A. When do I need a fund?

Many of our clients trade crypto in their personal account or via a proprietary vehicle.

A fair number show very encouraging (and occasionally spectacular) performance, but do not have meaningful amounts of capital of their own and/or want to scale their assets under management by taking outside money.

At what point is a Fund setup required?

The legal analysis is that a Fund is required the moment you manage money for other people.

If you simply pool assets with friends and family and all of them have an equal say in how the assets are invested, you merely have a club. However the moment investment decisions are delegated to one or more managers (we will refer to them as “Managers” with capital M in the context of a Fund setup) you have a de facto Fund and will want to structure it as a Fund for your and your investors’ protection.

An initial track record will not be sufficient to attract outside money: only with a credible setup will you be able to attract capital and charge the level of performance fees that, if you do well, will propel you into the rarified league of top hedge fund managers.

Such robust setup seeks to minimize the infrastructure risk, leaving investors exposed to only the investment risk.

This distinction is significant:

Investment risk

Investment risk comes from being exposed to the market and the Manager’s strategy. An investor who decides to stay passive, e.g., by just holding BTC, still takes market risk. An investor who allocates capital to an active strategy will add active portfolio management risk — essentially the risk you (or your algos) make the wrong calls (or make more wrong than right calls).

Typically, portfolio management risks such as your algos not performing as expected, your risk management blowing up, or even a fat finger order entry mistake are considered investment risks as they relate directly to your activities as Manager.

As part of how you manage such investment risk, investors will want comfort about your strategy, including how it performed in the past, your team and their roles, your risk management policies etc.

Infrastructure risk

Pretty much all residual risks to investors can be categorized as infrastructure risk. This includes where you decide to set up your fund, how your and investors’ rights are protected in the fund documentation, whether and with whom you custody the fund assets with an outside custodian, who is your fund admin, and who looks after your entity setup and maintenance.

Here, investors will want to see two things: (1) a stable of recognizable names, e.g., custodians, legal counsel, fund admin, and (2) best practices, i.e. a structure they recognize.

Otonomos’ overall approach when setting up a Fund for our clients reflects our view that crypto is already a new asset class with higher risks, therefore adding an innovative structure may scare off investors.

Many of the templates and practices that have emerged out of the “tradfin” hedge fund world can be copied over to your crypto hedge fund setup. As a result, sticking to such tried and tested formulas will help you raise and save money.

In addition, as non-lawyers who coordinate the setup and launch of many new funds in the crypto space, Otonomos has developed a reasonably good feel for the commercial boobytraps that, if you were to parameter your fund terms wrongly, could kill you as a Manager. Part III will dissect those terms in detail, whilst this Part focuses mainly on the infrastructure risks.

B. How much will it cost?

Before we dive in, let’s talk money first.

For many aspiring managers, whether or not to set up a Fund may be a simple matter of budget. But how much do you need?

The good news is that many service providers such as custodians and fund administrators (but not lawyers) will take it that they don’t get paid until you make it and will accept a % sharing in your AUM or your fees rather than charging you upfront.

As a result of such carry, the upfront expense can be drastically reduced and will mainly relate to (1) the legal documentation of the Fund itself, (2) the cost of the regulatory license of the Manager if such license is required and (3) legal advice related to what the Manager can and can’t do when soliciting investors for money.

Legal documentation

For a British Virgin Islands Incubator Fund setup, count about USD 5k to incorporate the actual Fund vehicle and USD 12k to 15k for the fund’s legal documentation. Cayman is significantly more expensive, both to setup and maintain a fund (see below).

When it comes to legals, here are some dumb things we’ve seen people do:

If you don’t have the budget, perhaps you should not go with a white-shoe counsel who does not come out of bed for less than 50k: some legal firms only deal with the Blackstones and Goldmans of this world and can afford to say no to poor clients. For what you need, second-tier counsel will do (or ideally top-tier counsel who believes you will make it big and become his/her next best client…).

