1. Don’t “wrap” your DAO in a legal entity

It may sound sexy to speak about wrapping your DAO in a legal entity, but in our minds it shows a lack of legal imagination and puts a straitjacket around the hard-won freedoms of governing your project via a DAO.

Wrapping your DAO in a legal entity effectively means turning it into a recognized corporate form, such as an LLC in the US.

Some States incl. Wyoming and Vermont have passed laws that recognize corporate wrappers for DAOs, however conventional corporations centralize power in managers or directors who steer the organization based on what they determine is in the best interest of its shareholders.

In contrast, DAOs decentralize control by forgoing the traditional board or executive officers and distributing decision-making power across token holders. Governance is typically conducted through a series of proposals that members vote on using blockchain. Because tokens are exchangeable and regularly change hands, the voting cohort is dynamic.

We believe DAOs will eventually acquire legal personhood and that - through legal precedent or changes in the law or both - they will change corporate organization and stakeholder liability, similar to what LLCs did in the 1990s. Gradually or suddenly, the liability of members of a DAO and their fiduciary duties (if any) will become clearer.

Until then, instead of shoehorning your DAO governance in an existing centripetal corporate form, we believe the better approach is to leave your DAO and its governance intact, and organize an onchain vote to let the DAO control a real-world entity as its “handmaiden” in the realverse.

One of the best ways to do this is through Cayman Islands Memberless Foundations. Cayman Memberless Foundations are ownerless and shareholder-less entities governed by onchain voinge by DAO token holders. Such on-chain votes can then be given legal effect by a Foundation’s Director (often a Nominee provided by Otonomos) who acts under a strict power of attorney.

One of the most common onchain votes is the award of grants to individuals or other real-world legal entities - including the “lab” entities of the project itself.

2. Don’t participate in DAOs as a natural person

Without a recognized corporate form, the law assumes that individuals working together in a common enterprise have formed a general partnership and, unlike stockholders, the token holders would not be immune from personal liability resulting from the DAO’s conduct.

In this default legal analysis, such personal liability would be joint and several, meaning that each and every member of a DAO could be held liability for all of the DAOs liabilities and enforcement could be sought against each token holder.

This is the worst of all worlds and should make many token holders think twice before participating in a DAO from their personal wallet. The very minimum protection is to create a distance between yourself as a natural person and the wallets you use to hold tokens, by making such wallets an asset of an LLC or other form of limited liability entity you control.

Such holding entity may still be held jointly and severally liable for all of the debts of the DAO if it came to it, but when debtor claims exceed the entity’s assets, that’s where the bucket would stop. No bailiffs on your doorstep!

Ideally, you want a separate entity for each of the wallets you use. We see a lot of Otonomos users doing exactly that.

3. Don’t optimize for tax before you have revenues

On the Otonomos side, we see a lot of users aggressively optimize for tax, spending thousands if not tens of thousands of dollars upfront with tax advisors to come up with a layered structure that seeks to arbitrage jurisdictions before there is even revenue on the horizon, let's stand profit.

Whilst this talks against our own shop (as Otonomos makes more money the more entities its clients order, we also want to do right by them and typically advise them to keep things simple.

