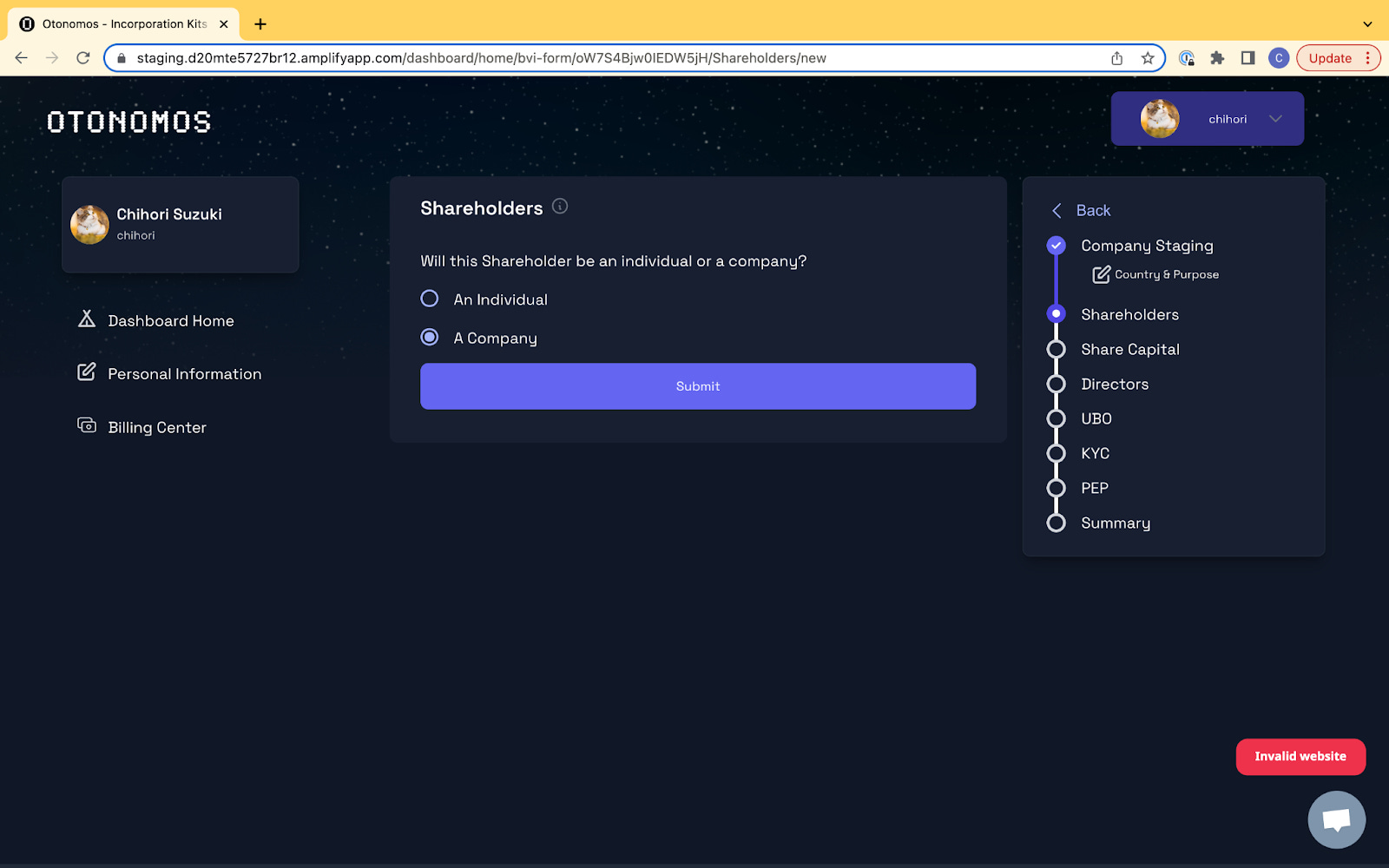

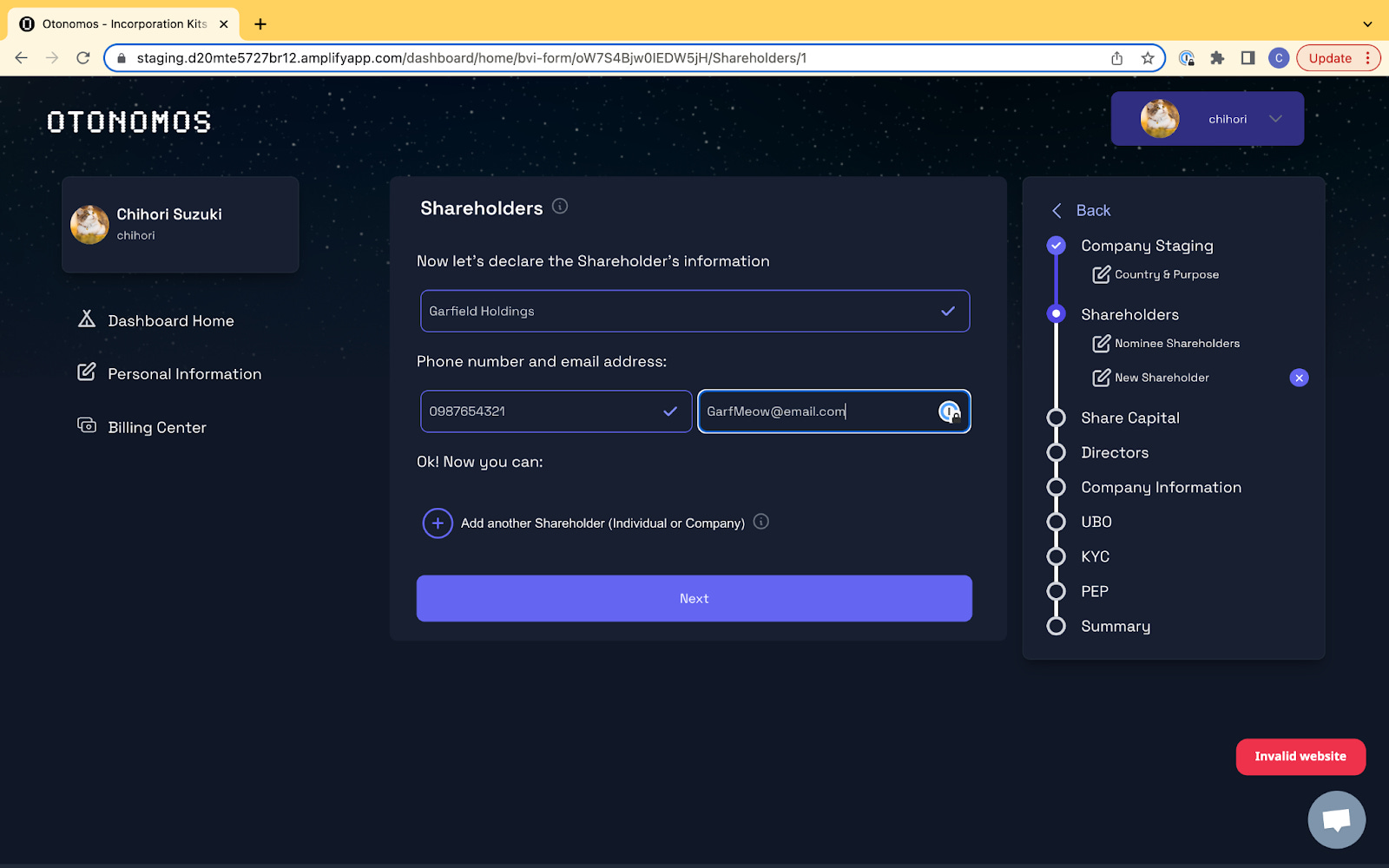

If you do not use a Nominee, you need to name the Shareholder(s), which can either be a company or an individual.

