In this final part of the Otonomist OtoCo Special, we share how the project is currently governed and where we want to go from here

Let’s admit it: Governance is messy. Not just in Web 3 (just watch Succession!).

Coin voting, even if attainable, is rarely desirable.1 Tokenholder participation remains low and we have seen lots of projects lapsing back into a high degree of centralization out of habit, design, or lack of imagination.

The Otonomist has blogged with some frequency about governance, specifically in the context of OtoCo’s own governance experiment, including:

- A first post in May 2021 “OtoCo Introspective”, Part IV of which on OtoCo’s proposed governance and “exit to the community” remains broadly intact.

- A piece in 24 February 2022: Double dip: Should you go for tokens, equity, or both when investing in a Web3 project?

- On 25 August 2022, in a special “OtoCo Governance Introspective”.

The summary of our governance approach so far is that by launching a governance token early, we wanted to make an unambiguous statement that we feel very strongly about users having participation rights and benefiting from OtoCo’s growth, whilst asking our community to indulge in a degree of centralized helmsmanship in the early years.

So for the next 18-24 months out, not much will change as we steer the project through its infant years.

Quick chronology

OtoCo’s initial development, from early summer 2020 up until around March 2022, when OtoCo raised its first funding from the community, was entirely funded by Otonomos.

In March 2022, OtoCo minted 8 million OTOCO governance tokens and raised just over USD 1.1MM in a bonding-curve algorithmic sale of 2,100,129 tokens to its community.

The balance of 5,899,871 OTOCO tokens together with the proceeds of the algorithmic sale have since been held in otoco.eth, the multi-sig wallet of the OtoCo Foundation. No allocation of tokens has yet been made to the leads or any other grant recipients, which means only participants in the 1Q2022 sale currently hold tokens outside of the Foundation’s Treasury.2

This Foundation was set up in May 2021 as a decentralized Foundation in the Cayman Islands of which Han, Otoco’s inventor and lead, is a Director. However under an Enabling Resolution put in place by the Foundation, Directors can only act upon a valid onchain vote conducted on OtoCo’s snapshot. Any holder of OTOCO tokens, as beneficiaries of the OtoCo Foundation, can table a proposal.

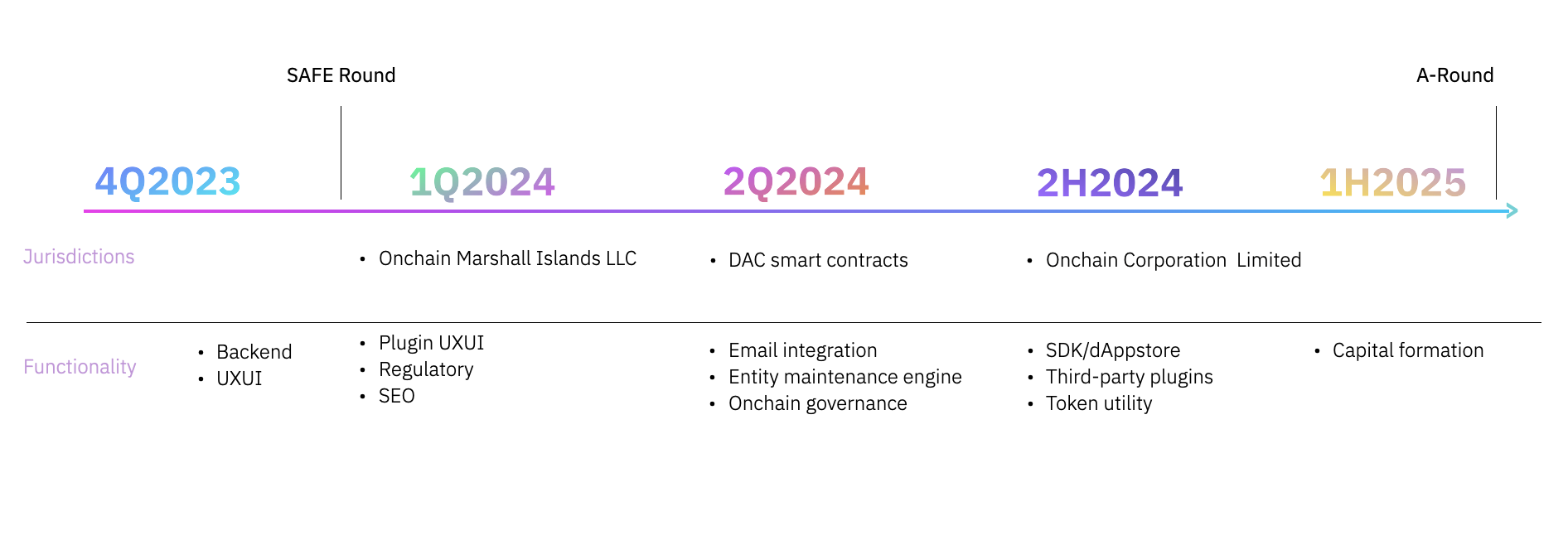

On 18 February 2022, OtoCo Inc. was formed as OtoCo’s main development company (“devco”). It was set up as a Delaware C-Corp to facilitate venture capital funding, which it is looking to raise in 1Q2024 via SAFEs. Most of OtoCo Inc.’s working capital over 2022 and 2023 was provided by the OtoCo Foundation by way of grant, and more recently by way of a shareholder loan.