In the same vein, don’t consider the Cayman Islands unless you launch with USD 100 million plus. Cayman may still attract lots of funds but is clearly aiming for launches above USD 500 million and ideally into the billions. Currently, that is still a big launch size for a crypto Fund. As a result, there’s a risk you won’t feel a good enough customer with many of the service providers in Cayman who rather charge on a next USD 5 billion Carlyle Private Equity Fund than your esoteric yield farming entity set to launch with USD 10 million. In addition to the USD 15 - 25k setup costs, count at least USD 100k per year to keep a Cayman Fund ticking. This means that with USD 10 million in AUM, only the running costs would represent 1% of the Fund’s AUM, or half the standard Management Fees of 2%.

Don’t let counsel tell you that your setup is unique hence they’ll have to document it from scratch: they’ve used the same templates many times over, and there are only that many variables in a fund setup. We all know that after your initial call with the partner, a low-level associate will pretty much press “print screen” to generate your suite of documents, slotting in your fund’s name and the commercial terms you decided for your fund. That should not cost 40k. You want to pay for brain trust, not document generation.

What may cost 40k is if you use billable hours to educate yourself about the basics of a fund setup. We have seen clients eat through their entire legal budget by asking questions they could have googled (or got the answers to from us for free!). Instead of clocking up time to get a Hedge Fund Structures 101 course from a-thousand-dollars-an-hour Partner at a legal firm, you could spend some time reading up here and save yourself five figures.

Manager licensing

This aspect of a Fund setup is consistently underestimated.As a general point, in all jurisdictions where you perform activities that include investment advisory, i.e. deciding how to invest other people’s money, such activities will be regulated if the underlying assets are securities or if you use instruments such as derivatives.

We talk in more detail about the Manager in A.2 below.Do’s and don’ts of raising money

Thirdly, there will be some do’s and don’ts related to how you can solicit investors for money. For instance if you plan to raise from U.S.-based investors, the so called blue sky laws will kick in: a set of state laws that regulate investments and investment companies.

For all matters related to blue sky laws and how our clients can raise money for their fund generally across a number of jurisdictions, Otonomos invites clients to engage appropriate counsel, as this work is outside the scope of the actual fund setup. Count on an extra 5k - 10k if you target the U.S.