If a company is selected, we will need the company’s documents along with certified KYC documents of the Ultimate Beneficial Owners of that company.

But first we just need its name and contact details, with more detailed information to follow. On the right side of the screen you can see that a new shareholder has been added:

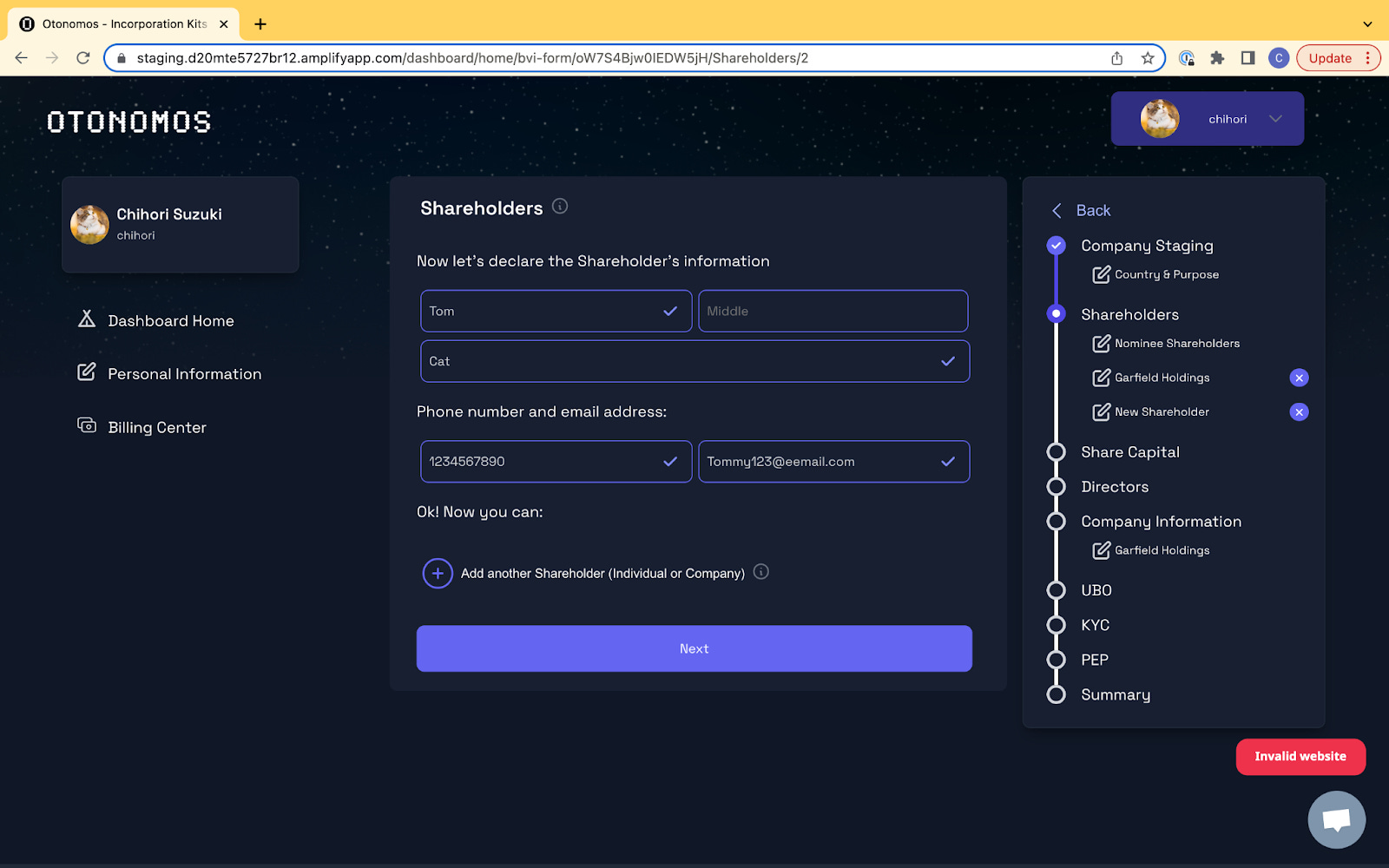

You can now add more shareholders, in this case a physical person. Again you see on the right that you have now added two shareholders:

Share Capital

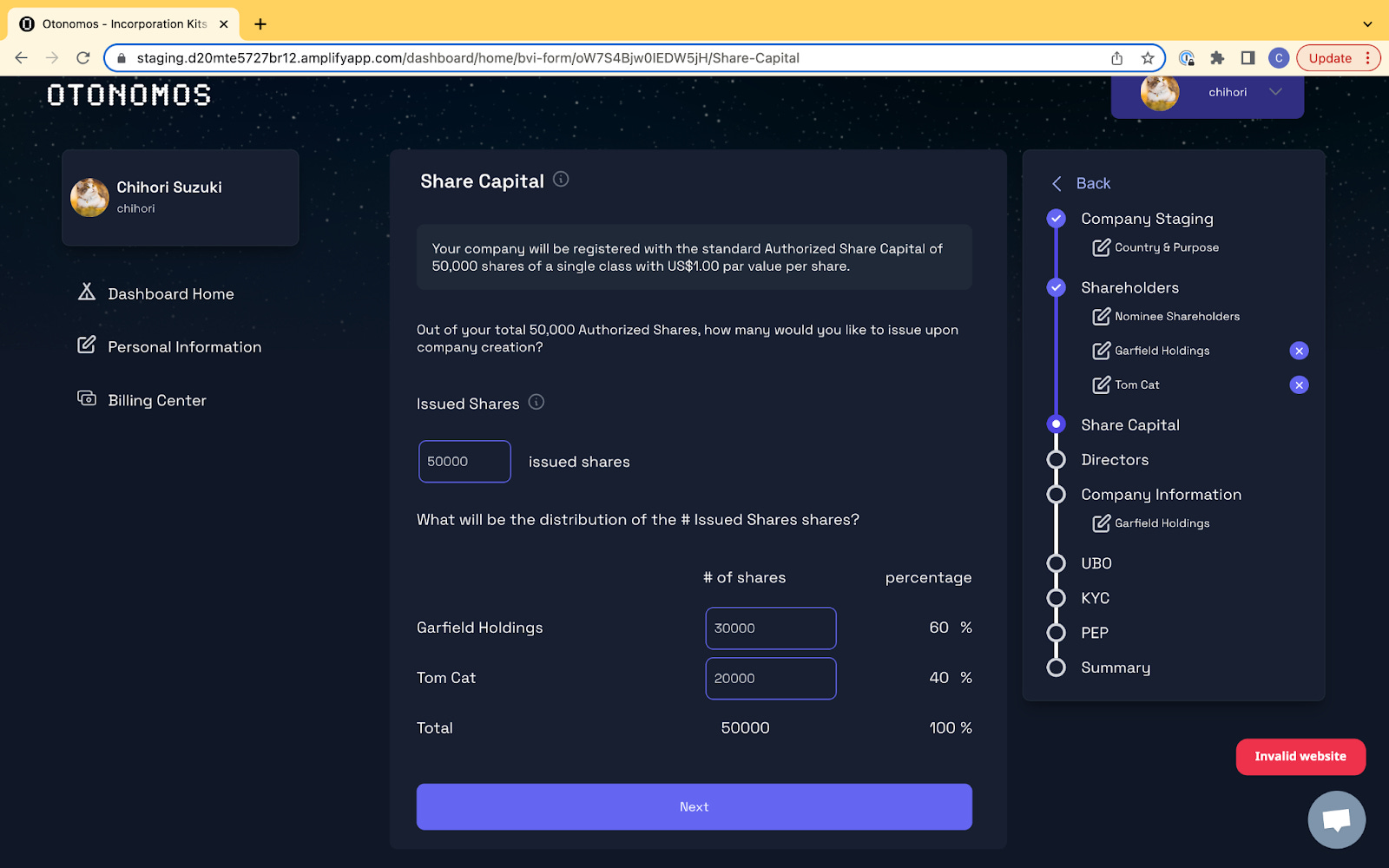

To many clients, the share capital section is a bit confusing so we spent a lot of time to make sure this screen is designed in a way to make it easy to decide on the right share structure.

BVI Limited companies are typically registered with 50,000 Authorized Shares (anything above attracts more annual dues) with a par value of $1 per share.

In other words: there are 50,000 shares to distribute between the shareholders. However, this does not mean that all 50,000 shares have to be issued at the moment of incorporation.

You can decide to allocate as little as 1 share per shareholder, leaving the other shares available for investors and/or employees.

Our form simply lets you distribute the amount of issued shares between the shareholders, with their ownership percentage calculated automatically:

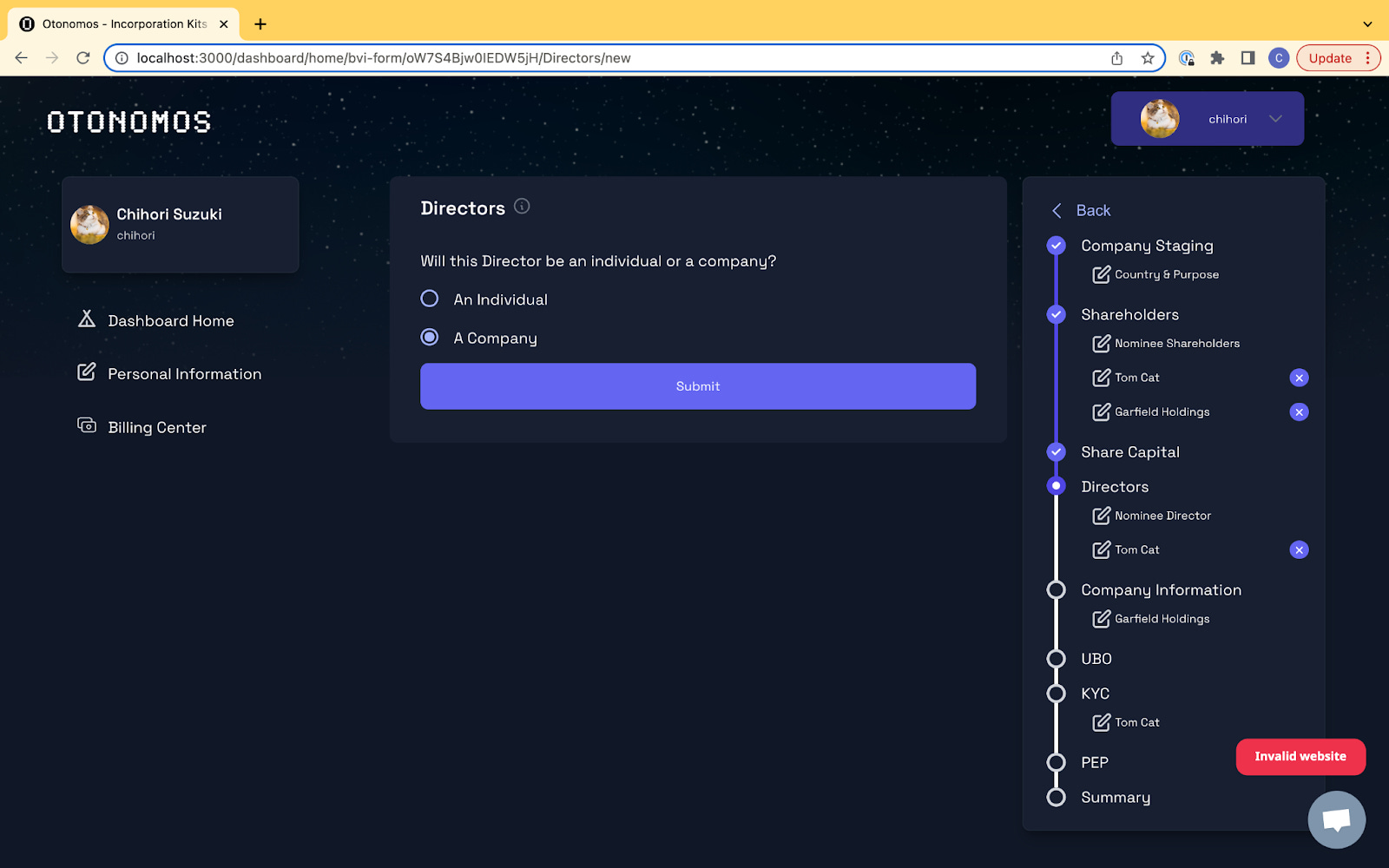

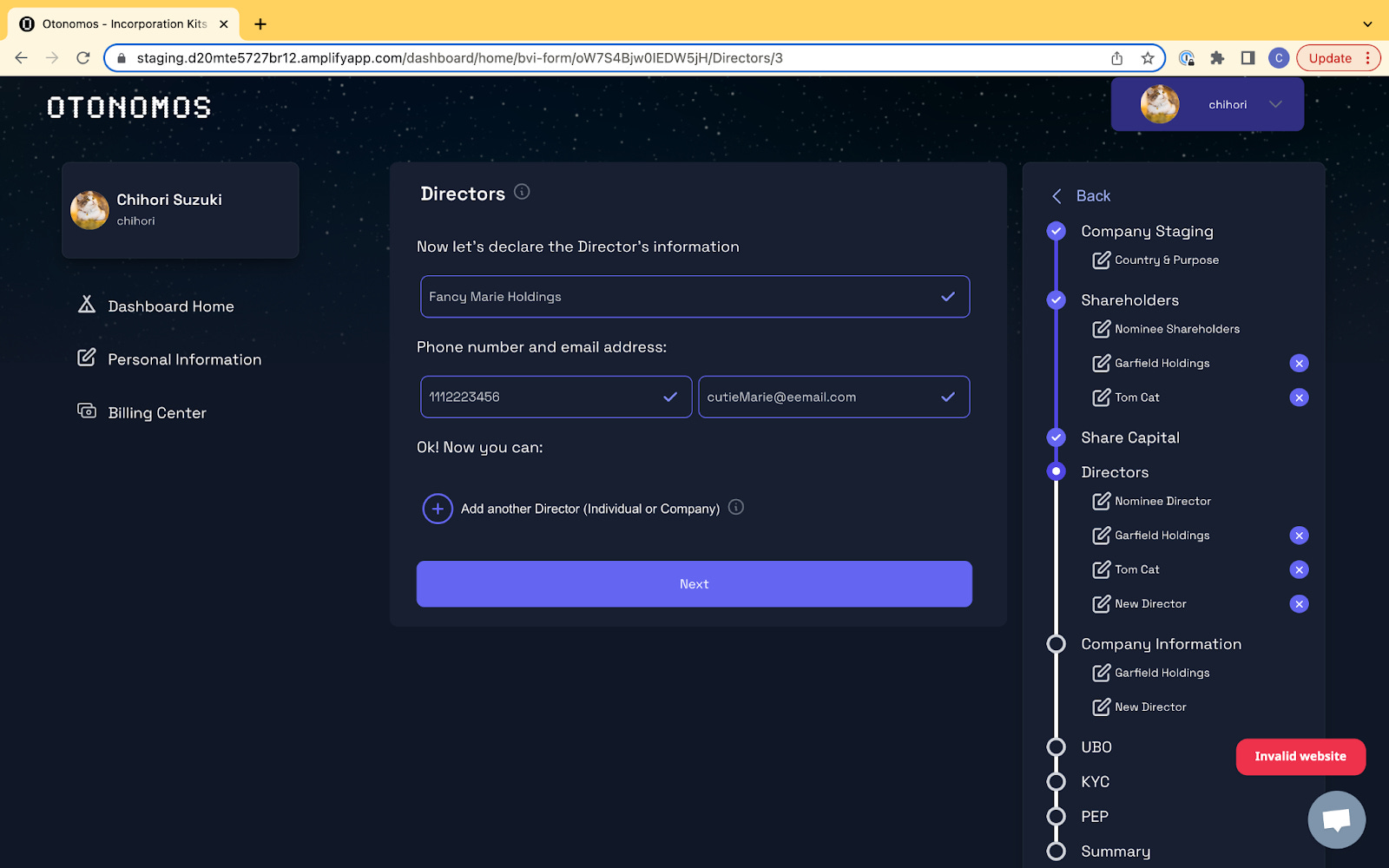

Directors

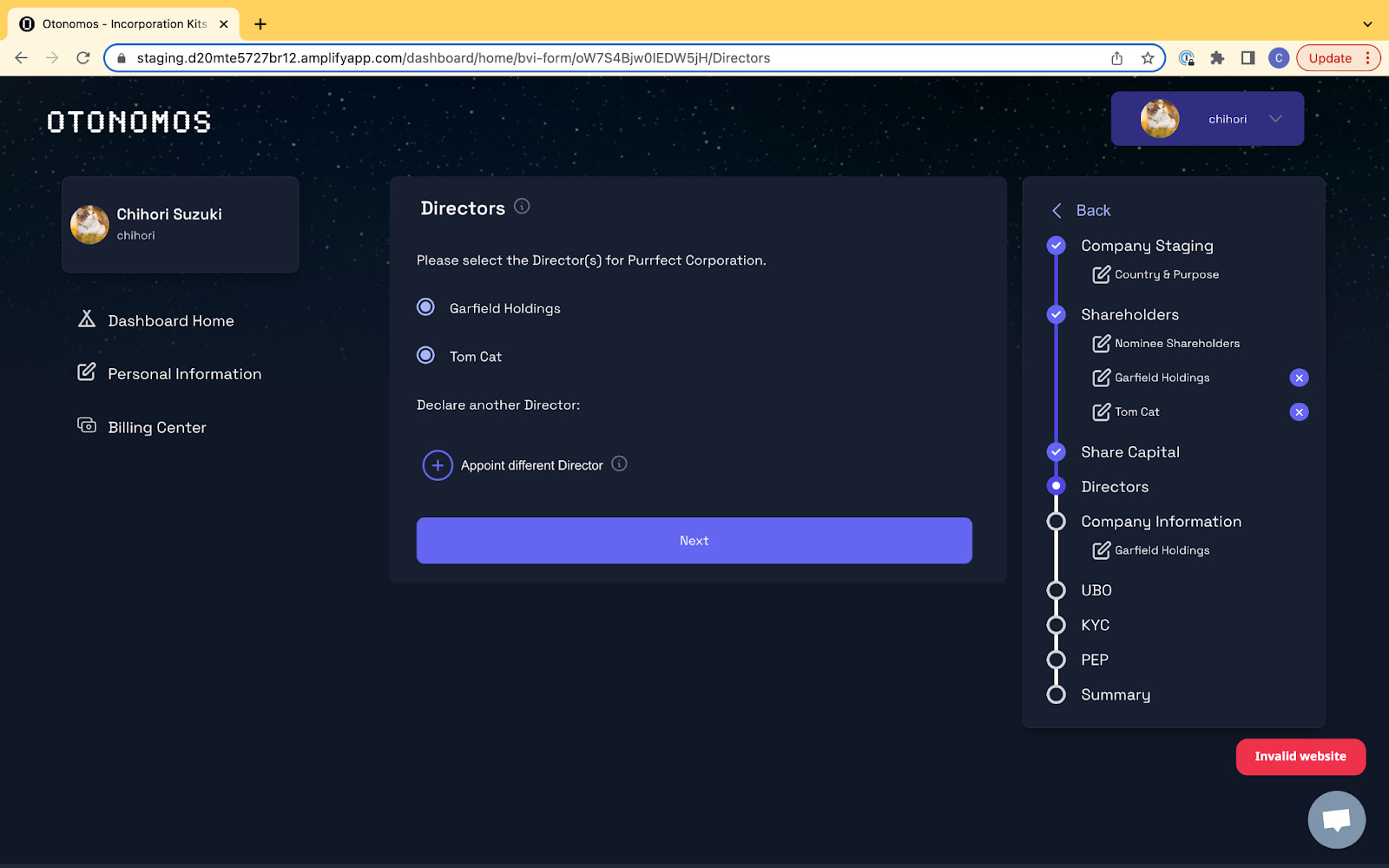

Once all shareholders are declared, it is time to appoint directors for your new entity.