In September 2022, a small liquidity pool on Uniswap V3 was created to allow for purchase of the token at a floor price of US$5/token, with liquidity so far very low and expected to remain very subdued until the tokens gain utility in 2H2024, when OtoCo’s marketplace for plug-ins is set to open (see Part II, roadmap).

The relationship between OtoCo and Otonomos

OtoCo is not owned by Otonomos however as an early backer, we propose Otonomos receive a token grant in recognition of the early risk it took and the work it performed on OtoCo’s behalf.

The only communality between Otonomos and OtoCo is Han as CEO of both. Maybe at some point the two effort will be housed under one roof, however this is unlikely:

- Otonomos does offchain company formations and is a corporate secretary working in over 14 jurisdictions. As a result, the business scales in a very different way compared to OtoCo, which is determined to remain a pure tech play, outsourcing all analog fulfillment to third-parties via its plug-in store.

- OtoCo’s technology and legal engineering is truly frontier compared to Otonomos’ tech stack, which is almost entirely Web 2.0.

- OtoCo is determinedly a project for and by the Web3 community, hence its token, whilst Otonomos’ ownership and management is centralized.

The trade-offs from raising from VC

As with any community project whose development company raises from VC, OtoCo too will need to resolve a trade-off between the expectation by VC that their investment secures a carry in the entity where OtoCo’s revenue gets booked, and the expectation by the token holders that they have an upside in OtoCo’s growth as beneficiaries of the Foundation.

One way to align VC investors and the token holder community could be a quid pro quo in which VC is also a token holder and the Foundation receives a share of the devco’s revenues:

- VC will be offered token warrants as part of their SAFE investment in OtoCo Inc. as a way to secure a voice in decisions at the Foundation level. Such community decisions would mainly consist of the parameters around token mint/burn, the sale of tokens out of the treasury, who receives a community grant, and a mechanism to determine what share of revenue in the devco the Foundation should receive.

- Equity investors should look at this revenue share as just another cost for the devco. In the end, in the knowledge that the Foundation’s treasury will be used to help fund OtoCo’s development by way of grants to the community, they should be indifferent whether this development cost is paid for directly by the devco or out of the Foundation’s treasury funded via a revenue share with the devco.

From the above, it can be seen that the trade-offs from having equity investors alongside token holders are perhaps less sharp than they initially appear.

OTOCO’s prelim tokenomics

Finally, on the OTOCO tokenomics itself, our approach is that the OtoCo community still has time to fine-tune the model, and discussions are actively taking place within OtoCo’s Telegram channel as well as bilaterally between the leads and members of the community.

The token is only expected to gain utility when the dAppstore launches in 2H2024, at which point we plan to introduce an automatic burning of tokens linked to how much is spent in OtoCo. Such deflationary token burn would benefit the three groups of stakeholders in OtoCo:

- OtoCo users would be receiving tokens as loyalty awards pro rata their spend in Otoco and use their OTOCO as credit towards further purchases (similar to an air miles scheme);

- Third party developers would receive a token grant linked to the sales turnover from their plugins sold in the dAppstore.

- Token holders would benefit from holding a deflationary token.

In addition to the above, there is some thinking around token rewards in recognition for sustained governance participation by token holders, including the use of soul-bound, equitable NFTs as an additional way of rewarding a hardcore contributor base.

Such “proof-of-work” NFTs are meant to remedy what we perceive as the main short-coming of Web3 projects vs. Web2: the difficulty to keep a core team sufficiently motivated, beyond an initial token payday, to work on the same project in a sustained way.

Conclusion: Imagine

Alan Turing, who we also met in {{Part I}}, reportedly said:

Those who can imagine anything can create the impossible.

We imagine this also applies to what’s possible in new models of governance.

For OtoCo, we imagine our governance stack will eventually have:

- A fully decentralized Foundation with an elected board of Directors and Supervisors;

- A Foundation representative on the Board of OtoCo Inc., the project’s main development company. This is something we haven’t yet seen in other projects and would give the Foundation - and hence the token holders - a real element of control over the main technology choices and corresponding resources within OtoCo’s devco.

- An ever more dissipated token holder community forming a “General Assembly” with a genuine say in key matters related to the Foundation’s treasury and the OTOCO tokenomics.

- Mechanisms that reward active members of the token holder community for their consistent participation in OtoCo’s governance.

- A “second chamber” consisting of the core leadership team who, in addition to liquid tokens, receive soulbound, equippable NFTs with augmented governance rights as an extra incentive to stay with the project for the longer term.

> Participate in OtoCo’s governance debate by joining our official Telegram group!

Some of Vitalik’s posts on the subject of the merits (or not) of ”tightly coupled” onchain voting go back to late 2017, followed by a Governance, Part 2 post of 28 March 2018, On Collusion of April 2019, and the August 2021 post about Moving beyond coin voting governance., which fairly consistently warns about the dangers of pure coin voting. ↩

On 13 September 2023, a vote passed to grant 480,000 tokens to OtoCo’s main outside development team with 4 years vesting and a 1 year cliff commencing 1 July 2022. The first year vested tokens will ↩