When we set out to build a tech-centric equity funding solution, we used a little thought experiment to help us draw up a list of its desirable features: How would God have designed this?

In doing so, all along our intent was to make our solution comply with existing securities laws, shortcoming as they may be.

Despite those confines, our thought experiment generated a list of 10 features which we believe have the potential to change the way equity is offered beyond recognition.

In what follows, we discuss each feature in detail and show how we made it work within our own funding round portal.

1. Entirely online

Our first requirement was to put the whole raise online, with both investors and Founders accessing the round without ever having to leave their browser.

a. Investor side

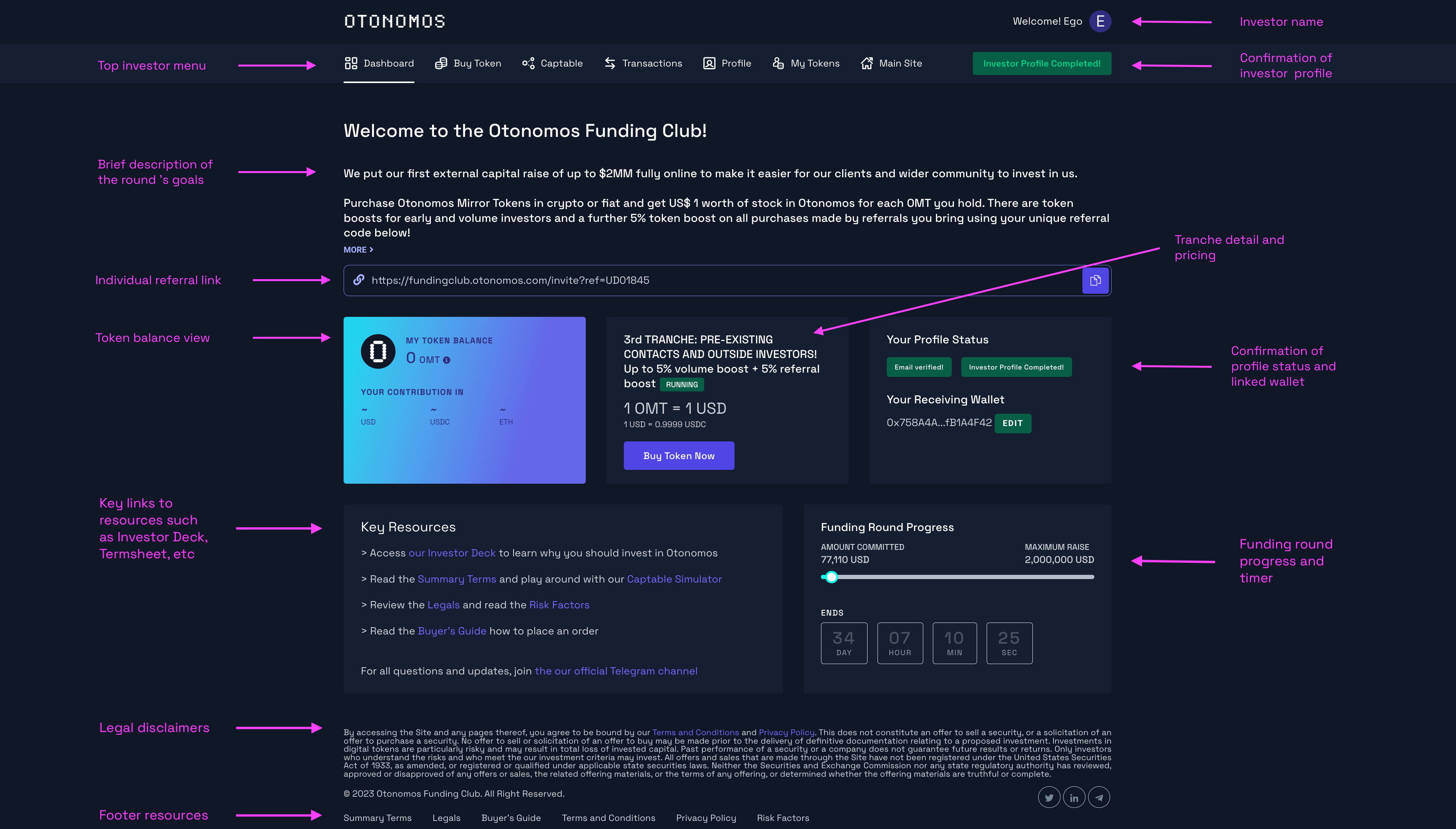

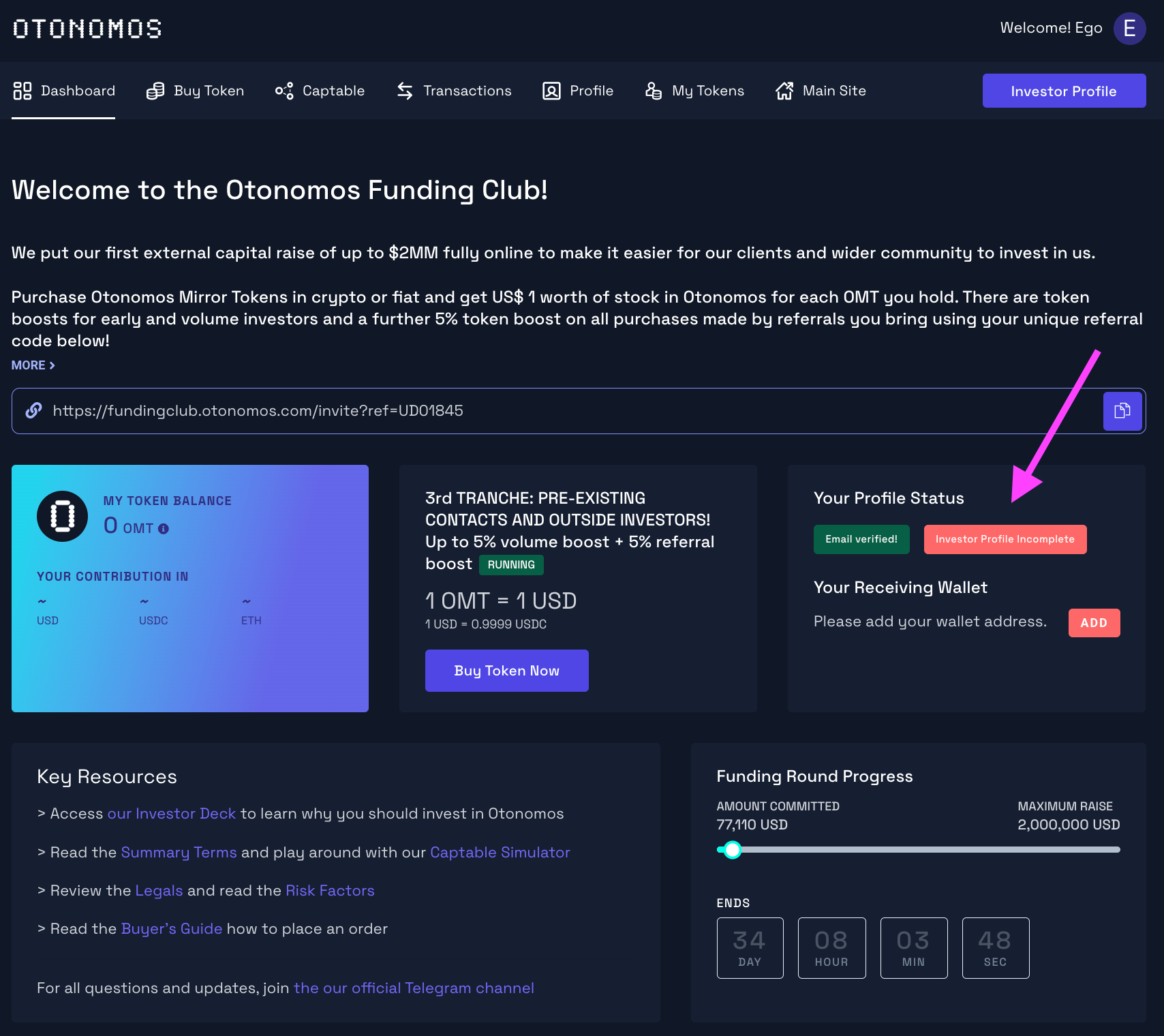

Founders opening a round can simply link to their funding portal’s customized URL, e.g. fundingclub.otonomos.com in the case of Otonomos’ round, from their homepage.

From there, investors can create an account, and once logged in they can access everything related to the raise from the welcome page:

When investors first logs in, their status will show “Incomplete” until their profile is submitted and approved (see requirement #7, Compliant, below). Once approved, they can proceed to participate in the round.

b. Admin side

The counterpart to the Investor environment is the Admin console.

Via this console, Founders can configure their entire round and monitor its progress, customizing each part of their raise, including:

- Setting deal terms

- Linking to key resources such as investor deck, financials, legal documents, etc.

- Determining the offering period

- Setting price tranches and their duration

- Approving investors

- Setting triggers for notifications and customize outgoing e-mails from the platform

- Seeing who signed up and monitoring transactions

- Populating each section of the Investor portal

- Systems settings

2. Fully automated

Our desire to make funding fully automated is different from it being entirely online (see requirement #1 above).

Full automation means human intervention is minimized to the maximum extent, avoiding dependencies that even in an online environment can lead to a stop/start process.

Many aspects of a funding round can be automated, e.g.:

- A token dispenser smart contract helps automation by dispensing (equity) tokens to the same white-listed wallet an approved investor makes payment from.

- KYC submitted by candidate investors can be run through databases to check against sanctions, political connectedness etc. Commercial solutions in this respect are plentiful and can easily be integrated via APIs.

- Carefully crafted legal language can give equivalence to a sequence of clicks and check marks in an online environment, instead of wet or e-signatures (see requirement #3 below).