As with the shareholder section, the system first checks if a Nominee Director was part of your order. If so, it will be automatically added to the form. If not, you can add and pay for a Nominee Director from within this stage.

Here again the form is smart in that it assumes that the shareholders you bring to the company will also be its directors, which is the most common scenario:

If none of the shareholders will be directors, you will need to appoint a director who is not a shareholder:

Here again, we need to know whether this will be an individual or a company. Once that is established, we will only ask for name and contact details at this stage.

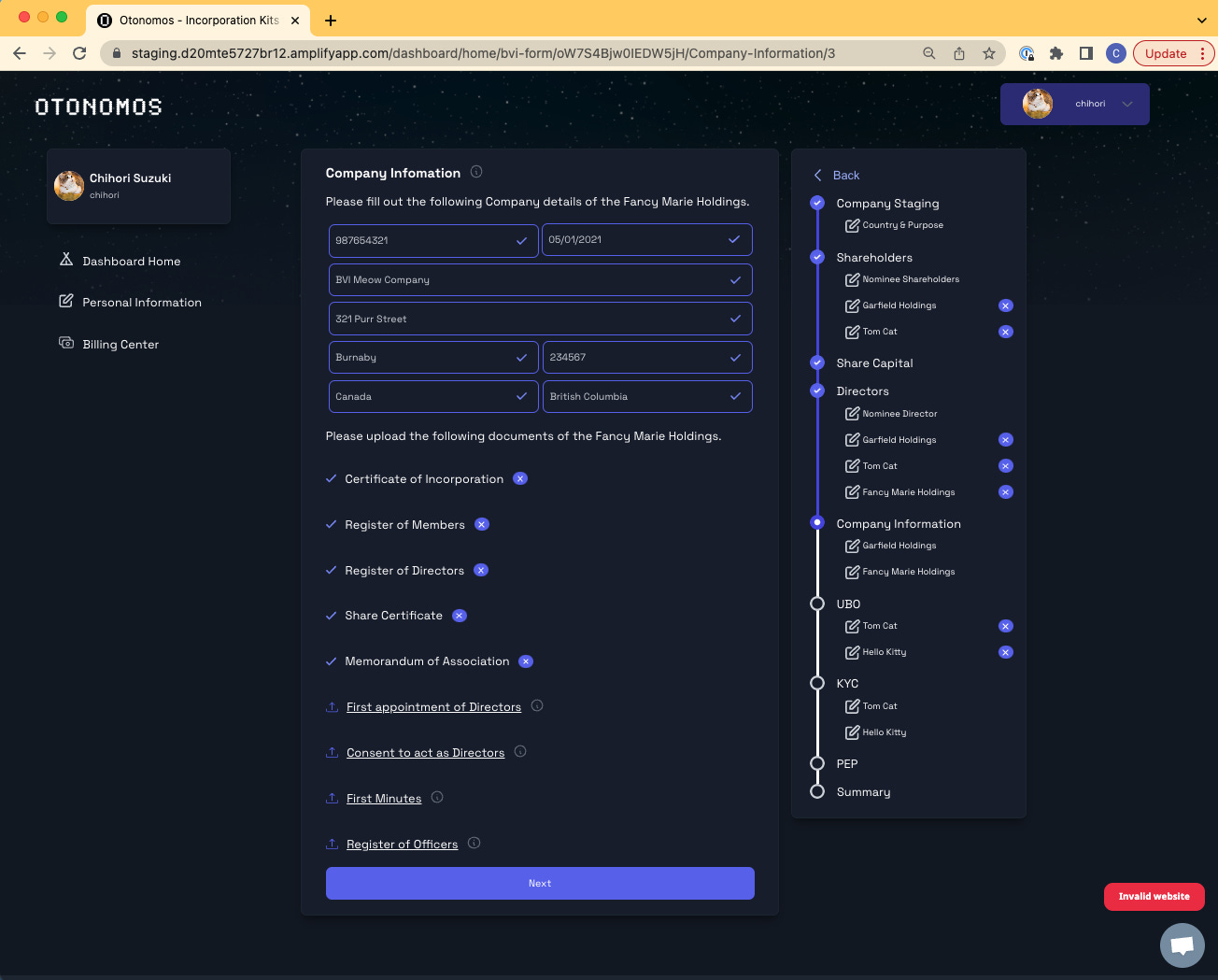

Company Information

Once all shareholders and directors are determined, we move over to the due diligence part of the form.

Here we ask for documentation and further details about the shareholders and directors.

If there are companies selected as one of the participants, we will first ask for the company details along with the company documents like Register of Directors, Register of Members, Certificate of Incorporation, etc.

Ultimate Beneficial Owners (UBOs)

Next we come to the UBO declaration for the entity that is being registered.

If the shareholders is an individual, the UBOs typically coincide with the shareholders, but you can add additional or entirely new UBOs (though the latter is rare).

If any of the shareholders or directors is a company, we will need to establish its UBOs. Here too the form guesses that these will likely be the individuals who have been named earlier on in the form.

The UBO - who is always an individual - can also be somebody different. In the example above, an additional UBO to “Garfield Holdings” is named, who is one of its Shareholders and Directors.

