Curiosity and embarrassment

Here is my admission: I am a Crypto newbie in an office filled with Crypto Natives. I don’t even have a wallet yet, and that is all going to change right now. I am going to set myself up in Crypto from a standing start, I am going to buy some Cryptocurrencies, try some different exchanges, try to buy real goods, and this article is my shared experience.

My mission is more driven by curiosity and, if I’m completely honest, some embarrassment that I’m not already fluent in Crypto. I have no illusions about making my fortune here and, having read the many, many doom-laden predictions about crypto I am very aware of the many hazards facing my hard-earned funds. If Crypto really is the future then this ought to be straightforward and consumer-friendly. Traditional currencies and their underlying systems have the advantage of hundreds of years of refinement, whereas Crypto’s zero-hour was only 15 years back. If it is going to have a chance, this had better be good. Let’s see.

The first thing to get right: “centralized” vs. “decentralized” crypto

I’m going to need a wallet to put my Crypto in. Wallets are one of the first things I had to figure out: I could leave my crypto scattered around different accounts at several digital exchanges. However, digital exchanges are “centralized”, where users hold “accounts” and their funds are held in custody by the exchange. This is a crucial difference with decentralized wallets, which let users custody their funds themselves and which are more aligned with the “not my keys, not my money” ethos of the crypto crowd. So the first question any noob to crypto will need to work out is: what kind of wallet do I need?

Hardware wallets

At the top end of the scale are hardware or “cold” wallets such as Ledger or Trezor. These are physical devices you plug in to your computer and remove when not in use. They manage the secure access to your digital assets. The big plus with these is that when it’s not online it cannot be hacked. The downside is that you have to buy them, and if you lose your hardware wallet your assets are all lost unless you wrote down the mnemonic words (also called a “seed phrase” even though they consist of 12 randomly generated words) when initializing the wallet.

These words will allow you to regain access to your wallets via a new device if your previous one is lost of stolen, however storing the mnemonic phrases on your computer is not a good idea. That’s why Legder and Trezor comes with a card for you to write down the words for you to keep in a safe place - for instance a good old bank vault!

Software wallets within your browser

Hardware wallets is what you want to use when you hold substantial funds due to their higher level of security. I don’t feel I need the additional complexity or expense of cold wallet yet. I am only learning to use a few hundred dollars, so on to the other option: software wallets. These are (supposedly) secure online tools and many are free. They are convenient, easy to get set up and many include a process to help you recover lost keys. I am told it is good practice to spread your digital assets across more than one wallet for increased safety. Common wallets include Coinbase wallet , Trust wallet, Uphold, Brave, Gemini, to name just a few. I chose none of those, I chose the biggest one of all: Metamask.

This system has around a third of all software wallet installations, it has an extension for Google Chrome browsers, an app for mobile devices and it offers the ability to buy, sell and swap currency.

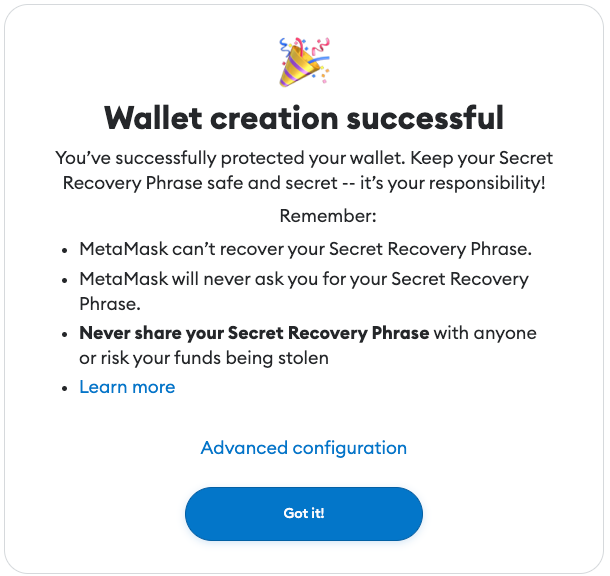

Setting up a new account is quite painless requiring a download and a few basic settings. Metamask too requires you to set up what it calls your “secret recovery phrase”, basically your “seed phrase” of . This is a set of 12 words generated automatically for you. As with hardware wallets, this becomes your ‘Get out of jail free card’, however the key difference is that your secret words are not stored in hardware device but in the browser, making browser wallets less secure. As with hardware wallets, if you ever forget or lose your password, this phrase is used to help restore your access to your wallet, so it needs to be stored very safely. I stored mine as files on two different computers and I also wrote it down in a notebook.