C. The typical setup

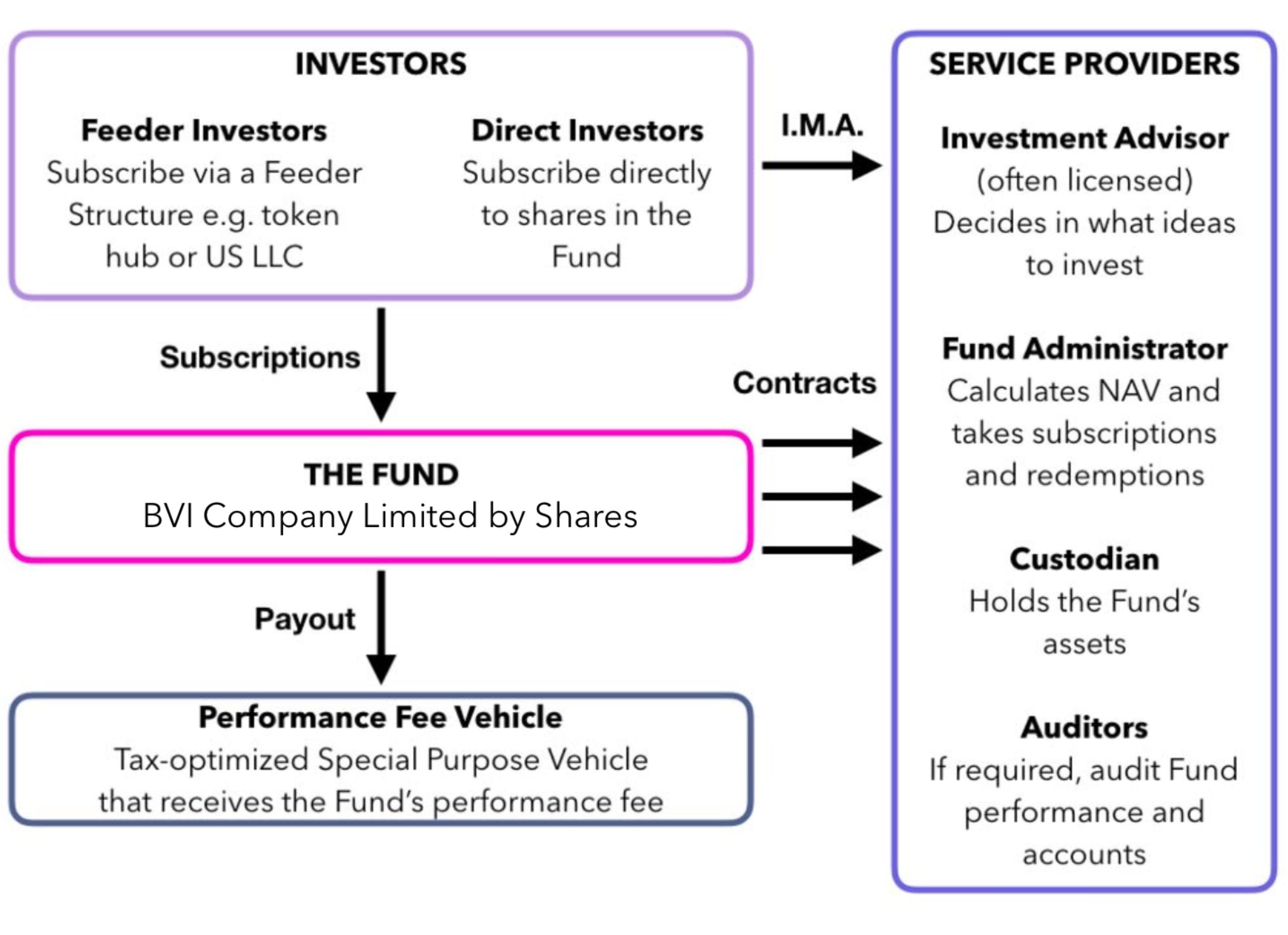

To get started, we put together a diagram of a typical hedge fund setup, which we’ll use as a guide for the discussion to follow.

We will use the British Virgin Islands Incubator Fund setup as a reference on the assumption that most crypto hedge funds will launch with less than USD 100 million in assets, which is the higher limit for a “reg-lite” setup in BVI.

1. The BVI Incubator/Approved Fund

The term “Incubator” is slightly unfortunate as it seems to indicate the BVI Incubator Fund structure is limited to early-stage Venture Capital funds.

Such V.C. funds are typically formed as a Limited Partnership, lock up investors for the lifetime of their Funds, and invest in illiquid assets (e.g. company stock of their portfolio companies).

By contrast, a hedge fund generally invests in liquid assets and therefore lends itself to a more liquid capital structure that allows investors to come in and out at any time, subject to certain limitations. As a result, it typically does not have a cap on its AUM (hence “open-end”) and no defined investment horizon (or “vintage”).

For this reason, a liquid BVI Incubator Fund is typically set up as a limited company with variable capital.

This company form lends itself ideally to issue shares as more investors come in and buy back shares when they redeem.

Such share issuance and redemption is done at Net Asset Value (“NAV”) per Share, which is calculated at regular intervals to coincide with the fund’s subscription and redemption windows (typically monthly but sometimes also quarterly - See Part III).

Because crypto trades 24/7/365, it its arguably easier to mark-to-market each of a crypto hedge fund’s positions compared to a traditional hedge fund. Its NAV is the aggregate value of all such positions, capturing all capital gains (if any) of the Fund minus the management and performance fees you charge and other expenses billed to the fund up to that moment in time (hence “Net” Asset Value).

By dividing the NAV with the total number of Shares outstanding at that time, the NAV per Share is calculated, which is in essence your Fund’s share price.

Note that the variable capital structure for a crypto hedge fund also allows for non-core allocations to illiquid assets, including stakes in private companies or illiquid tokens, however this will not facilitate the calculation of the Fund’s NAV and may therefore be held in so-called “side-pockets”.

2. The Investment Advisor (“IA”)

Top right in the diagram above is the entity that provides the “brain” to the fund, advising what to invest its assets in.

The IA is generally based in one of the world’s financial centers, e.g., New York or London, where it is fun to spend one’s money, but this is not a requirement as such.

What clients too often overlook and/or underestimate is that typically the IA will need a local license to manage money. Such a license may be expensive and may take a long time to acquire, but there are hacks, e.g., a license can be borrowed for an initial period from another licensed entity until the Fund applies for its own.