3. Legally binding

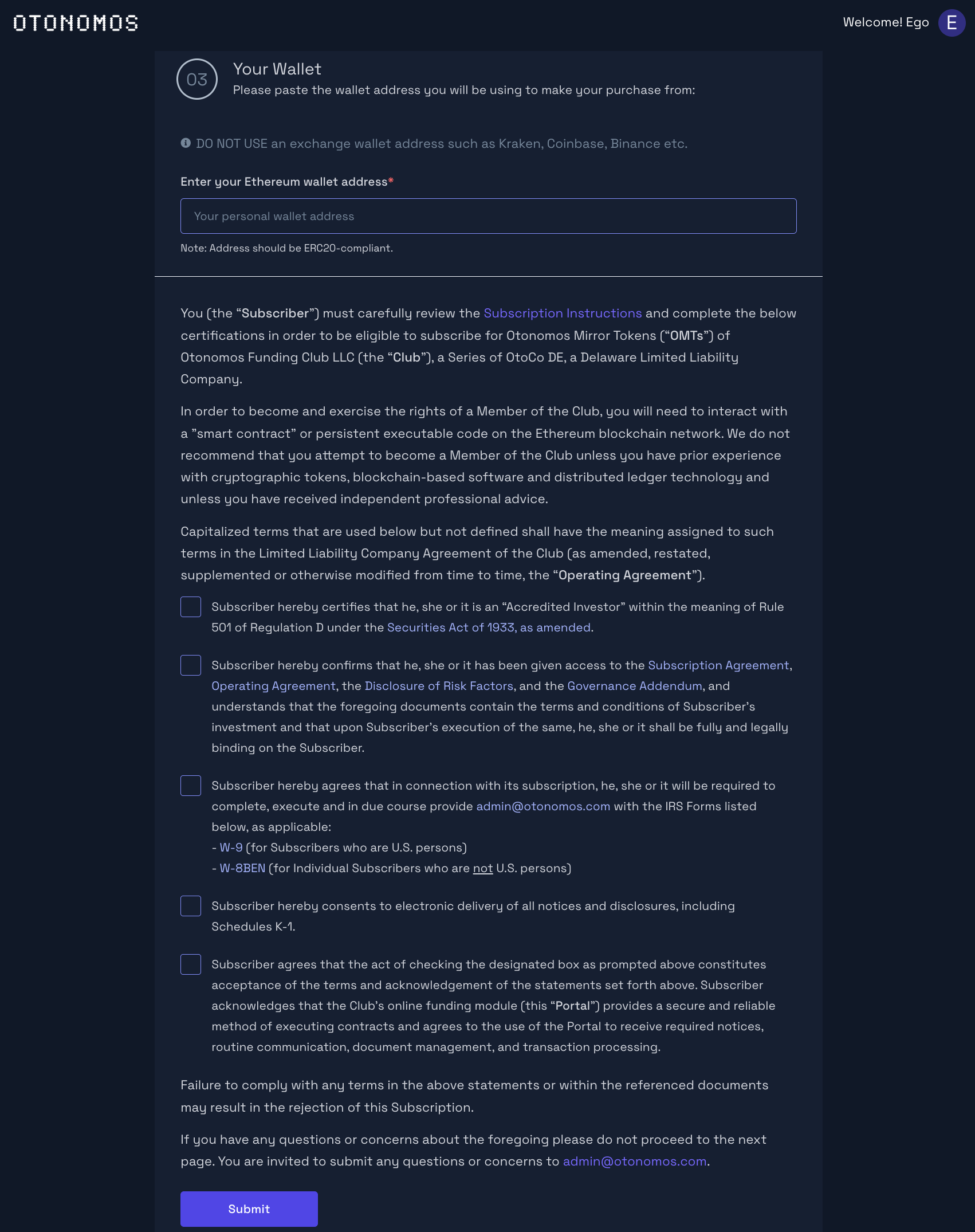

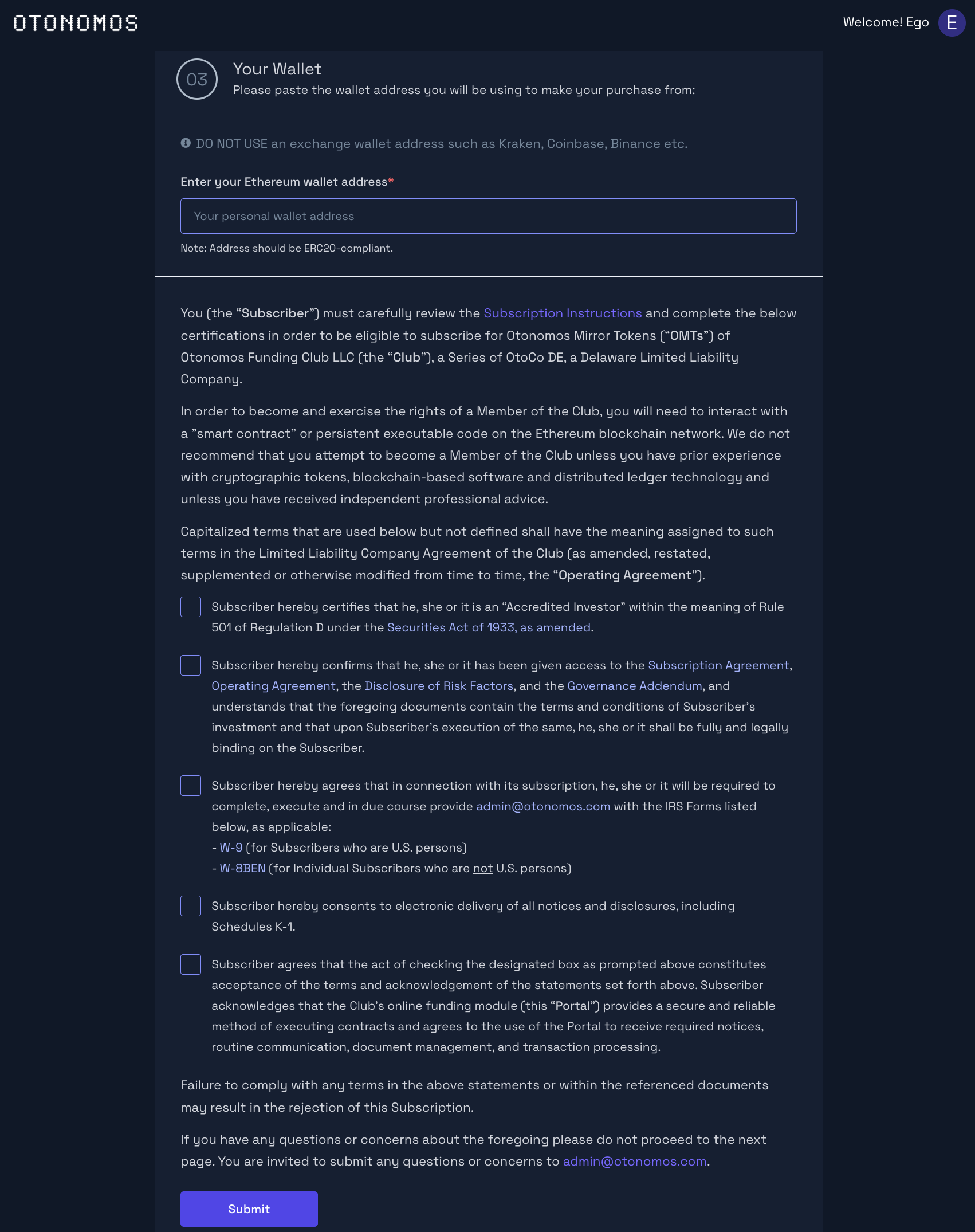

An ideal design doesn’t require investors to sign anything if it manages to guarantee legal equivalence to signed documents by using a sequence of online consents.

Otonomos’ portal has legal wording to that effect, linking online consent to operative legal documents accessible via the dashboard that enshrine investors’ rights and obligations in long form prose.

For instance, before investors can submit their profile, they are asked to agree to a number of certifications.

These certifications have been heavily lawyered over to give their wording the effect of subscribing for shares without signing a traditional subscription document.

As can be seen from the screenshot below, the certifications themselves contain links to long form documents including the Subscription Agreement itself, Risk Disclosures, a Governance Addendum, and the specially worded Operating Agreement of the funding vehicle in which they are set to become a Member by making a payment for tokens that represent their Membership interest.

4. Fully transparent

Putting a funding round online creates full transparency as to deal terms and commitments in a way no analog round could ever replicate.

At Otonomos we’ve seen clients’ SAFEs where one investor got a 30% discount, another a 55%, and a third a 15% discount on future equity, all within the same round!

By contrast, in an online round, deal terms are disclosed for all to see instead of bilaterally negotiated. In addition, pricing and valuation benefit from best-nation by default to include everybody who invests in the same online tranche, rather than being agreed offline in the corridors of some conference.

Investors simply go to the round URL to look at the terms and read up on the company. If they want to speak to the team, a Calendly link from within the portal lets investors book a call. If they like te deal, they can invest straight from within the portal and their contribution immediately shows as a % of the total raised.

This is very different from offline rounds which have very low transparency and often make Founders feel like they’re in a Grand Bazar haggling over price and terms in parallel negotiations.