After I write down my 12 words, Metamask asks me to create a password, so I don’t have to enter the seed phase each time I want to access my Metamask wallets. Accessing your Metamask account is particularly convenient if you set up the Chrome Extension where you’ll be prompted for your password each time you want to use it.

Have wallet, will buy

Great, now I have my wallet, but it’s empty, so I need to buy some Crypto to put in there.

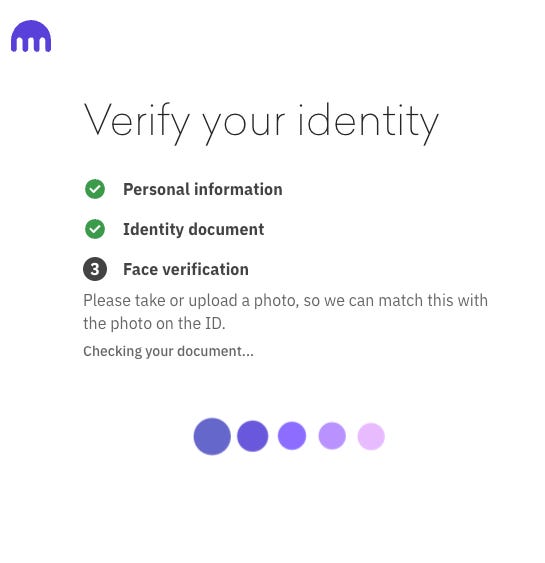

Creating an empty wallet does not trigger any security issues, but moving cash around does. For the next steps I will have to present some ID details in order to comply with ‘Know your Customer’ (KYC) regulations, part of the Anti Money Laundering (AML) laws that exist in most countries. Metamask accepts payments using a payment partner called Ramp and it is here that ID is needed.

Based as I am in the United Kingdom I can choose to ID using my drivers licence or my passport. ID options vary by region but the document you use must be in-date for at least 3 more months. I took a photo of my licence and submitted that. The system took around 10 minutes to process my document and I conveniently received emails confirming my progress. Both Metamask and Ramp are very user-friendly with great help areas and support available. This process is clearly built with newbies like me in mind.

Now I have both a wallet and also a means of paying. I had imagined I would pick up a range of different currencies like I was shopping for groceries. Maybe some Bitcoin as the defacto Crypto, some USDC as the universal stablecoin and some Solana. Not so fast though: these coins live on different chains and Metamask is an Ethereum-based service. This means some coins are not directly available to me from here. I can’t easily buy Bitcoin or Solana from within my Metamask. There are some techniques to work around this but essentially I am on the wrong network for some coins. On the upside, anything I buy here is going to land in my wallet automatically, buying elsewhere requires an additional step to bring it in.

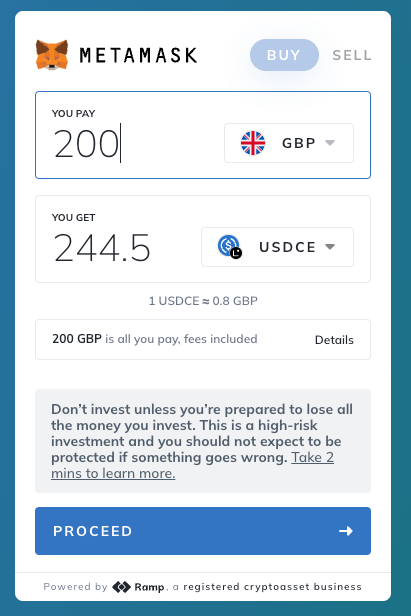

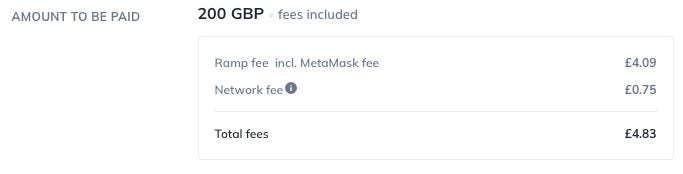

I chose to buy some USDC, a stablecoin which is as unadventurous as Crypto gets. 1 USDC=$1. It once had a wobble in March 2023 when Silicon Valley Bank collapsed but it recovered itself and now, aside from some daily fluctuations of fractions of a cent, it sticks to the dollar like it was welded to it. Buying is really very easy indeed. In Metamask I clicked on the Buy icon, chose a Cryptocurrency to buy, the currency I wanted to pay in, and how much I wanted to spend. I chose to spend 200GBP and that translates to 244.5 USDC after fees.