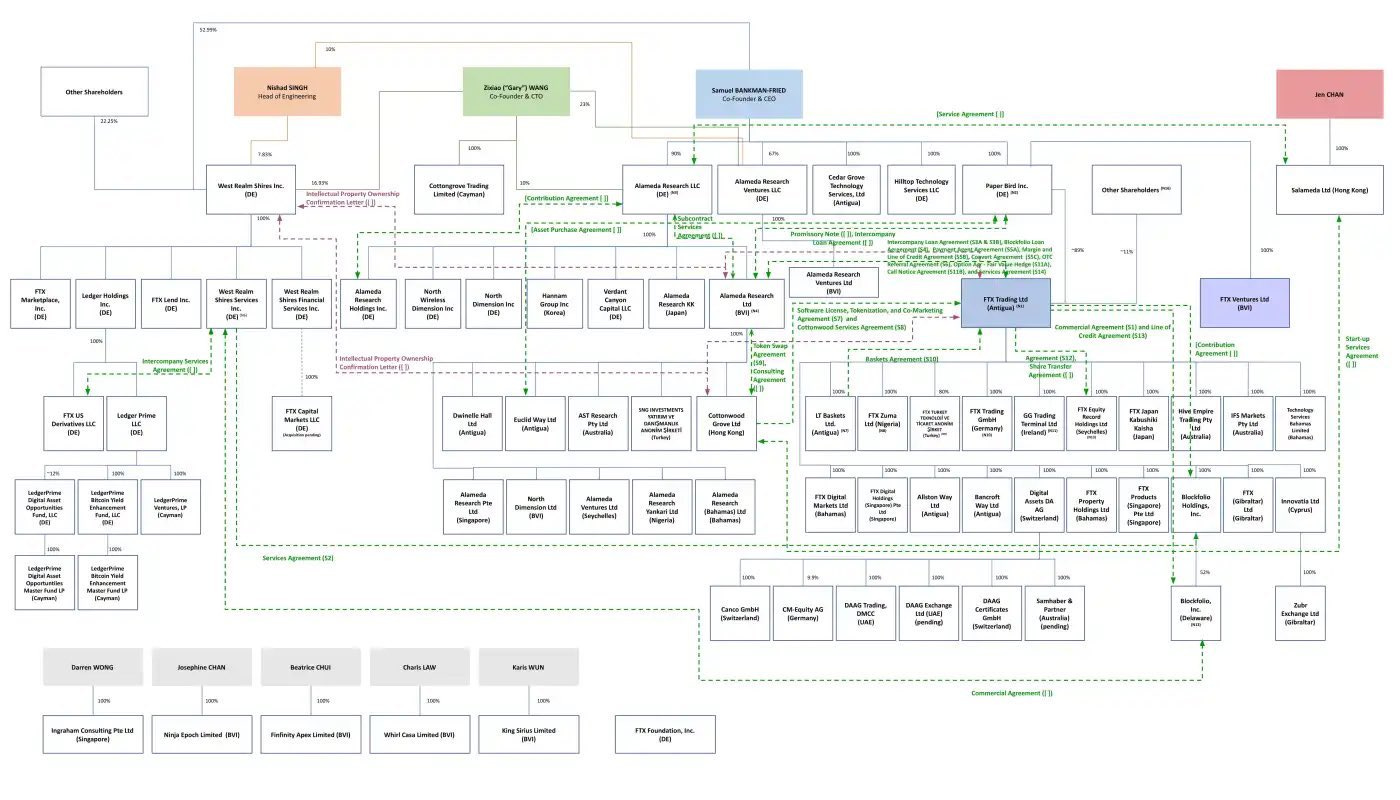

As an example of somebody who didn’t keep things simple, here is a diagram of SBF’s entity stack. Just from looking at this (unless it was kept hidden from them), Sequoia and the other VCs who claim to have done due diligence on FTX should have ran as fast as they could!

A simple structure should serve most doers and investors in Web3 best. Further down the line, once profits kick in, things can be rejigged and you can add layers to your stack, but nothing - unless you seek to obfuscate - justifies an intricate web of interrelated entities similar to FTX’s.

4. Decentralize ASAP

If you’re genuine about building in Web3, you’ve got to eat your own cake and decentralize.

This is not just for the optics of it or for ideological reasons, but also for self-preservation: you want to decentralize to minimize possible legal blowback.

More specifically, one leg of the infamous Howey test determining whether your token could be considered a security in the US is whether it gives buyers “a reasonable expectation of profits to be derived from the entrepreneurial or managerial efforts of others.”

On this and other grounds, a recent decision by a District Court in New Hampshire1 - which should arguably worry DeFi more than the FTX debacle - declared the LBRY token a security.

Many see the ruling affect “every [crypto] company in this room”. The least the can be said is that it seems to further narrow the window for compliant offerings of tokens in the US without registration with the SEC.

5. If you want to offer your token in the US, you know what to do

The LBRY case is one more indication that - until the law changes - judges are unlikely to stray from the status quo.

The SEC’s argument has pretty consistently been that when you want to offer a digital token in the US, it’s likely a security so you got to register it as a security and offer it in a compliant way.

Such compliance severely clips the wings of how you can sell your token, and this is unlikely to change soon.

You can fight it as the devil in Holy Water, but since so few projects do public sales anyhow, and lots use SAFTs (or warrants) for pre-sales which are per definition investment contracts that can only be offered to accredited investors, doing a “Reg D” (i.e. accredited investor) offering should not be the end of the world.

Of course it is a screaming injustice that only people who meet the SEC’s accreditation test - effectively a wealth threshold - can invest, but we see most projects courting wealthy investors anyhow.