5. Blockchain-enabled

God’s fifth design commandment for an online funding portal insists on the use of blockchains as the enabling technology for 3 key features that would be difficult to achieve via a central server stack:

- The use of decentralized ledger tech gives investors cryptographic proof of their position as an investor: the token they receive in return for their purchase of shares acts as an incontrovertible receipt of their subscription. The whole idea is that if the UXUI environment that stages the online round disappears, the investors’ legal position is safeguarded by just looking at etherscan.

- Hand in hand with the above is the need for a token that represents an actual equity interest. As mentioned above (see feature #2, “Fully Automated”), a smart contract can dispense such equity tokens in return for monies received if investors use digital currency for their subscription. Once the lock-ups of the tokens expire (which in a private round under Reg (D) have a mandatory lock-up period before transfer can happen), blockchains will also act as the rails for transfer of shares, becoming genuine “DeFi securities”.

- Finally, the equity token also acts as a voting card, giving investors an element of control in the company they invest in as per the terms of the deal. For instance investors as a collective could be given liquidation preferences, which are standard in VC-type rounds. Exercising their voting rights would then be similar to how DAOs allow their governance token holders to vote, via a Snapshot-type dashboard to which they connect the wallet that holds their equity tokens.

6. Crypto-first

The requirement for an online funding solution to be crypto-first means that investors should be able to pay for their equity in crypto first and fiat second.

Enabling crypto payments has ripple effects throughout the portal:

- It lets a token dispenser contract send tokens to white-listed wallets as soon as subscription monies in crypto have been received, rather than relying on APIs into fiat bank accounts.

- Subscription monies in crypto confirm quasi-instantly compared to bank wires.

- It reduces the costs and facilities “party rounds” with a bigger group of investors contributing smaller amounts towards the round’s overall funding goal.