I could have paid using a credit card, or an ‘Easy Payment’ from my bank (the transaction is set up for me and authorised from where I am), or a Manual Payment which requires me to log into my online banking and make a transfer to Metamask’s account.

I paid from my UK bank using the manual route, it was simple and uneventful. I had made my first Crypto purchase, it was reasonably straightforward. And expensive.

It’s simple to buy coins, the skill lies in buying coins well. Buying crypto incurs fees which are based on some clear factors and many invisible, unfathomable magical fees such as Gas fees, payment fees, network fees and more. How you pay matters; you can buy Crypto using your credit card, but you pay nearly 3% in fees to cover that. Fees for the exchange you use are volume-dependent.

There are ways to minimise the fees you pay by watching the way that you pay and the exchange that you use. This is a skill level above me for now, I just watched the quotes that Metamask was offering me and adjusted some choices until the fees went down a little. I need to improve my game on fees.

Yay! I am now a proud crypto owner

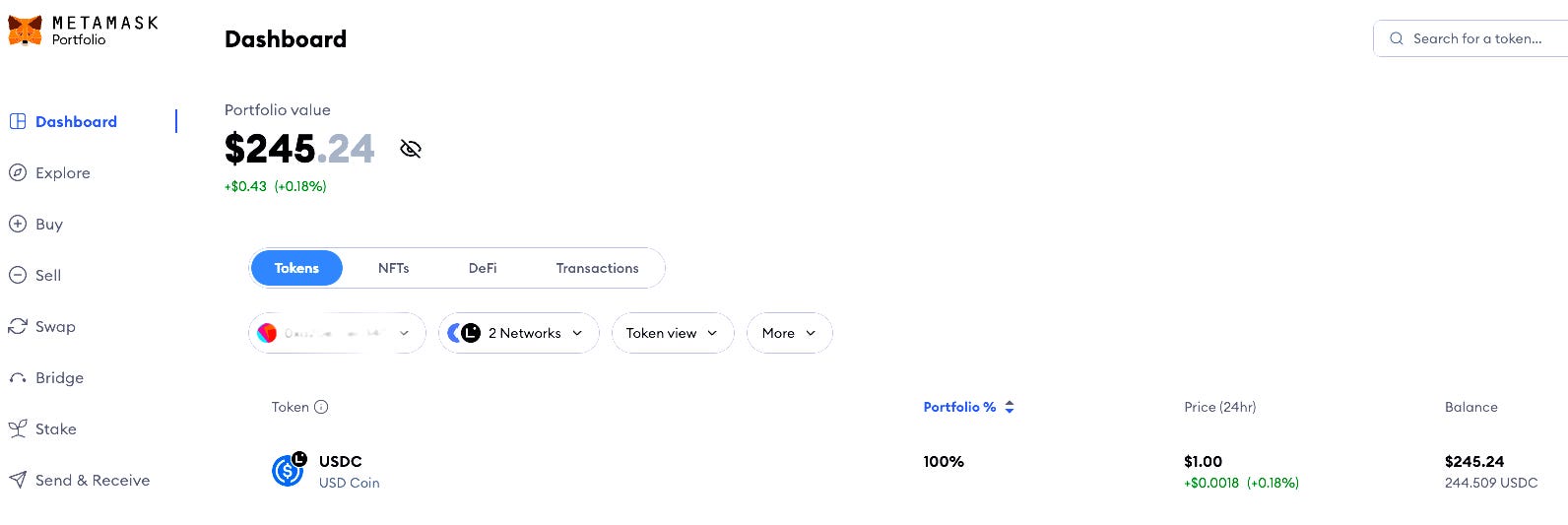

Ramp notified me by email that the trade had been completed and my Metamask wallet now showed $245 of USDC in it.