In addition, a lot of the institutional investors will have vehicles outside the US such as funds in Cayman or the British Virgin Islands that buy your token in bulk, so if you court VCs and family offices (even when they are US in origin) you could consider excluding US-based investors from your offering altogether.

It is a sad state of affairs that, as a result of the status quo of how securities can be sold, a technology that is meant to emancipate us from centralized capital is ultimately at the mercy of the very intermediaries it seeks to eliminate.

The dilemma is therefore: or raise from the crowd but exclude the US, still the deepest pool of capital in the world, or include the US, do what you know you’ve got to do to stay compliant, and try to get along with your investors.

6. Distribute your project tokens from a special purpose vehicle

There is a fair bit of misunderstanding about this: if you sell a token say into the US, it does not have to be distributed from the US.

In fact, it is advisable to issue and distribute your token out of a special purpose vehicle that is legally ringfenced from the rest of your project, especially your development unit, and from a jurisdiction that makes it easy to create and distribute a token.

The British Virgin Islands remain our favorite for such token issuance vehicle: there is no sales tax (in case your token would be considered a sale of goods), nor is there tax on the proceeds from a fundraise (though this is the case in many places if your sale is seen as a one-time fundraise event), and though there is a Virtual Asset Service Provider (VASP) regime, BVI law exempts non-security tokens which it defines much broader than other places. (Disclaimer: No legal advice).

The end state of the token offering is that the Special Purpose Vehicle will end up with assets consisting of (1) the sales proceeds from a (hopefully) successful sale, i.e. the crypto you received from token buyers, and (2) the balance of your native tokens (assuming you did not sell all of the tokens you created).

The “ringfencing” comes from creating a distance between your development company (“DevCo”, if you have one), the project’s DAO, and the vehicle that issues the project’s token: there are no cross-shareholdings nor common board positions between the token issuance vehicle and the DevCo, nor is it the DAO that spins up and distributes the tokens (which could put its members i.e. token holders at risk).

Rather, it is an independently formed entity, of which the Leads will typically be shareholders and a Nominee Director will be on the Board, that does the fundraise.

Since Shareholders can freely dispose of the assets of their company, the proceeds of the fundraise together with the balance of the project’s native token is then typically pledged to a Foundation which is decentralized in its setup and controlled by the DAO (see below).

7. Decentralize your project by having your token holders control a Foundation

Companies - and this applies to any jurisdiction - are not the right vehicles to decentralize governance: they are setup for centralized decision making and it is the very duty of managers, to whom shareholders delegate powers, to act in the best interest of the company and its owners.

Foundations are of an entirely different nature. Traditionally, individual Founders set up foundations, typically charitable ones, to donate assets to named beneficiaries. Foundation Directors are more akin to trustees acting in the best interest of the beneficiaries, who are not "owners” as such and can be granted benefits (rather than receive dividends) out of the assets of the Foundation.

Decentralized Foundations then strip away (1) the need for a Founder, i.e. a named person who founds the entity, (2) the need for named beneficiaries, by making them “undetermined”, e.g. “anyone who at a given moment in time owns a project token X”.

What’s left is the role of the Board, but here Nominee(s) can be appointed who work on the basis of a very narrow delegation of power, which basically limits their freedom to only execute when a valid vote took place at the DAO level.

Such execution, e.g. a decision by token holders to extend a grant, is then typically executed by internally appointed Treasurers, which means the Director doesn’t even have the private key to the Foundation’s wallets.

As a result, it can be said that the DAO (i.e. the community of token holders, who are also its undetermined beneficiaries) controls the decentralized Foundation without “owning” it the way shareholders own a company.

As a final step, the granting of working capital to the project’s DevCo can then be put to a community vote, resulting in a way to reward anybody, including the original project Leads, for contributions to the growth of the project.

8. Incorporate your DevCo early

Many projects start out as a Telegram or Discord group and a GitHub repository. Our guidance is to form a limited liability company as soon as the effort gains traction, and - in light of the Tornado case and its developer’s arrest - even own the GitHub repository through an organization rather than an individual.

In our mind, Leads should never deploy code without already having set up a DevCo, which can be the simplest and cheapest of entities, and can easily be in a high-tax, OECD location, since the DevCo’s expenses are to be covered by a commensurate grant from the project’s Foundation (see 7 above) without it ever making a taxable profit.

