Web3 is rapidly on the ascent, earning the trust and time of users and businesses alike for a whole range of reasons.

However, it’s still in the earlier stages of adoption and can’t be considered mainstream just yet. So, particularly when it comes to matters of finance, Web3 projects have to find ways to increase accessibility for the uninitiated and those who have one foot in crypto and the other in fiat currencies.

This bridge is referred to as ‘ramping’ but is simply just a matter of exchanging between the two formats of economy. It’s a process that can be made overly complex, and thus hinder a project seeking to appeal to as many users as possible, but there are now many tools that make for efficient, secure, and accessible ramping companions.

Blockchain meets the real world – why has it been a struggle to transfer value?

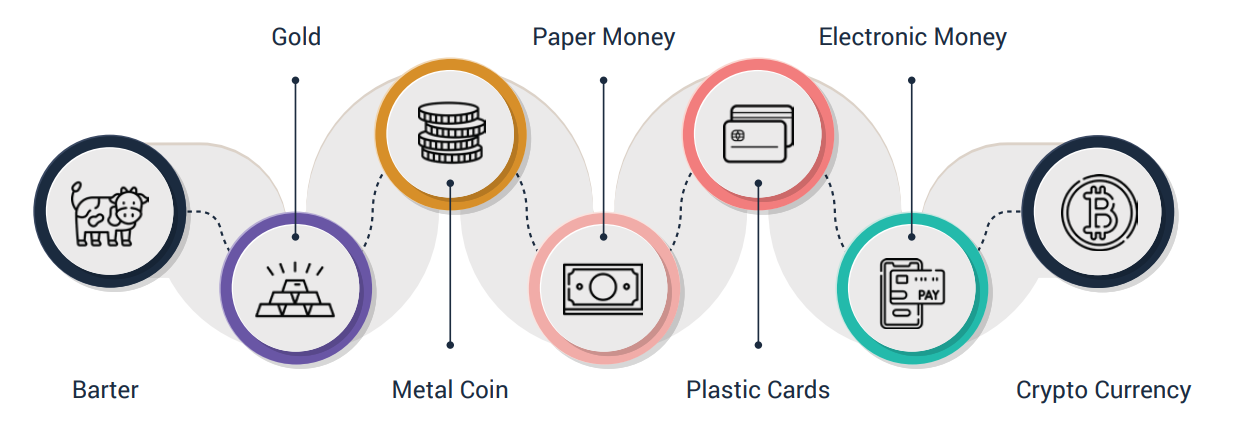

The core struggle of the divide between blockchain economies and fiat economies has essentially been the exchange between formats. The two financial ecosystems are in stark contrast to one another and yet seek to achieve the same goal: exchange monetary value. So, a system had to be created that would allow for a true exchange of value between the many fiat currencies of the world and the various blockchain cryptocurrencies.

A major struggles has come in the form of the stigmatisation of cryptocurrencies – regardless of how inane such positions may be. Most mainstream audiences have little interaction with the Web3 world, instead predominantly knowing of Bitcoin and its volatile prices. The system is seen by many as an investment vehicle, something to be bet on, rather than a revolution in personal and business decentralisation that offers freedom from the restraints of major corporations and governments.

Some governments even continue to refuse to call cryptocurrency a form of convertible currency or outright ban its use, as is the case in Qatar, China, Saudi Arabia, and Cameroon. Throw in the difficulties of crypto-friendly banks collapsing, as Silvergate Bank did, and major exchanges like Binance struggling to find new fiat banking partners in major markets, particularly France, and you’ve got a lot of friction between transferring value between the two.

Challenges faced by traders, DAOs, funds, and other projects

Dealing in and out of a blockchain, naturally, presents challenges to what’s become the accustomed state of play. For traders, the challenge and potential benefits lie in the volatility of coin prices, but there’s also the fact that some 15 per cent of bitcoin in circulation belongs to around 100 addresses, making the system more centralised and somewhat disadvantageous to your average investor.

A decentralised autonomous organisation can be hindered both by the time and cost of transactions from fiat to crypto or between blockchains; then there’s the incredibly varied regulatory landscape around the world. The lack of one standardised portal for on-ramping and off-ramping can create challenges for all, but that’s also part of the appeal of the decentralised form of finance.

The evolution of on-ramping and off-ramping platforms

On-ramping and off-ramping, or rather, allowing users to exchange fiat currencies for cryptocurrencies and vice versa, has long been a necessary part of the blockchain environment.

Without these tools, the blockchains would essentially be limited to those who could mine coins and acquire them through other means. To become accessible to the world, ramping platforms had to be established and refined.

Where once there was a somewhat sprawling field of platforms that would either specialise in on-ramping or off-ramping, many of the more centralised platforms now cater to both. The major exchanges are a prime example of offering this duality of exchange nowadays. The need also opened the door to specialised third parties that would appeal to Web3 projects by offering an all-in-one service and other related perks.

Projects can now integrate on-ramp and off-ramp features into their apps through third-party widgets and services that also cover other regulatory requirements like Know Your Customer and Anti-Money Laundering checks. It makes the process easier and more streamlined for Web3 developers and their intended users.

Centralised and decentralised exchanges

Centralised exchanges (CEXs) are your more traditional vehicles for on-ramping and, usually, off-ramping. Platforms like Kraken*, Coinbase*, and Binance* facilitate the exchanges and have built efficient user-interfaces to let people deposit and order- the platform then executes the order.

Decentralised exchanges (DEXs) eliminate this kind of intermediary, allowing users to trade directly with one another to give full control over the transactions, however they often have limited or no on- or offramping functionality.

What are the best tools and protocols for my project to move money between the blockchain and fiat economy?

As a baseline for best practice, if your Web3 project caters to users on-ramping, it should also allow them to off-ramp. Having protocols in place for both sides will do wonders for, at the very least, the user’s perception of the brand as it means that their funds don’t appear to be “lost” to the blockchain or unattainable as fiat funds again.

To ease some burdens, it’s also worth finding a platform with licence-free integration to lessen the administrative and legal document work required. With this in mind, for many, third-party crypto ramps offer the most streamlined and efficient way to move money between the blockchain and fiat economy.

You could look to the Ramp* for complete ramp solution, which is a free widget that handles user verification requirements, chargebacks where necessary, and, of course, exchanging fiat currencies for crypto.

MoonPay* is another major player in this space. Boasting over five million customers, users can easily on-ramp and off-ramp once the system is integrated into a Web3 project thanks to its support of major card providers, mobile wallets, and regular bank transfers.

Mt Pelerin* offers what many users may deem to be a near-idyllic solution. The total ramp tool offers a limited number of transactions without KYC verification requirements.

The leading on-ramping and off-ramping solutions present the connective tissue that allows for fiat users (most of the world) to enter into and explore the ever-growing world of Web3. As a Web3 project, the key is to make the transition as seamless and accessible as possible.

> Reach out to our users via our official Telegram group to swap intel about the tools they use or schedule a call with Otonomos if you would like to explore crypto to fiat options for your company.

*Note: mention of this service is not an endorsement by Otonomos and we do not receive any form of compensation from these or any other providers we work with.