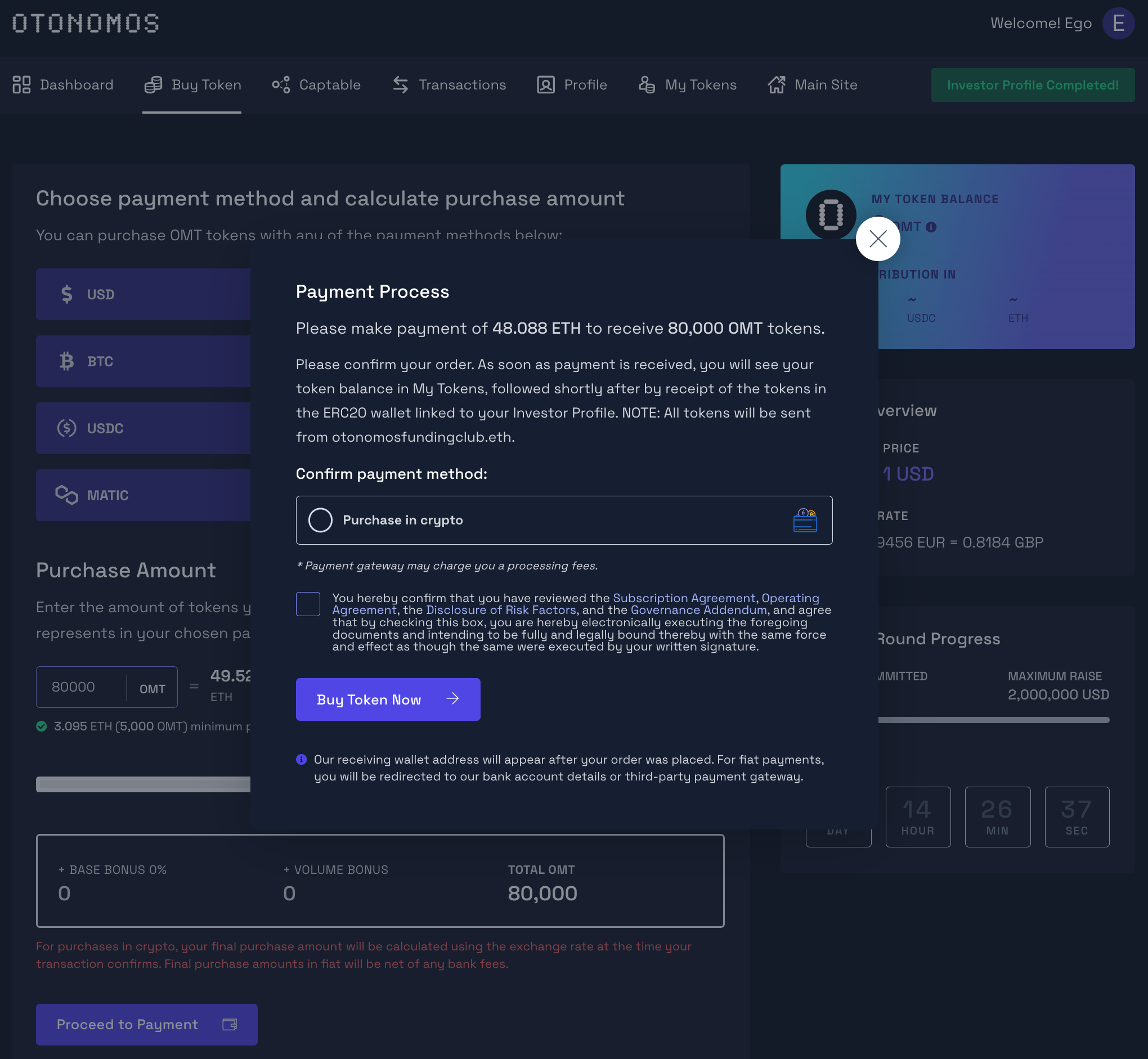

In the Otonomos portal, once an investor status is approved, all contributions can be made in crypto. A conversion engine automatically converts the USD price of the token into the digital currency of their choice and calculates the total to be sent.

Below is a screenshot of a subscription to 80,000 Otonomos Mirror Tokens (OMTs) in ETH on fundingclub.otonomos.com, representing 48.088 ETH at the time of publication of this post (28-Sep-23):

7. Secure and private

Security is often taken as a given, privacy is not. A legit reiteration of the ICO model would have to have both.

The former is achieved first and foremost from letting distributed ledgers take over all potentially vulnerable aspects of a centrally-hosted front-end, most importantly the distribution of the equity tokens as receipt for subscriptions into the rounds, and the payment for the subscriptions themselves, which are from wallet to wallet and hence do not rely on payment processing software. Security is then mainly relegated to the level of the wallet user.

Privacy on the other hand is governed by the portal’s privacy policy and the representations made therein as to the use of user data.

In the case of the Otonomos online round, its privacy policy in broad line makes it clear none of the information gathered as part of the investors’ profiles are to be resold or used in any other way than for the purpose of its fundraise.

8. Compliant

Doing away with regulatory restrictions when reiterating on the ICO model would obviously have given us a lot more design freedom.

It’s a lot easier to build in a vacuum and crypto is probably more guilty here than most, by pretending that a lot of the tokens on offer are somehow not an investment contract.

The true challenge is to keep an element of spontaneity in how projects get funded without going outside the existing regs, which are actually pretty clear when it comes to security offerings.

These security regs are what they are and building a solution in the hope of regulatory changes soon is neither pragmatic nor honest.

What we wanted to do is build a tool to offer securities DeFi-style to those projects that are clear-eyed about the nature of their token as a security, and are hence willing to do their token offering the right way.

Thankfully, technology can help a lot in making sure a securities token offering is done in a compliant way.

The way Otonomos engineered this is by controlling who gets approved as an investor in its portal on the basis of each investor’s self-certifications, which Otonomos is legally entitled to rely on.

It does so the following way:

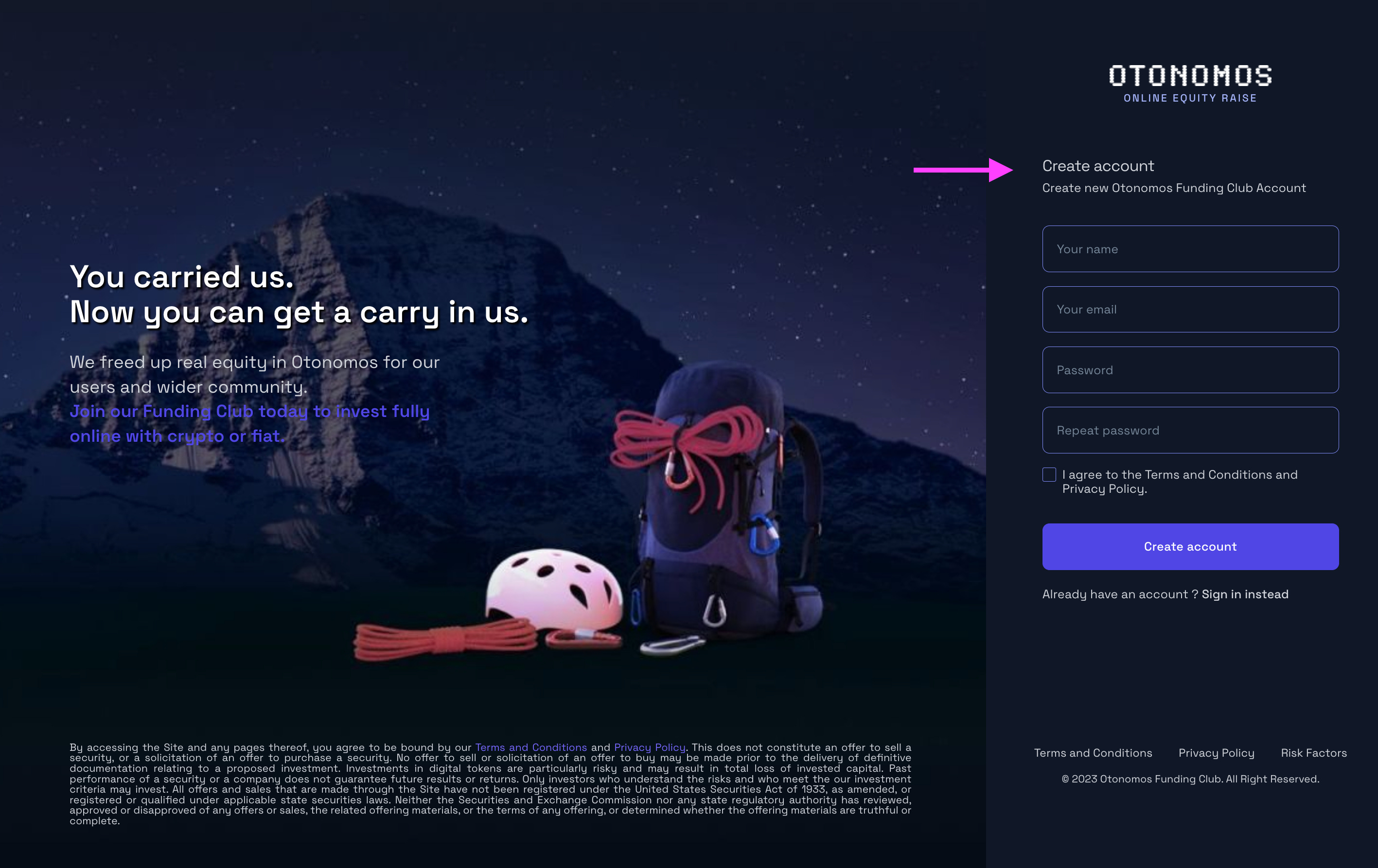

a. Create investor profile

The first step is to register for an account on fundingclub.otonomos.com so you can create your profile:

The system will ask you to confirm your login email for security reasons, followed by a second email to confirm that you can now access the portal.

Once logged in, you’ll see a welcome screen that indicates your profile status, which at this stage is still incomplete:

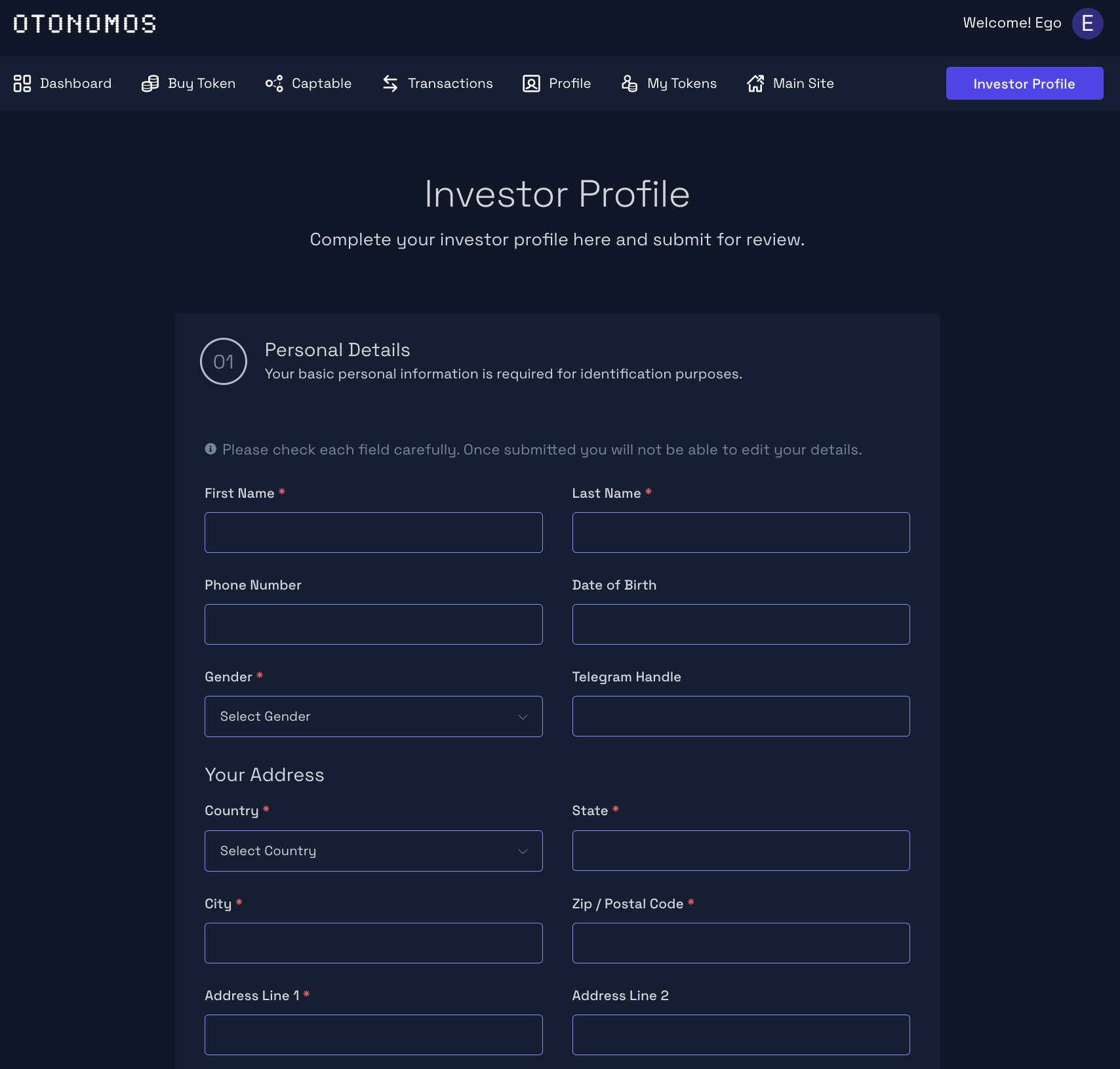

Clicking on investor profile will open up a panel that lets you share the personal details we need from you in order to meet regulatory requirements:

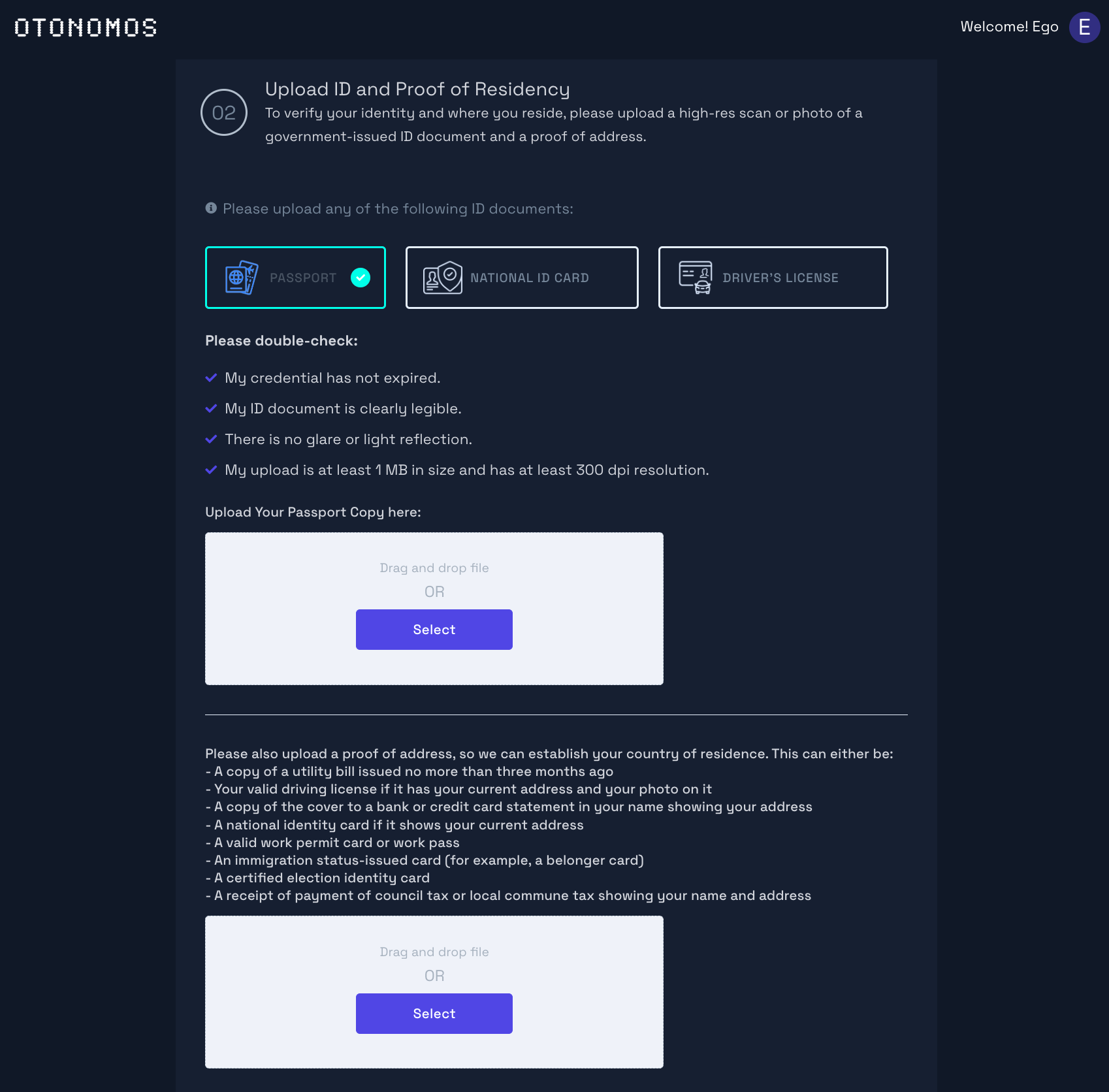

Scrolling down the investor profile section will allow you to upload proof of ID and residency.