The exception is when there are plans to raise money for the project by giving equity in the DevCo, in which case revenue should be booked there and profits may eventually be taxed. In such setup, the DevCo will probably be a C-Corp in the US, or a UK Ltd. or Singapore Pte. Ltd., basically any entity in which shareholders feel their rights are protected from being in a highly reputable jurisdiction.

For projects that fund themselves entirely out of a token sale, their DevCo in the US could be an LLC, and outside the US a UK Ltd or LLP, a Canada Ltd or LLP, or a Swiss GmbH or AG. In Asia the Singapore Pte. Ltd. is probably most suitable.

Practically, it may make sense to just form your DevCo where you or most of the project’s Leads are resident, which will make it easier to run expenses locally and enter into agreements such as leases. It will also help you employ local collaborators who cannot be paid as contractors.

As a general rule, offshore companies are not suitable as DevCos since a company based there will have a hard time accessing OECD-type infrastructure incl. bank accounts. Offshores are better used as special purposes vehicles for token sales (see 6), for Foundation setups (see 7) where Cayman is typically used, and for holding entities or IP legal containers.

9. Coders should revaluate business skills

The point here is: no matter your coding creds, if you are a Founder or a project Lead, don’t be cavalier about the business side.

Everybody who can code can get their head round business, and intentional neglect of corporate governance and legal issues will eventually come back to bite even the most solid technology project.

At Otonomos, we quickly get a sense of the diligence clients apply to their setup and the time they are willing to invest to understand non-technical issues. No surprises, it is often those clients who show the greatest care that survive and thrive.

There’s tons of free materials and at Otonomos we will be more than happy to spend time with you.

10. Document everything

Finally, one of the key weaknesses we have seen in early Web3 projects is the lack of formal documentation.

The first years of any business are a whirlwind and the ease with which wallets can be opened and crypto transactions can be made makes it double difficult for Web3 projects to keep track of everything that happens.

This, combined with the average age of entrepreneurs in the space and a general allergy for business processes and planning, is ultimately counterproductive and potentially lethal.

SBF is an extreme example of this attitude (mixed in with what seems like clear fraudulent intent), however we recognize a lot of what we see happen at young Web3 projects in Pascal Gauthier’s observations when he met SBF back in July 2021, as reported by Fortune2:

“I wanted to learn what his secret sauce was, to grow his business so quickly,” recalls Gauthier, CEO of Ledger […]. But as their conversation progressed, Gauthier became startled. SBF was describing a model for scaling an enterprise that, in retrospect, contradicted everything Gauthier had learned in over two decades as a successful, serial entrepreneur. “It all sounded like a classic recipe for disaster,” he recalls. “I was wondering, ‘He’s a myth; he’s backed by the best investors; he’s got a valuation in the tens of billions. What don’t I understand?’ But it looked like he was building a great business, and we thought it was great to partner with them.”

[B]ankman-Fried, or “SBF” as he’s called in crypto circles, described how he could achieve something that Gauthier had never seen before—run a major financial institution as a kind of permanent startup. “He was adamant that he could do it with the very few employees he already had; the number I recall was something like a hundred,” says Gauthier. “He was saying he could build a business with far fewer people than his competitors. That was my number one surprise.” The number one shocker: SBF’s assertion that “maybe one day we’ll buy Goldman Sachs,” a boast that he also made publicly. Gauthier reflected, here’s a guy with $1 billion in revenues, and he’s going to buy one of the world’s biggest investment banks with a market cap of over $100 billion and revenues of $50 billion?

Many months later, Gauthier had still more reason to puzzle over how such an unorthodox, unproven approach could apparently work so brilliantly. “I later read that Sam was pitching investors around creating a worldwide financial super app where people could do anything with their money, and maybe that was the reason he got to the $32 billion valuation. And apparently, he’s going to do this with so few people! I thought, ‘To do that you’d need thousands of people!’” Gauthier notes that he wasn’t predicting FTX’s collapse. He was simply amazed by the gulf between SBF’s ambitions and the number of people he’d put behind that superambitious execution.

If one of the purges out of the crypto debacle is a revaluation of business building skills, then we will reduce the level of dilettantism in crypto and arm ourselves for the real battle: replace the highly-trained professional armies of TradFin!

> Schedule a call today with the Otonomos team to talk about your project.

DISCLAIMER: No legal nor tax nor regulatory advice.