The Fund contracts directly with the IA under an Investment Advisory Agreement (IMA), which is one of the key documents in the legal suite. This IMA is essentially a mandate to the IA to take the investment decisions over the Fund’s assets.

In the context of a BVI setup, there is a check at the moment the application for the Fund is submitted for approval by its local regulator (see Part II) if the appointed Manager has all necessary licenses or benefits from regulatory exemptions. This check can be in the form of a ”comfort letter” by legal counsel where the Manager is based or an extract of the register of authorized firms e.g. the Financial Conduct Authority in the U.K.

To avoid stalling your launch, if as Manager you do not have a license yet, the two Directors to a BVI Incubator or Approved Fund can be appointed as Managers to the Fund.

3. Third-Party Service Providers

Another significant risk of stalling your launch is from working with third-party service providers such as a fund administrator or custodian.

Each of these third-party service providers contracts directly with the fund, and their fee is paid out of the fund’s AUM.

Since each will want to impose their own contracts, significant time can be lost in negotiating terms and reviewing if all agreed terms have been reflected accurately.

Helpfully, a BVI Incubator Fund does not have to appoint a fund admin until it reaches US$20 million in AUM, any which point it turns into an Approved Fund (See Part II). Neither do a BVU Incubator or Approved Fund need a custodian or audit, which allows for a much speedier setup.

Below, we give a brief overview of the key responsibilities of the three key service providers to a hedge fund: the fund administrator (“fund admin”), the fund’s custodian, and its accountants/auditors.

The fund admin

The fund admin’s primary role is to handle the onboarding of subscribers, including KYC/AML checks, and to provide an independent source for the calculation of the fund’s Net Asset Value (“NAV”). The fund admin’s overall functions include ongoing services such as:

- Maintaining the accounting records for the fund including general ledger and original books of entry;

- Maintaining shareholder capital accounts;

- Maintaining shareholder information, including tax and contact information;

- Calculating distributions from the fund;

- Calculating management fees and other contractual fees;

- Preparing quarterly account statements for the fund;

- Calculating year-to-date and life of fund internal rates of return (IRR);

- Distributing financial statements, account statements, etc. to investors;

- Maintaining an online reporting portal.

Also, the fund admin’s year-end services include:

- Audit liaison for the year-end audit process for the fund

- Handle any accounting-related questions from investors.

- Distribute audited financial statements and tax information.

- Complete audit confirmations for investors.

A fund admin would typically charge a capped monthly fee up to a determined level of assets under management (“AUM”) for its services, with basis points (bps) share in the AUM when the fund reaches a certain size.

This may be your saving grace since their fees only kick in once you’re up and running. From what we’ve seen, fund admin fees range between USD 2,500–5,000 per month for a medium-size fund up to USD 50mm. Once the fund grows in size, expect the basis points to be in the low teens.

Note that as of today, only a select number of fund admins take on crypto hedge funds clients. Fewer still will let you take subscriptions from investors in crypto, since they perceive the compliance risks to be higher — even though the technology for whitelisting crypto investors online is much more robust than the analog process!

Eventually, smart contracts and blockchain should be able to replace a lot of what the fund admin does at a much lower cost (see Part V).

As mentioned above, a BVI Incubator Fund is not required to appoint a Fund Admin as long as their AUM is less than US$20 million.

Custodian and accountants/auditors

As with the fund admin, only a few custodians specialize in crypto hedge funds; however, the number is growing steadily. Also, some legacy players like Fidelity are now carving out a name for themselves in the digital asset space.

In our opinion opinion, self-custody is a total no go, as is the lack of outside accountants and auditors to the fund. At least some lessons from the Madoff scandal should percolate into the crypto space!

As a very minimum, investors will expect you to have multi-signature privileges on the Fund’s wallets.

if you do appoint a custodian, work with recognized players, either boutiques that specialize in the custody of crypto assets or established players that branch into this new space.

Expect to pay high single-digit bps sharing in your AUM to your custodian. Auditor fees are typically high (into the 20k) since the big four accounting firms abuse their dominant position. We recommend going with a second-tier name until you rake in the assets, or (in BVI) go without an audit until your investors insist on one or you want to graduate into a Private or Public Fund.