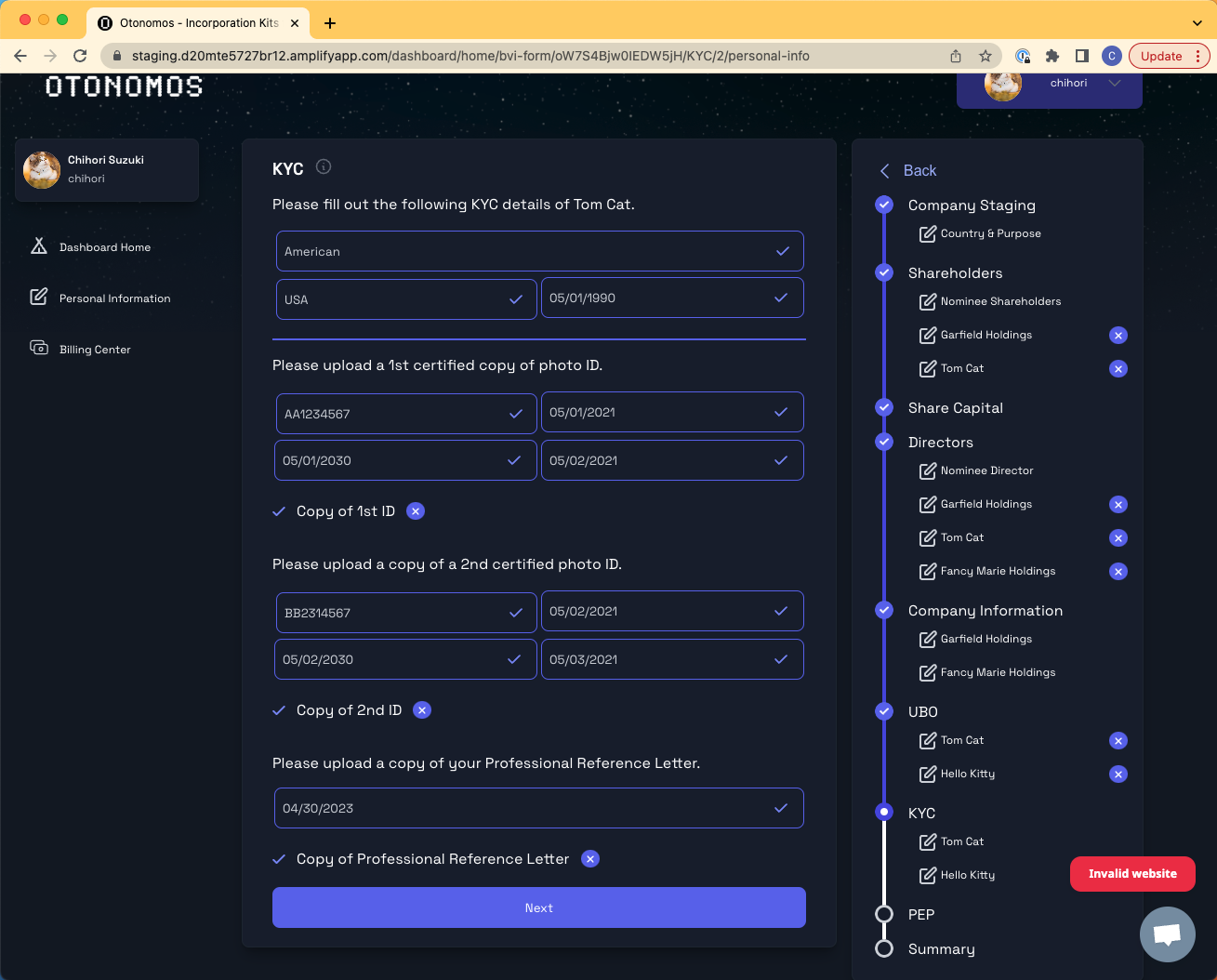

KYC (Proof of ID)

With all of the principals and UBOs identified, we now move to gathering the KYC data of the individuals who are part of the entity.

First, we need to know the personal information along with 2 pieces of certified ID, supported by a professional reference letter which needs to be provided by a certified lawyer or accountant.

We ask for certification dates so our backend can keep track of the status of the provided KYC which will help with future entity management.

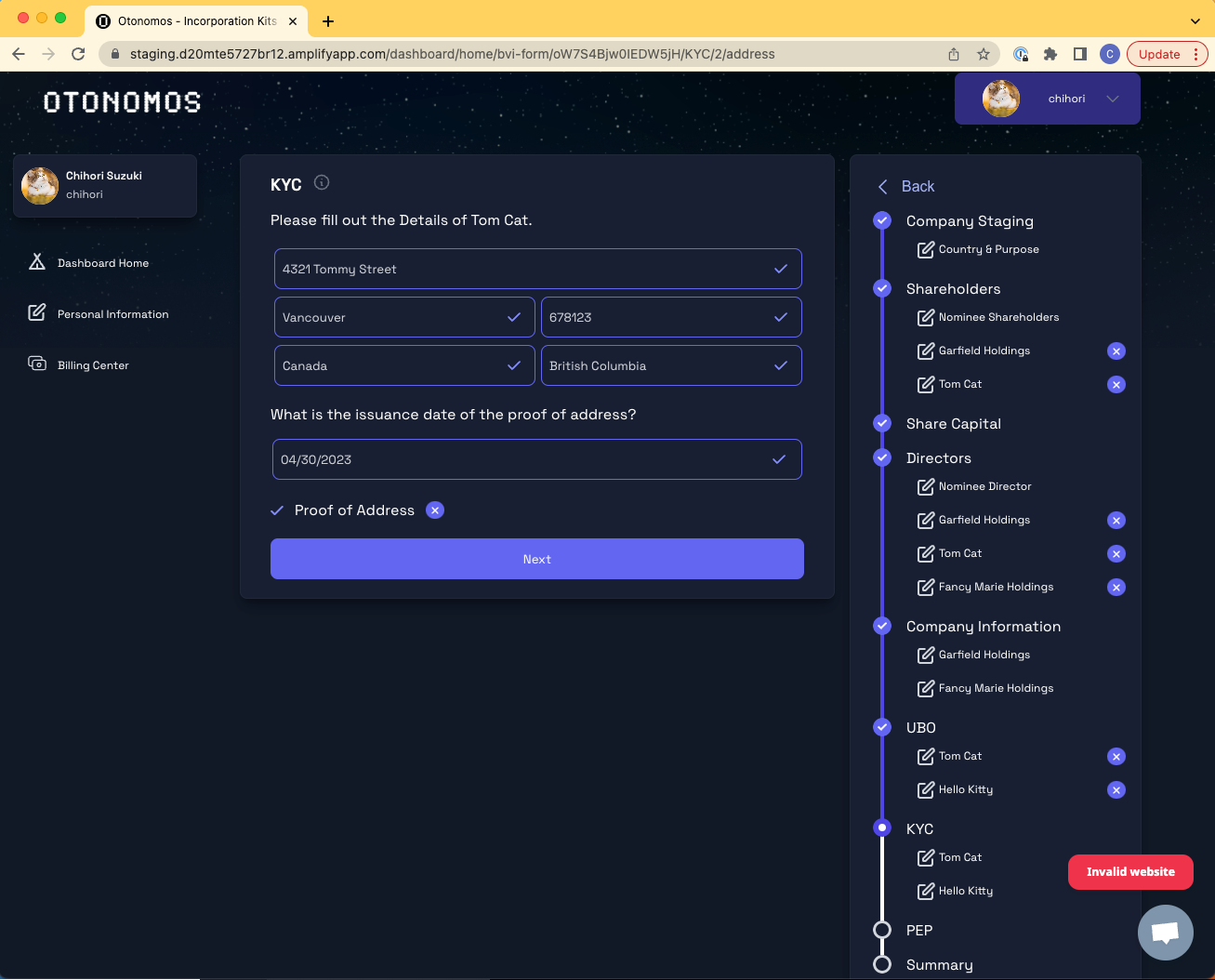

KYC (Proof Of Address)

Lastly, we are required to gather address details along with a proof of address which is not older than 3 months. This document needs to be certified as well.