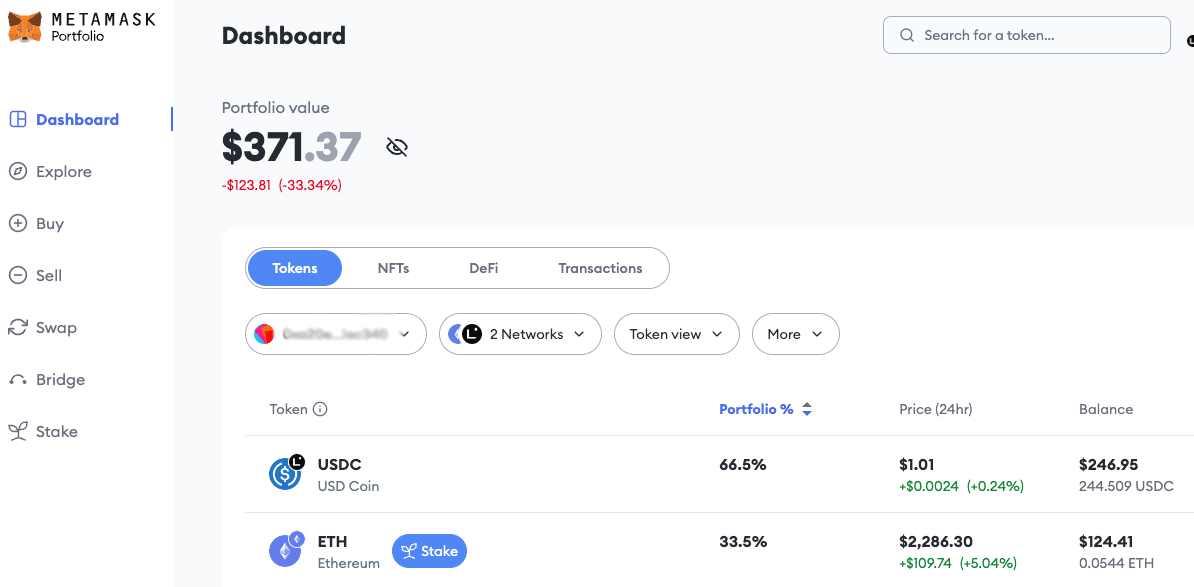

Unfortunately this is of little use alone, I can’t transfer or swap it just yet. In order to make a transaction I must be able to pay the network fees on Ethereum (known as Gas fees) and that requires Ether, the ‘native’ coin of the network. Ij simple terms, the Gas fees are what helps incentivise participants in the Ethereum network to help validate transactions. If you want your transaction to confirm, you need to fuel up your wallet with some Gas. So I added some Ether to my wallet as well.

Adding Ether was the same as adding the USDC, but this time everything was already set up and the transaction was fluid, quick and simple.

Let’s talk about CEX baby

Feeling satisfied that I had moved past the level 0 beginner status I aimed higher.

One way of swapping my stable coin into other tokens is via a Centralized Exchange (aka CEX). A CEX is like a centralized stock exchange which holds your funds in custody, and it requires an account with the CEX.

Even though it’s by many who typically swap and trade straight from their wallet on DEXs (or Decentralized Exchanges, you guessed it!) and who consider CEXs no go, I was told that the convenience of a CEX trumps whatever self-custody considerations.

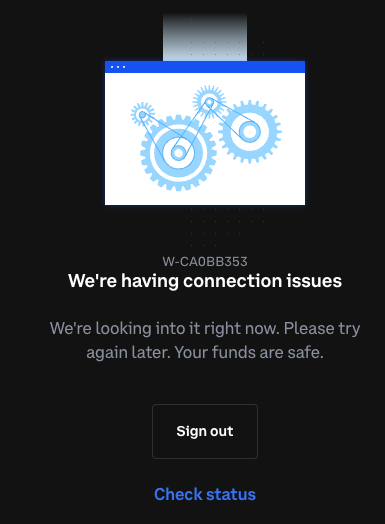

So I chose one of the world’s most trusted Cryptocurrency exchange with a daily trading of nearly $3Tn: Coinbase. It didn’t go well.

For a short while I set about establishing a new account, and it did feel like I had moved up a level, until I had this screen which persisted for the rest of the day:

So I gave up on Coinbase and tried the third largest CEX called Kraken. This however meant opening another account with a new service provider, hence completing the ID process over again.

Access to Kraken uses a combination of password and 2-factor authentication, including Google authenticator. Just like with legacy exchanges (or brokerage accounts), you must first deposit funds into your account, and once they are showing in your Kraken account you can use those to buy Crypto.

In principle the process of adding funds is the same as for payments using Ramp in Metamask. However when I chose the manual bank transfer method and tried to wire to Kraken’s account details, my UK bank wouldn’t recognise these and refused the payment…

Instead, I used the other option, to pay using ‘Plaid’, a tool similar to Ramp which sets up the bank transaction on my behalf, ready to be authenticated by me. This worked very well and the funds showed in my Kraken account after just a few minutes.

