In this February Otonomist, we unveil the idea of launch pools as a new way to raise funds from the community. For our paying users, we prepared a manual on how to convert a US LLC into a private crypto investment fund. We also scheduled a first webinar on how to arbitrage jurisdictions which is FREE to join.

Fair winds and following seas!

– Han, Founder & CEO, Otonomos

PRODUCT UPDATE

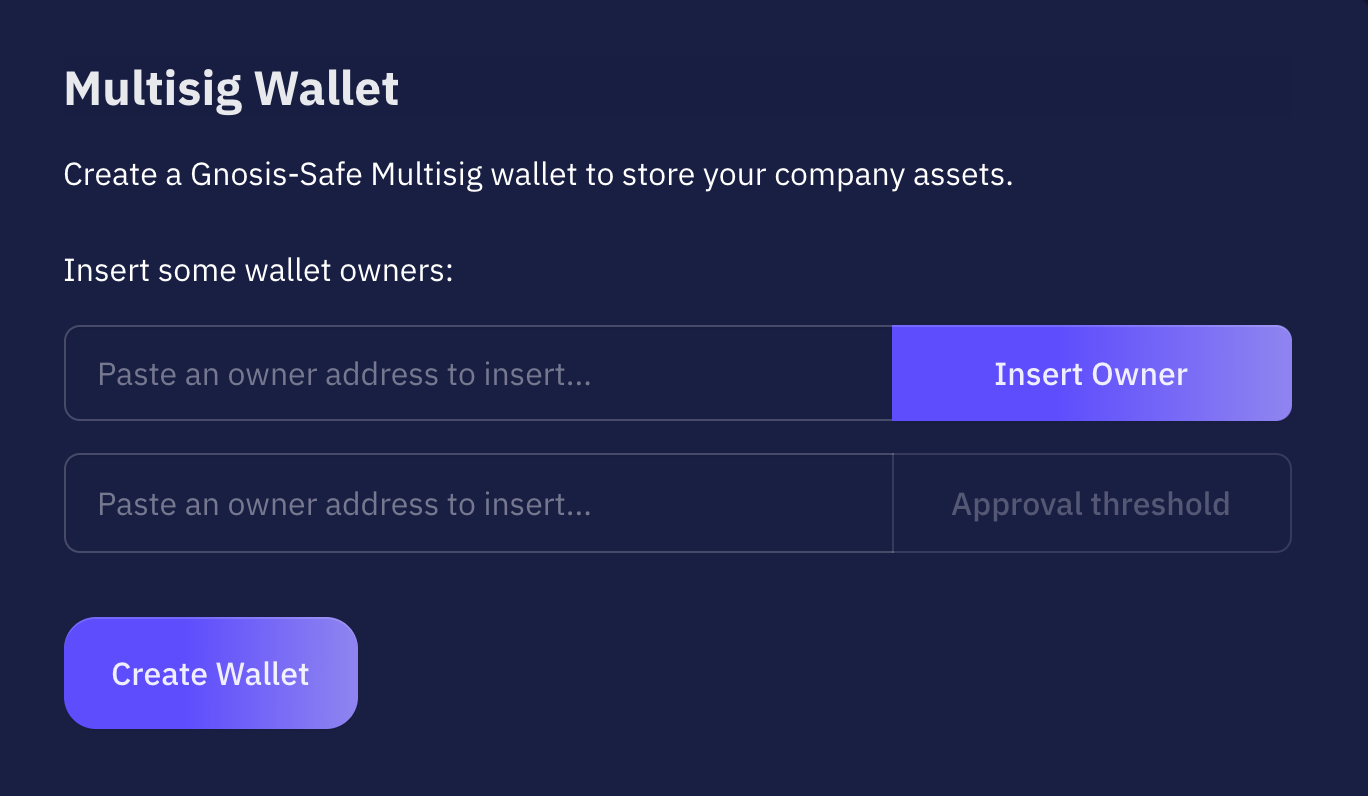

Towards Crypto Banking: Using a Multi-Signature Wallet To Manage Your Company’s Digital Assets

With legacy companies such as Tesla now holding part of their treasury in crypto, adding a multi-signature to your company’s wallets will help secure your digital assets.

Our latest version of the OtoCo company assembler uses the Gnosis-Safe Multisig wallet to protect your crypto currencies and tokens without giving up self-custody.

We made it easy by letting the first user simply paste public wallet addresses of co-signers, set an approval threshold, and create a dedicated crypto treasury wallet.

Spin up an LLC today or add a multi-sig wallet for your existing company now.

UNBOUNDED THINKING

Put Your Money Where Your Vote Is: Introducing "Launch Pools"

Capital formation is the Holy Grail of decentralized finance: how to preserve the ease of DeFi-style staking with the process of raising capital for a project, a company or a fund?

Today we introduce launch pools. Launch pools are what you get when you cross DeFi-style staking with escrow on blockchain.

It essentially reshuffles the sequence of how you raise money for your project, by first engaging investors with a refundable escrow pool and only turning it into committed capital once the project passes a community vote.

Read the full post to learn how we turned capital formation on its head.

PREMIUM CONTENT

Turn Your US LLC Into a Private Fund: A User Manual ($)

Many of our clients have friends, family and close contacts asking them to invest money in crypto assets on their behalf.

Other clients want to establish an initial track record and/or test a strategy or algorithm with proprietary capital, with a view to raise more money from third-party investors further down the line.

In what follows, we provide a manual for budding managers, aiming to cover most aspects of setting up a private fund, from fees to redemptions to how profits and losses are allocated, using downloadable legal documents as a guide.

PREMIUM CONTENT (FREE THIS MONTH!)

Webinar: Where to setup your blockchain business

On Thursday 25 February at 8 a.m PST / 11 a.m. EST / 4 p.m. London / 5 pm CET we are hosting our first live Webinar, giving the floor to clients and prospects to ask us anything about setting up and managing their crypto business.

We’ll cover topics including:

- Do you need to form a company for my project?

- Where is good to incorporate?

- Where can I easily open a bank account to offramp from crypto to fiat?

- How do I organize a token sale?

- How do I push code anonymously and decentralize governance?

Our first Webinar is FREE and is there is no hard sell: after a short presentation, anybody who registered can grab the microphone. We want to learn as much from you as we hope you learn from us!

Next month: Look out for our Otonomist March issue in your inbox on the third Thursday of the month.

You receive The Otonomist because we met, corresponded or you previously reached out to or expressed interest in Otonomos. We apologize if this is not the case and made it easy for you to unsubscribe if you wish to.