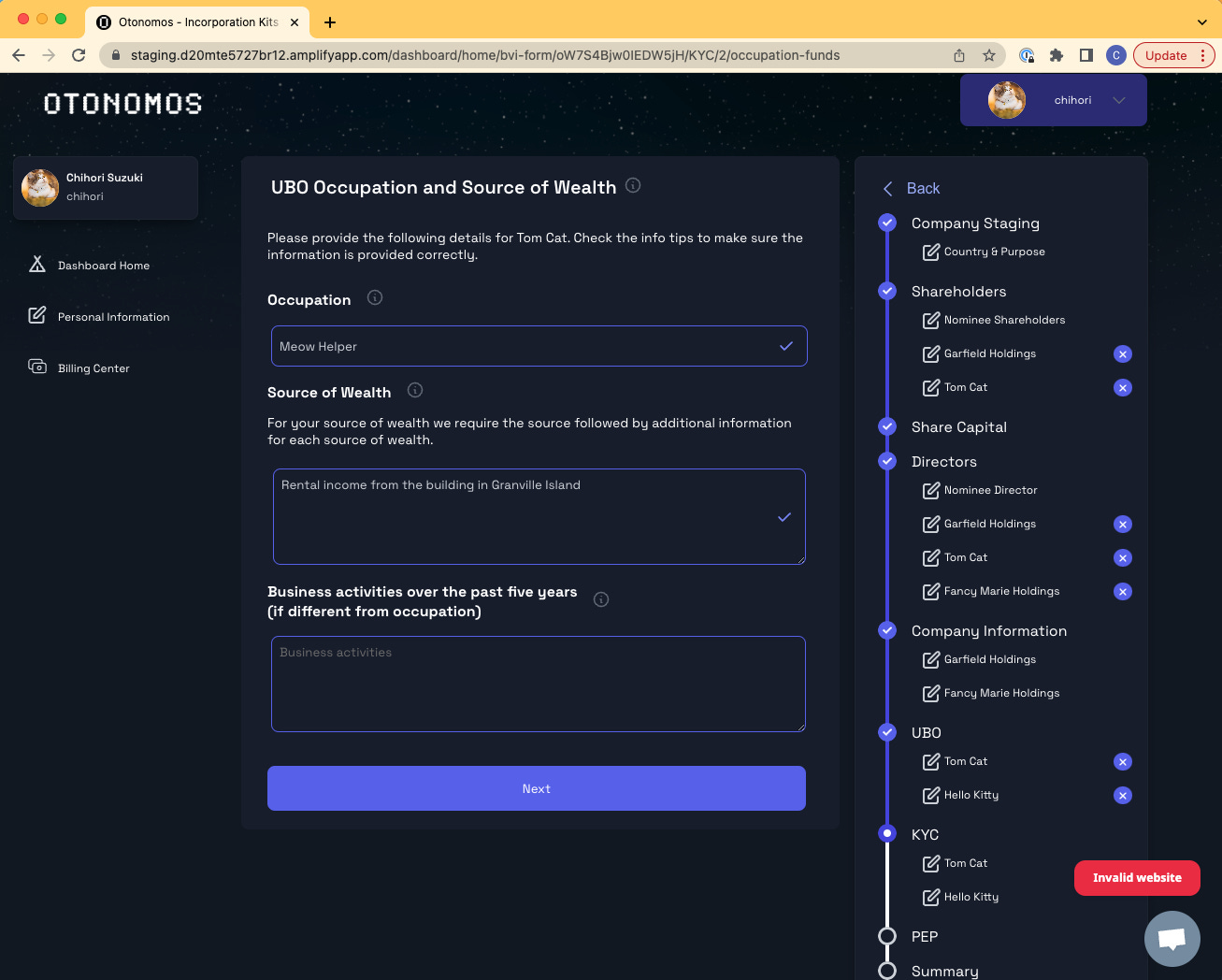

KYC (UBO Occupation and Source of Wealth)

UBO’s are required to give a little more information than shareholders and directors, including their occupation, source of wealth and business activities over the past 5 years if they different from their current occupation.

It is important to make the information as detailed as possible to prevent any follow- up questions from the registry at the point of fling, which could delay the incorporation process.