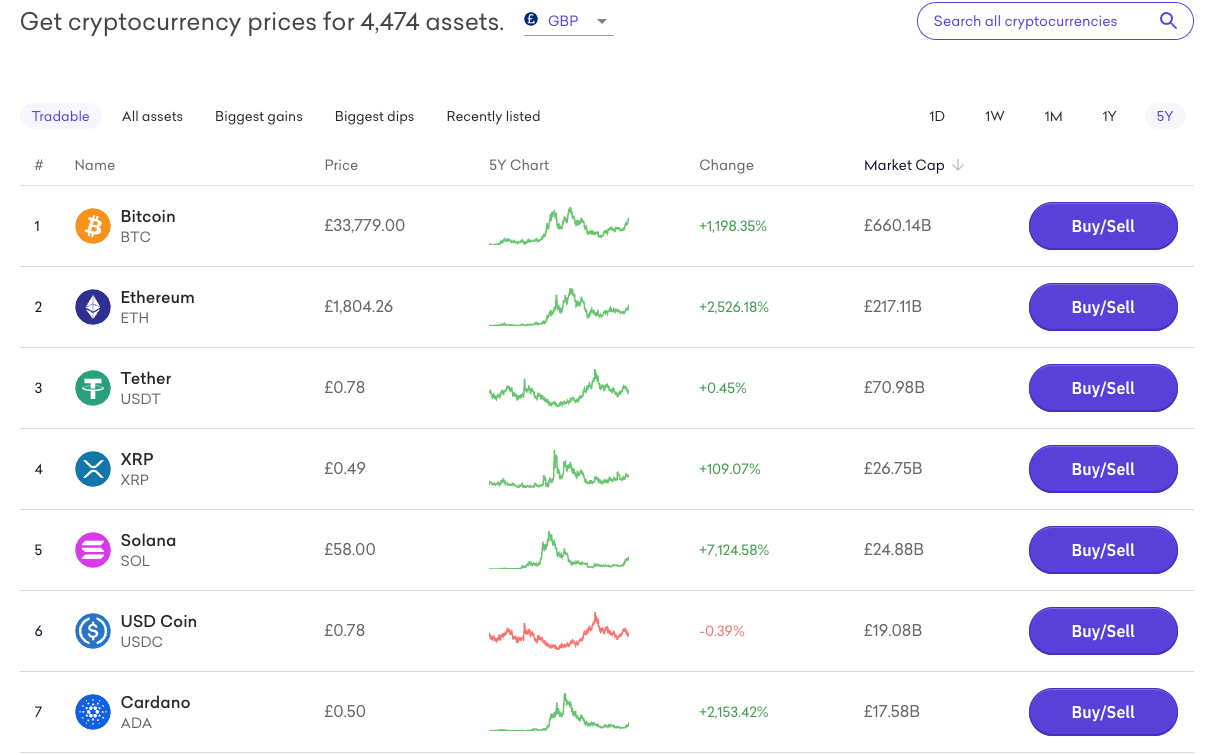

To buy Crypto in Kraken I used the link at their Cryptocurrency Prices tab. I had expected that clicking the Buy/Sell button for the chosen currency would take me straight into a trade for that currency, it doesn’t, but it does open up a selector.

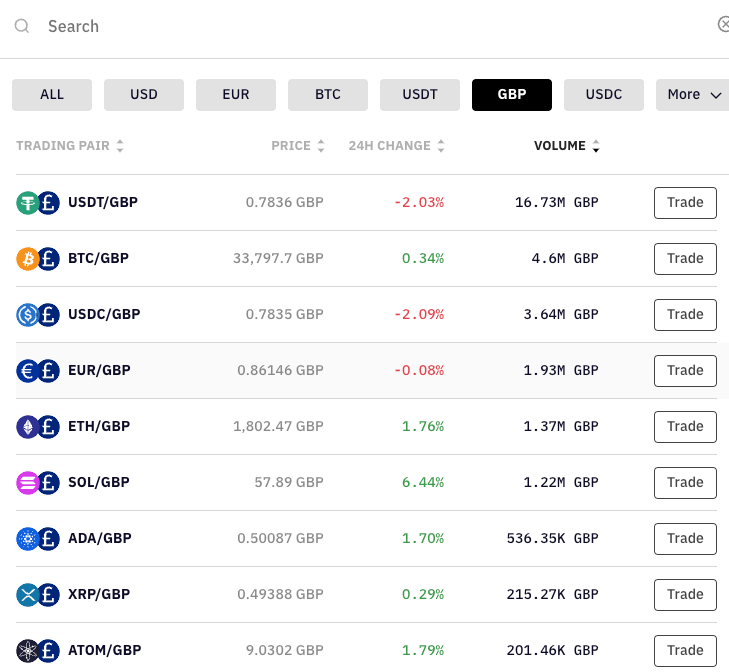

The other way to do this is to find the “Market’ button and select the pair of currencies you wish to trade, for example GBP and Solana.

