In the second half of September, OtoCo will be releasing a brand new governance plugin for its users’ LLCs.

As Members, users will be able to run operations at their company while dynamically granting permissions to a delegated Manager smart contract.

Our overall objective was to turn some key vulnerabilities within traditional companies into immutable smart contract code that preemptively addresses the typical “agency problem” that stems from a delegation of powers.

Governance in Companies

In traditional companies, key responsibilities are delegated to one or more executives who handle day-to-day business and operations.

This allows a company to run smoothly without requiring its owners’ constant involvement in every decision. No company can afford an Oxford-style debate on every decision!

Whilst Web3 came with the promise of Gov3, coin voting by liquid token holders has known shortcomings, such as low voter turnout, member apathy, slow decision making, and overly complex governance processes.

Sometimes it feels we’ve added a lot of bureaucracy to make our vision of bottom-up organizations work, largely stemming from our allergy to delegation of power, which to many reeks of re-centralization.

Managing your manager

Appointing managers does take powers away from the community at large and carries the risk of transgressions.

In an analog setup, transgressions can be as a result of confusion and lack of clarity about the Managers’ responsibilities, and most transgressions will be in good faith.

However, obfuscation, desperation, greed, or other flaws in the human psyche may also lead to a Manager acting outside of the authority given by the Members.

If this happens in realverse companies, it will likely lead to messy litigation and a court or arbitraged decision.

Code-controlled delegation

When using smart contracts, delegation of powers can be on a matter-by-matter basis and transgressions of power can be pre-empted.