The need for a performance fee vehicle

The above diagram is a simplified structure. More convoluted setups sometimes have a BVI-based AI, which in turn, sub-contracts with a sub-advisor based outside of BVI.

A myriad extra entities can be added, typically for tax planning purposes. We usually recommend clients not to optimize for tax from day one and rather rejig their structure once performance fees start kicking in.

Performance fees are where the juice comes from. Management fees (typically 2%) typically only cover the AI’s overheads like office and staff in high-cost centers and are therefore paid to the Management entity.

The performance fees are what may propel you into the three comma club of hedge fund billionaires if you do well! Therefore, we do think it is essential to have a Performance Fee Vehicle in place from day one to optimize not just for tax but also to have the flexibility of how the performance fees are paid out. Most likely, your investment team will be promised a share of the performance they contributed to the fund. When paid out to a Performance Fee Vehicle, fees can then flexibly be redistributed by way of dividends out of the company or as partnership payouts.

In both cases, you want to use an offshore entity and then let the shareholders or partners in that entity deal with their respective tax at the personal income level. Often, they use a company to hold their shares in the Performance Fee Vehicle.

If initially, you are the only portfolio manager, performance fees will go integrally to you. Still, you want to make sure you have a vehicle in place once these fees start accumulating.

D. Fund registration and regulations

Part II talks about the BVI setup in more detail and list the requirements you will need to meet and what needs two be reported on an ongoing basis to run a BVI Incubator or Approved Fund.

Other jurisdictions will be similar however the regulations and tax may be very different.

As indicated above, the Cayman Islands have fallen out of favor with smaller funds, and new kids on the block like Singapore and perpetual contenders such as Luxembourg or Mauritius haven’t really been able to fill the void left by Cayman’s institutional lurch.

Whilst Cayman remains the leader in the number of funds domiciled there (on best estimate, over 85% of the world’s hedge funds, VC and PE funds are registered there, with a combined AUM at the end of 2017 of $3.5 trillion in close to 11,000 registered funds) it is clearly eying funds with hundreds of millions in launch size and has recently added quite a number of new restrictions to funds that look to register there.

As detailed in Part II, BVI seems to have recognized the need for a reg-lite fund setup for budding managers and this is now where the majority of the crypto hedge funds are converging.