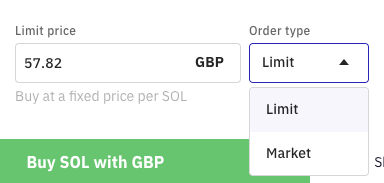

Choose how much to spend in one currency, in my case GBP, and how much Solana that will buy at current prices. Once all that is done you can press the green ‘Buy’ button to execute the trade, and it may or may not happen. That’s because of a final choice about how your trade should happen, there are two options here: “Market” or “Limit”.

If you choose “Market” then your trade happens right away based on whatever price the currency happens to be at that moment. If instead you choose “Limit” this allows you to set the lowest price at which you would be happy to buy/highest price you’d be hope to sell. I chose the Limit option and my trade didn’t happen at first because the price had risen while I was procrastinating. Shortly after the price dropped to just below my chosen limit and my trade went ahead.

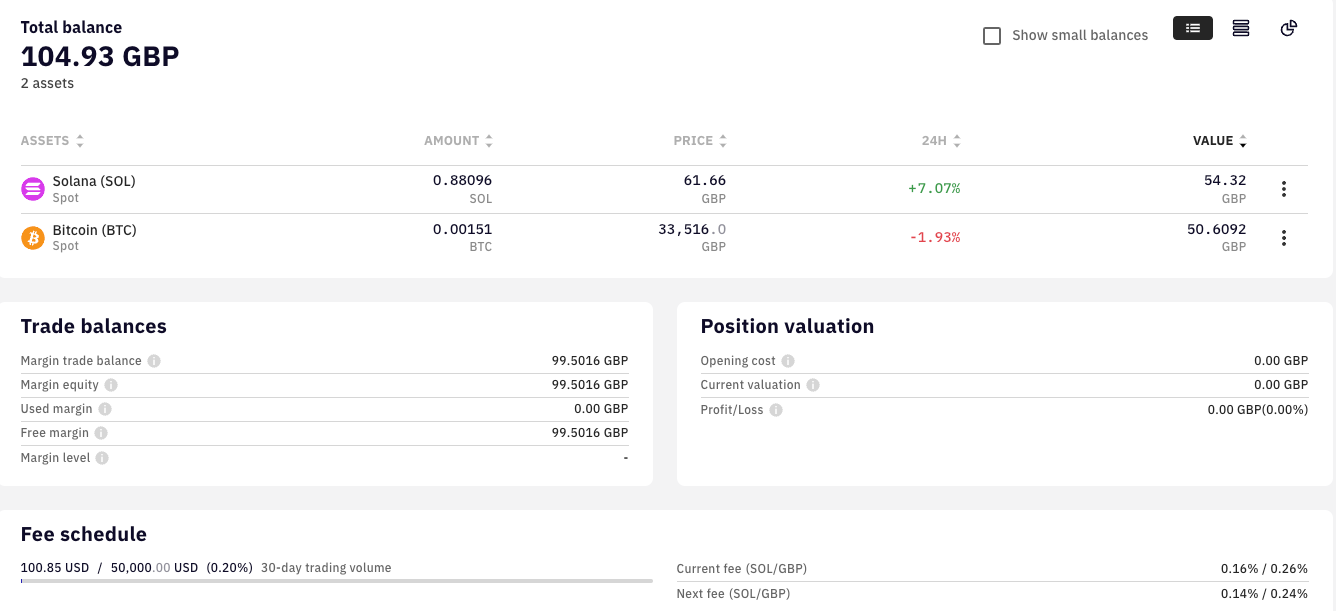

My Kraken account has traded the small amount of GBP I had loaded for Bitcoin and Solana, and my dashboard now looks like this:

New vistas

Now I have some Crypto in Metamask: USDC and Ether, and in Kraken I have Bitcoin and Solana. Good, now what? In fact this is where the options really begin to open up.

Crypto is a universal type of currency without borders, so one thing I could do is send money to someone else directly, if they tell me their wallet address (in fact its public key).

Keys are the unique identifiers each wallet has similar to a bank account number. If I have someone’s bank account number I can send money into it but I can’t move it out, so the same trapdoor mechanism applies here but the trapdoor is enforced via cryptography rather than a SysAdmin in a financial institution’s central server silo.