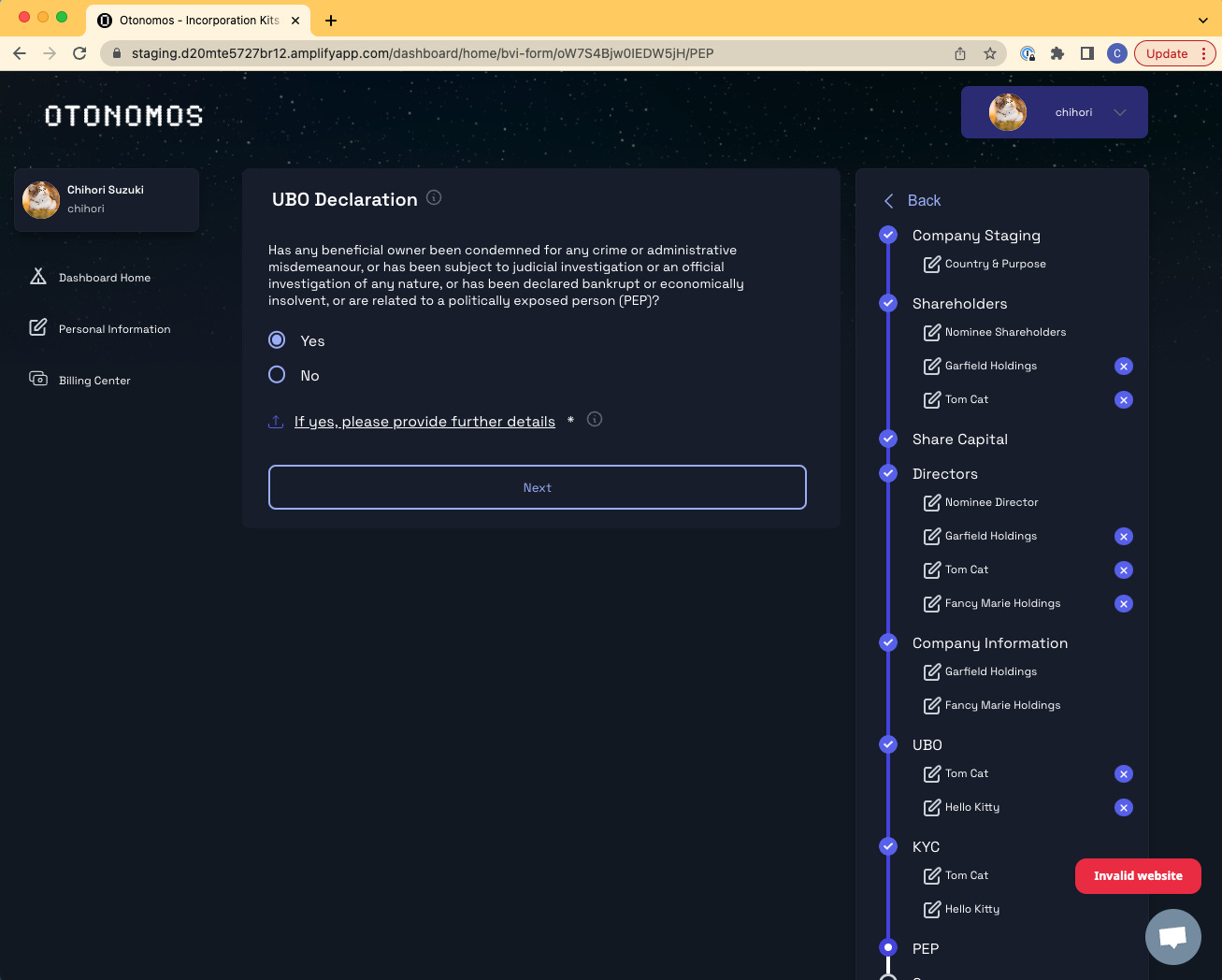

Politically Exposed Person (PEP) as part of the UBO Declaration

Finally, we need to know whether any of the UBO’s are potentially Politically Exposed and/or been accused of any misdemeanors. If the answer is yes, we’ll need a separate letter with further detail.

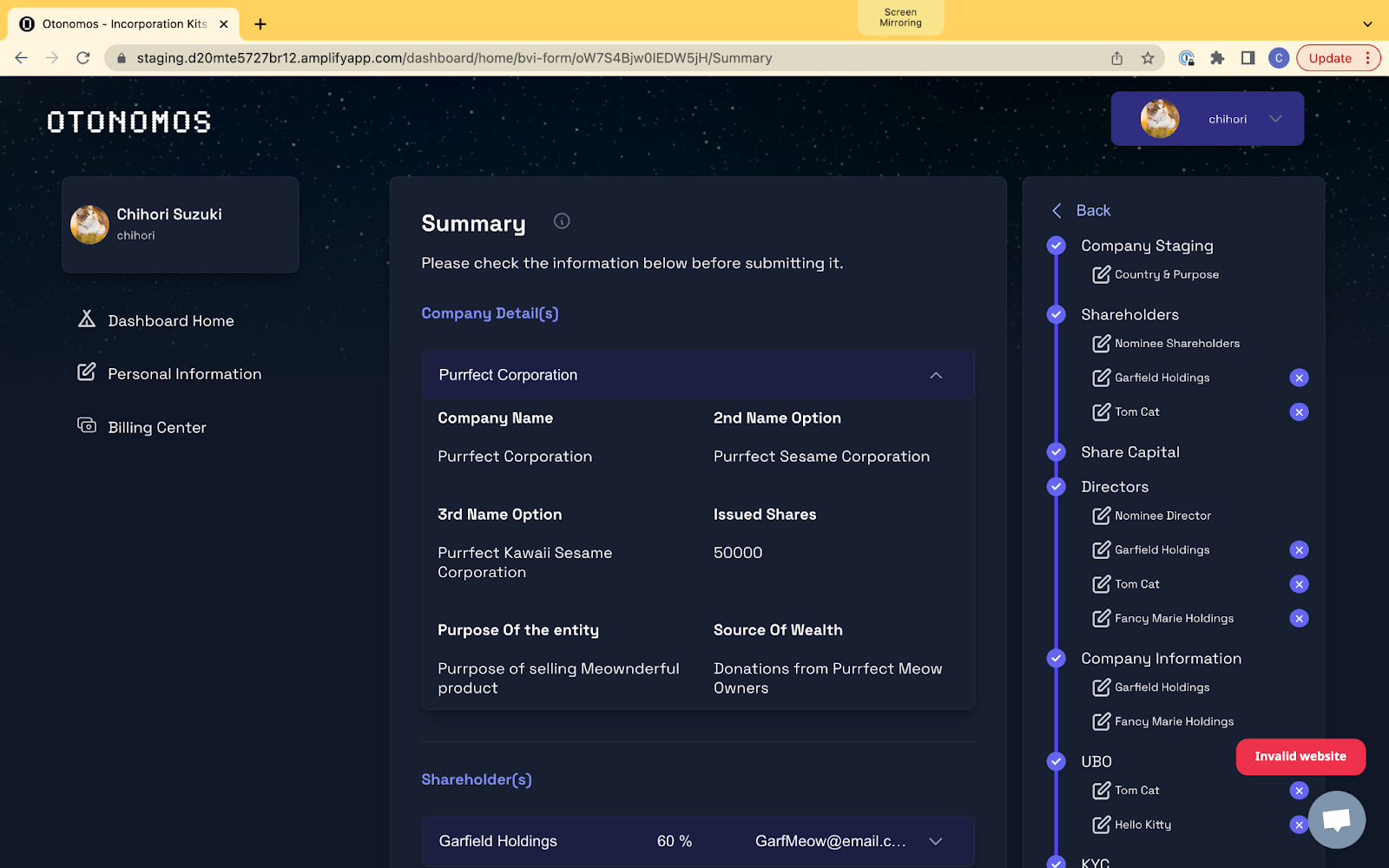

Please check results

At the very end of the staging, you will be able to check all the information provided in a neatly populated summary.

To make it easy to check everything, we have divided the information in different sections, and the menu on the right hand allows you to quickly navigate to the section where you need to make changes.

Once everything looks ok just press Submit. We then do a check our side and generate a printed PDF form for you to sign, after which we file with the BVI Registry. The day after filing, your entity legally exists and the documents typically come back from Registry within a week.

CONCLUSION

KYC and client DD is rarely a delight.

However the logic of code can make harvesting user information online so much more delightful compared to paper form filling, especially when forms build on previous answers to pre-populate the next fields, based on the most common scenarios.

Most BVI entities have the only one shareholder who is also a Director and UBO, so the staging is very straightforward. However our staging process does also cater for edge cases to avoid any manual input, for instance when your company has company shareholders and/or directors.

This is a further example of how Otonomos is automating every step of the company formation and entity maintenance process.