You will also be asked to paste in the wallet address you plan to use to pay for your subscription.

As seen above (see requirement #3 ”Legally valid”), you will be asked to agree to a number of certifications before you can successfully submit your profile.

Amongst the certifications is a self-certification clause that qualifies you as an investor as soon as the deal Admin has reviewed and approved your profile, making sure you are an Accredited Investor under the SEC’s Reg(D) safe harbor:

You’ll get a screen and email acknowledgment after submitting your profile and an email once the round Admin has reviewed and approved it.

Once approved, you can invest in the round.

b. Round admin side

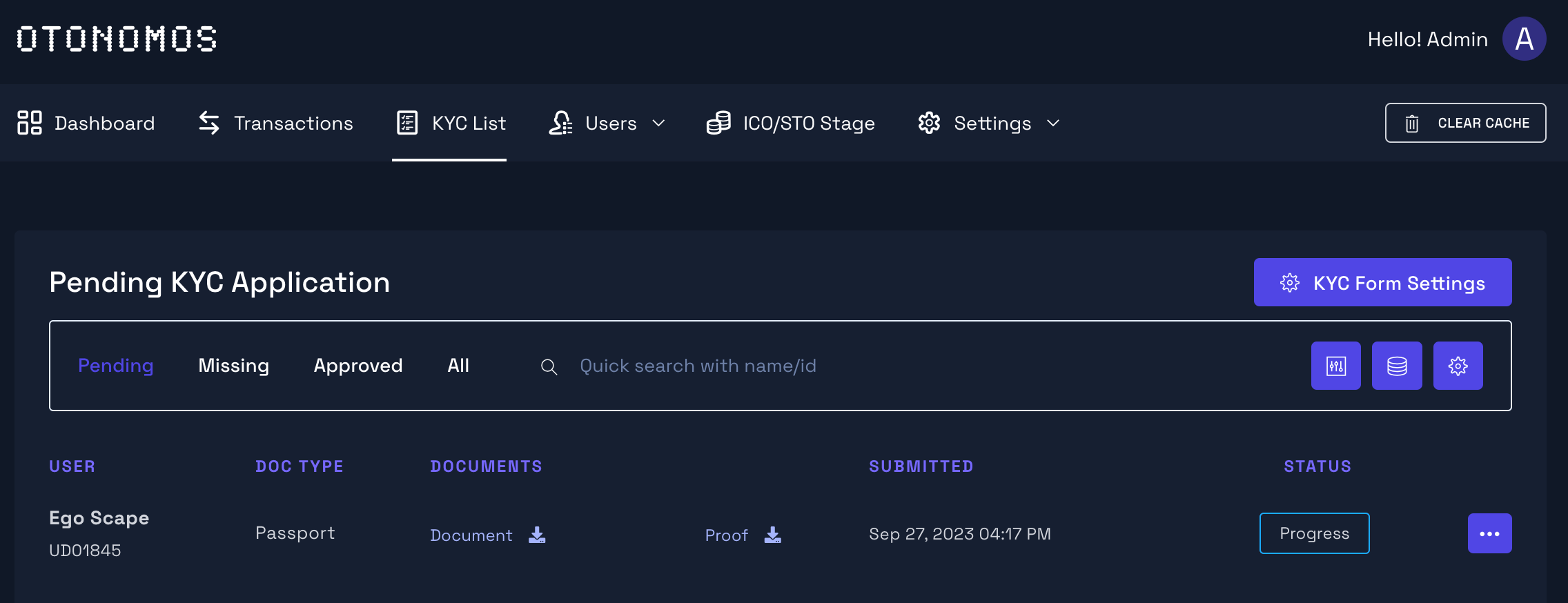

Let’s now look at this process from the Admin side.

When a new investor signed up and submitted their profile for approval, the Admin gets a notification and can see who is awaiting review.

All documents uploaded as part of the investor profile can be reviewed by Admin and logs of each approved investor’s certifications are kept, which would come in handy in case the issuer would ever be challenged about their compliance with securities regs, in this case whether the offering was conducted as a Reg(D) offering to only Accredited Investors as defined by the SEC.

In this context, the SEC’s definition of Accredited Investor is steadily expanding to go beyond a mere means test, and a self-accredited investor does not have to invest a minimum amount to remain considered accredited for purposes of a Reg(D) offering.

9. Maximally open

Within the restrictions of existing securities regs, any online funding portal should be minimally gated and maximally democratic.

As seen above, a portal such as Otonomos’ should help Founders stage increasingly popular “party rounds” in which many investors chip in with smaller amounts on “take it or leave it” terms .

This does not take away that accreditation is still a formidable obstacle to investment by the wider community and fundamentally limits opportunities to become wealthier to those who are already significantly wealthy (but, according to consumer protection laws, also to those who can afford to lose their money).

This post is not the place to engage in this debate. Rather, our approach has been to harness the power of technology to enhance the accessibility and transparency of equity funding rounds without counting on a regulatory change soon.

10. Out-of-the-box legal stack

Finally, any legit ICO iteration should come with a tried and tested legal stack.

Founders should not have to pain their brain on an optimal stack that works before they can stage an online round. Instead, they should be given the tools to easily spin-up their legal structure in the knowledge and comfort that it will work for them, because it worked for 99% of their peers and their situation is not materially different.

We discuss the legal stack in more detail in Part II of this issue of The Otonomist when we walk readers through our own funding round and the stack we used.