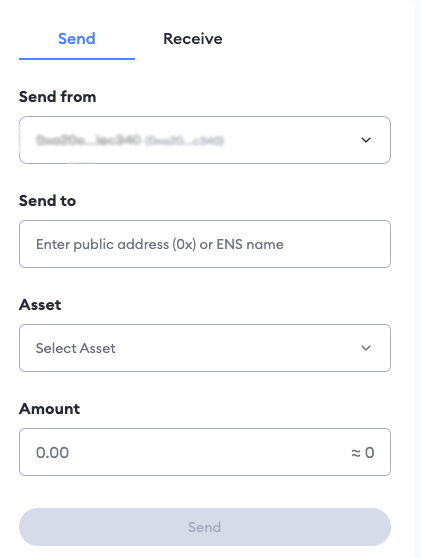

Metamask has a very simple tool to move Crypto from your wallet to another. Moving money to anywhere is significant because my other options would be to use banks to send and convert the cash to local currency, or to use a service like Western Union, both of which are subject to fees, often hidden exchange mark-ups and delays and restrictions.

I understand Crypto is already being used for remittances, saving people significant money and speed when sending earnings back home.

Have crypto, can’t spend

I can go shopping with my digital assets, but choice issues till very limited. Crypto is a long way off being universally accepted payment yet, but I could order a Dominos pizza, or a Subway sandwich (both via their gift cards, not on the spot payments).

I could order a new Apple Macbook for 0.053496 Eth at a ‘buy things in crypto specialist website’, which at today’s prices is a mark-up of 110% against paying in local currency at a leading UK retailer…

Some retailers have taken the logical step of accepting Crypto at the payment stage of their websites, which offer regular prices without the exploitative markup. I could buy insurance from Axa for a 1.75% fee, but only using Bitcoin. A small independent car sales company near me will accept Crypto to buy a used car. It feels like retailers are beginning to experiment with payments in digital currencies because getting paid is still getting paid. And of course Otonomos itself was one of the very first ones to accept crypto for payments on its website and for its invoices.

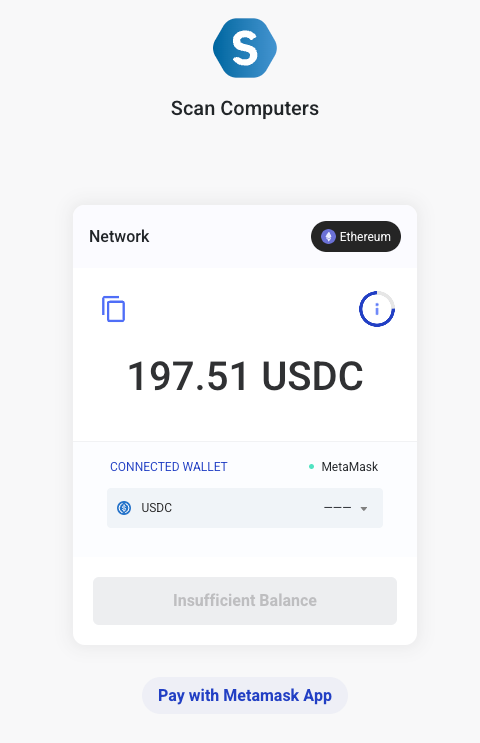

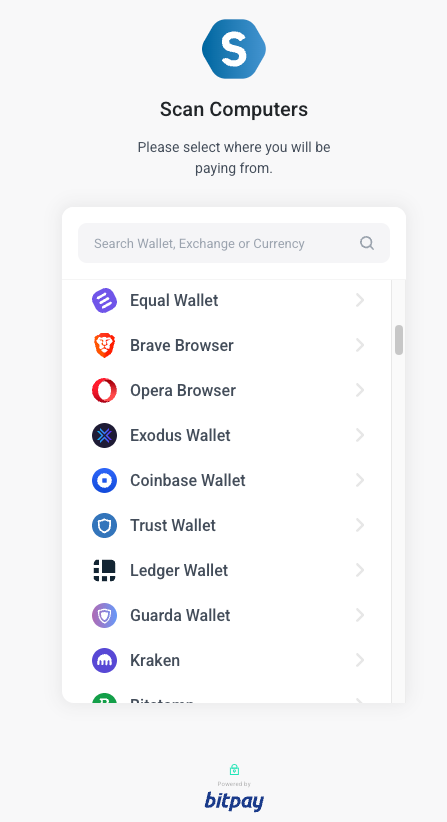

Let’s order something. I want to buy a computer monitor from UK retailer Scan Computers so I selected the model and placed it into my checkout basket. With delivery and tax the price is GBP 154.78. When I go to checkout, there is an option to pay in Crypto. It defaults to Bitcoin but it will accept a wide range of cryptocurrencies. I will use some of my USDC to pay for this and we are ready to specify which wallet I want to use:

Here there is also a wide choice of compatible wallets including Metamask and Kraken, I will use my Metamask wallet. The price in the final summary converts to GBP155.39 so there is 0.4% fee being taken somewhere, but I can live with that. I hit Pay and I have bought my monitor.