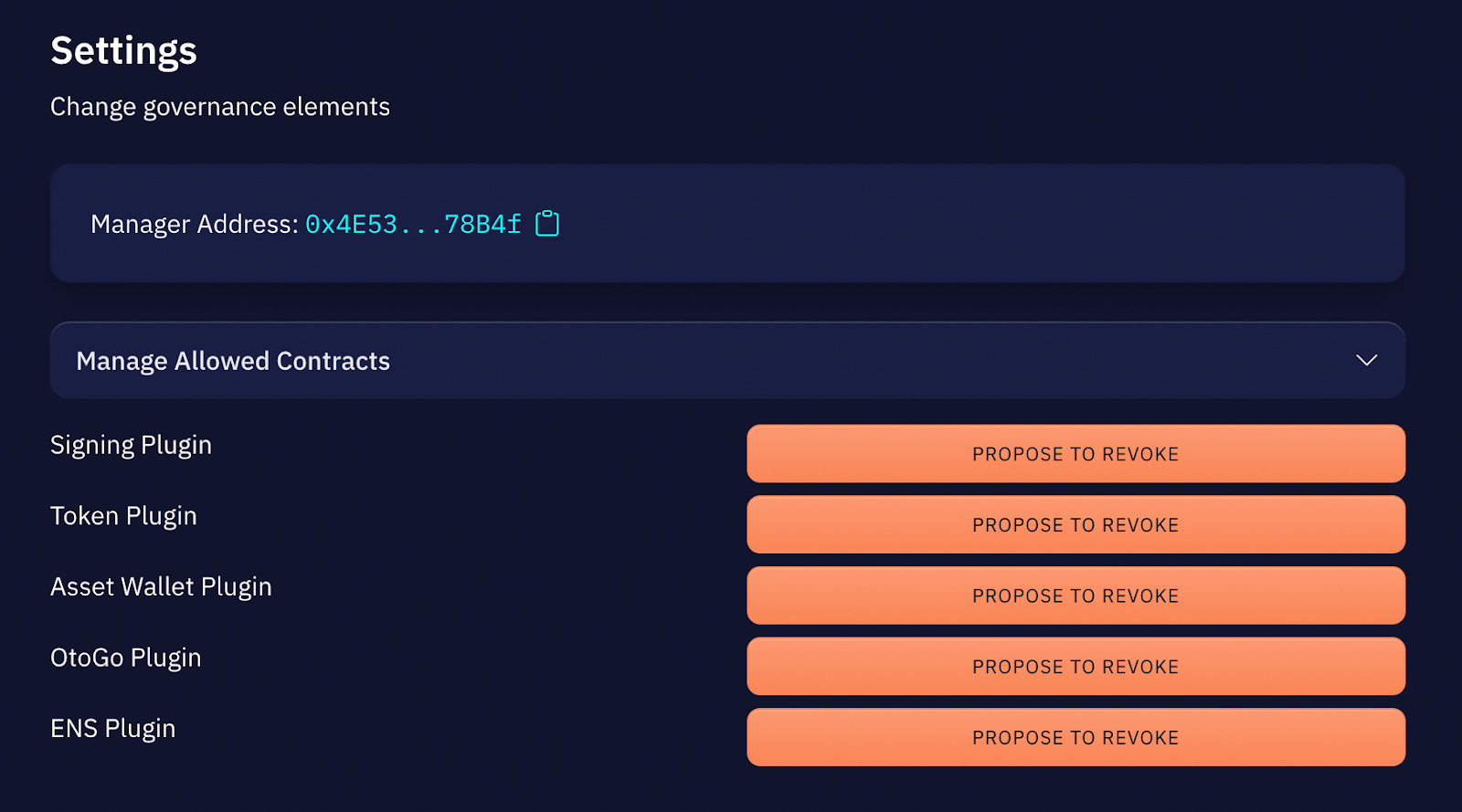

Our approach when designing our Tokenized LLC was to encase every Manager matter into a smart contract plug-in. As a result:

- Smart contracts can enforce limits on a Manager’s use of OtoCo features;

- Manager’s permissions can be dynamically adjusted to suit the company’s needs;

- Members have full transparency on the Manager’s decisions

The list of Manager Reserved Matters plug-ins can only be added to (or reduced) by way of a Members’ vote, who retain powers known as Member Reserved Matters (e.g. transferring or selling an ownership stake, dissolving the company or agreeing to an acquisition).

How it works

Once an LLC tokenizes itself on the OtoCo platform, the Manager of the company will be automatically authorized to use a suite of default features within OtoCo for:

- Creating tokens

- Deploying asset wallets

- Starting a launchpool

- Signing and timestamping company documents

- Acquiring an ENS subdomain name

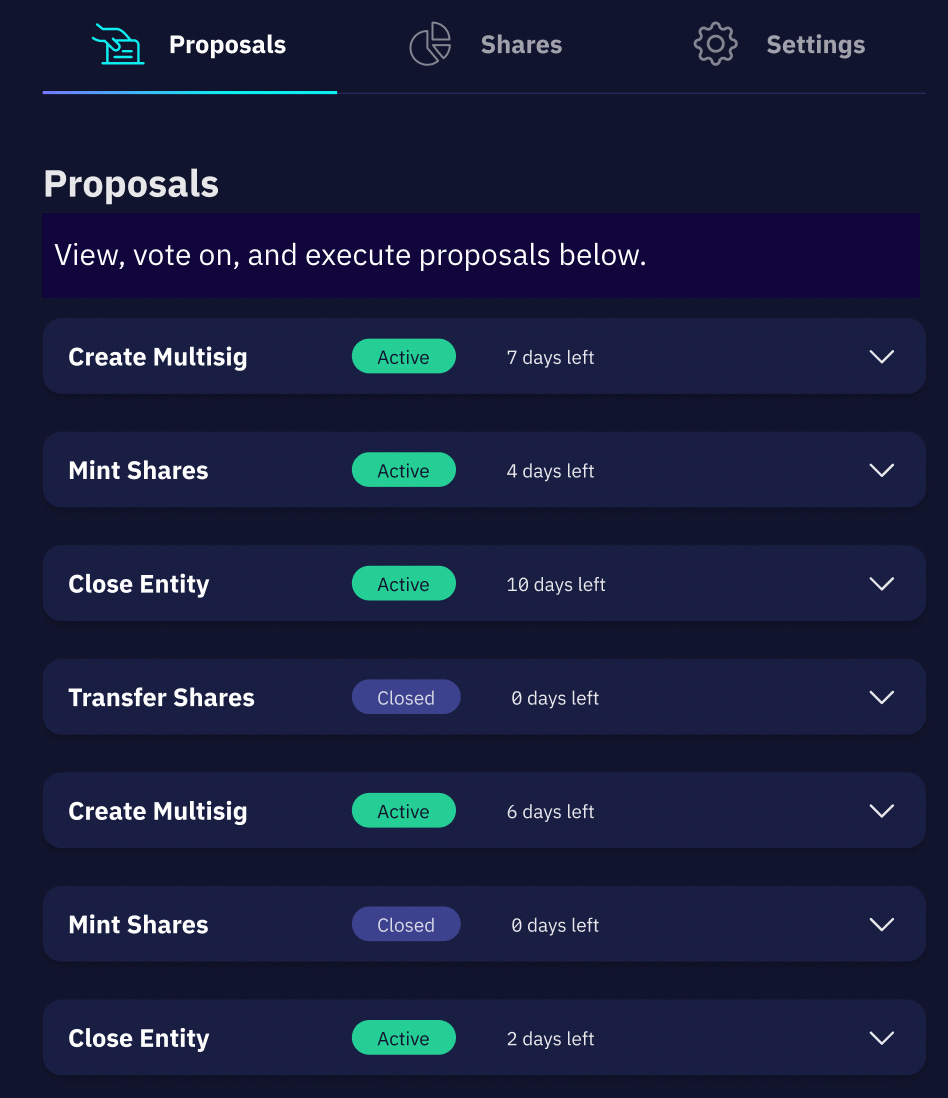

These are the Manager Reserved Matters referred to above. If a Manager interacts with any of these plug-ins, a proposal will be initialized for Members to view and vote on.

But as we know, voter turnout is low in politics, low in companies, and even lower in DAOs. How does OtoCo ensure that organizations remain agile and don’t fall into problematic bureaucratic patterns?

To solve for this, we coded a smart contract that deals with Manager Matters differently compared to a vote at the Member on a proposal that originated from any of the LLC’s Members.

In case of a Manager proposal generated by an allowed Manager plug-in, if there are no dissenting votes by Members within the specified voting period (also changeable by vote), the Manager proposal passes by default.

This contrasts with Member proposals which do not come “pre-authorized” and hence require a quorum and a majority threshold to pass.

If Member(s) take issue with a Manager proposal, they can vote against it, which results in the proposal morphing into a standard Member proposal.

The net result is a controlled delegation of power to the LLC’s Manager, who within the list of pre-authorized set of actions has full freedom to act as he/she sees fit.

Extendible powers

The elegance of the plug-in design is that the list of allowed contracts the Manager has control over can be easily updated: New smart contracts - including third-party developed dApps - can be added as the OtoCo platform grows. Reversely, existing permissions can be removed to tighten security controls. All of this via an onchain Membership vote.

Member Vote

Such Member vote requires (by default) a 51% quorum and 51% approval votes among the “present” Members i.e. those Members who together form the quorum.

In a next release, we will likely add a qualified majority setting for Member matters, such as the sale of the company, that are critical business decisions with significant impact on all stakeholders. However for now the above quorum and threshold rules cumulatively apply.

Note that the Manager of the LLC (along with any Member) can put forth a proposal on any of the Member Matters, in which case the Manager (unless they are also Member) will not have any voting rights and will simply be tabling these proposals as a facilitator, forcing the issue to a vote.

Finally, we made sure that all the Manager smart contract plugins are supplemented by legal documents as an analog fall-back for those who equal legal validity with paper-based resolutions!

Brad’s wallet vs. Angelina’s

The governance plugins represents a leap forward in OtoCo’s mission to turn “companies into code” by transposing a host of analog business and legal logic into computer logic, enforceable by the security of blockchains instead of the persuasiveness of a lawyer.

To make this more tangible, Brad Pitt is currently suing Angelina Jolie for allegedly transferring her 50% stake in a French vineyard to a third party (a Russian oligarch of all people!) without his knowledge, robbing him of a chance to match or outbid the external buyer, in circumvention of what is know as a Right Of First Refusal (“ROFR”) clause.

Such ROFR clause is standard in many shareholder agreements, prohibiting an exiting shareholder from transferring his/her shares in a private company without letting fellow shareholders know, triggering their right to buy the shares by matching or bettering the price offered.

The Brad and Angelina case is set to turn ugly and is tangled with their messy divorce. If however each had their 50% ownership of the company that owns the vineyard tokenized, a ROFR plug-in smart contract would have locked Angelina’s mirror tokens until Brad either unlocked them using his private key, or until he would have sent her the amount matching or exceeding the oligarch’s bid.

Our best estimate is that this ROFR smart contract would have been eleven lines of code, versus thousands pages of post-factum litigation.

This is one of many examples where a relatively trivial smart contract could pre-empt transgressions between Members and Managers of and LLC.

By eventually serving up more and more of these clauses as plug-ins for its Tokenized LLCs, OtoCo’s dash will ultimately become the digital control room that coordinates and automatically enforces decisions in the company of the future.