Swap at your heart’s content

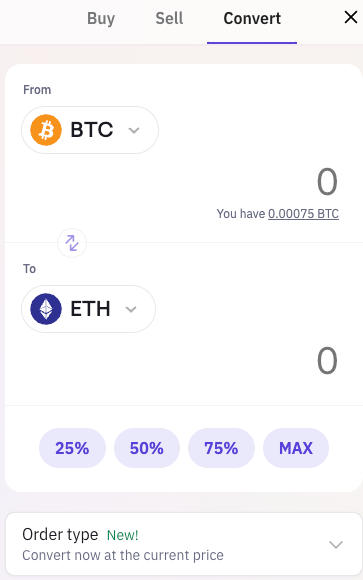

I could also swap the coins I have for other coins. If I have Bitcoin and I think that Solana or Ether is more likely to appreciate in value I can convert one directly into the other (at least on a Centralized Exchange). Fees for doing this are no clearer than anywhere else in Cryptocurrency but seem be around 0.2% per transaction, reducing to 0 if you trade sufficiently large volumes during any one month.

The experience of doing this on Kraken was really straightforward using this minimal screen pop-up:

The fees I paid are more significant because I am investing very small values and some fees have a fixed minimum. With knowledge it is possible to minimise transaction and network fees.

Ride the wave

I could also invest to profit from Crypto. There are endless strategies for profiting from Crypto including:

- Trading: forecasting which tokens will increase in value and buying or selling accordingly.

- Staking: locking away your assets for an agreed duration, during which time it is used for other purposes, typically to support a blockchain platform, and for which you will be paid a reward. This is similar to a high-interest bond in traditional banks and is a relatively low-risk strategy with longer-term timelines.

- Yield Farming: shorter term investments along the lines of staking but with more risk and higher rewards.

Investing and profiting is another aspect of Crypto where I don’t yet have the knowledge (or courage) to go just yet, it’s a complex skill set and I am just starting.

Beyond transfers and payments

What did I learn from my Crypto journey? That this is not the Wild West the media would have us believe. I have progressed from outright newbie to owning a clutch of Cryptocurrencies, making swaps and purchases in just a day.

In the main my journey has been entirely user-friendly and suitable for regular consumers. In fact the most difficult parts have been when having to satisfy laws or deal with traditional banks. Once in the on-chain realm things have generally been simpler. I am quietly relieved that some of the worst of the crypto excesses seem to have passed and some scammers have been prosecuted, which should help making Crypto more respectable.

However beyond buying and selling and transfers and payments, there’s a world that I will explore further which is the world of Decentralized Finance also referred to as DeFi. DeFi holds the real promise of crypto: the secure and guaranteed execution of programmable transactions.

“Blockchain not crypto” is in a way an ignorant slogan but there is some truth to it: it is the portability of your funds, permissionlessly-owned in your self-custodied wallet, which you can connect to any DeFi “dApp” without the need to open an account for each and every service you wish the access, which lets you back builders or start building yourself, invest in use cases across crypto, hold NFTs that represent title in real property, your university degree, art, music, etc. which will bring the next billion users to Crypto.

The next billion users

As a technology, it is in the use of blockchains as a record of ownership and rails of transfer of underlying value where the true use case of Crypto lies and which is leading to a Cambrian explosion of entrepreneurial activity well beyond the dot com of the late nineties.

I may be biased already but it would be a shame to let dusty legislators and old-world industries set the narrative about Crypto being a subversive, dangerous technology that deserves to die. So will I keep my Crypto? Yes, I will and I will learn how to use it properly, in the spirit of self-reliance and autarky in which it was born.

This is a journey and I have only just set off so expect a next post on my trials and travails in DeFi!

By Simon Lang (TG @SLang109). These are my own opinions and not necessarily those of Otonomos or The Otonomist.

> Join the Otonomos official “Towards Full Otonomy” Telegram group to compare notes with other users and our wider community!