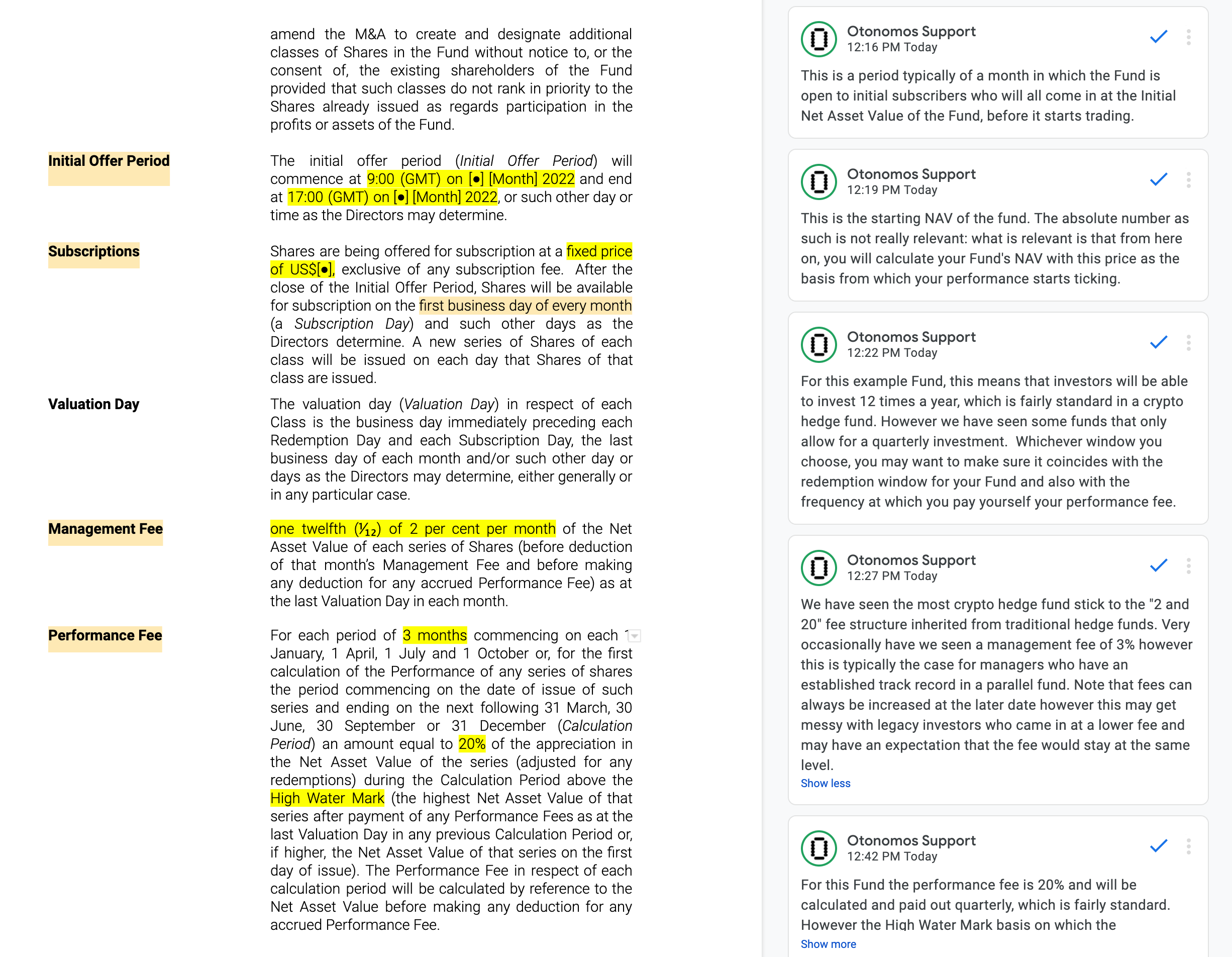

Part III then gives an overview of the fund documentation.

Feeders

The diagram above also shows Feeder Investors (top left) who invest indirectly in the Fund by way of a Feeder Entity (or “Feeder”).

These are special entities that funnel subscriptions into the “master” fund at the BVI level, and they are typically set up in a jurisdiction that is different from that master fund.

Subscription monies at the feeder level get bundled, and the feeder, in turn, becomes a subscriber in the master for the aggregate amount.

To get started and attract seed investment for your fund, no feeder should be required.

However, when we help clients set up their fund, we make sure that their fund documents come standards with a feeder “port,” which allows for an instant master-feeder setup. Think of this port as a USB plug, which allows seamless connection with a feeder if and when is is required. This helps avoid expensive reverse-engineering.

For funds that cater to U.S. investors, mainly for US tax and reporting reasons there will always be a feeder, typically a Delaware LLC that offers its shares on a private placement basis.

So if you plan to tap into a U.S. investor base, you will need to add U.S. counsel fees to your legal spend since all subscriptions and offering documents will have to be issued at the LLC level and be suitable to U.S. investors.

We are typically able to cap legal fees of U.S. counsel we work with at negotiated rates of 5k - 8k for the feeder documents but you are free to bring your own counsel to document the U.S part. The actual feeder entity in the form of a Delaware LLC is only a couple of hundred dollars extra.

An eventual second feeder could be a Europe-domiciled company, e.g., in Ireland or Luxembourg, to accommodate European investors who cannot subscribe directly to shares in an offshore entity, typically as a result of restrictions in their investment mandate. Asian investors, however, typically subscribe directly at the offshore level.

European feeders especially from Luxembourg tend to be a lot more expensive to incorporate and document.

E. The Economics

The economics of a hedge fund deserves a separate post as there are a lot of moving parts.

Here, we limit our discussion to three key areas where we have seen a lot of mistakes being made and which can become a matter of life or dead for your fund: (1) the level of fees, (2) how performance fees are defined, and (3) the redemption notices and frequency. We close this chapter with some thoughts on tokenization of the fund’s shares or issuing tokens that give token holders the same economic rights as direct subscribers.

1. Level of fees

This is delicate. Here are some pointers:

- Investors are typically not buying the narrative that because crypto is a new asset class, higher fees can be justified, at least not until you have proven yourself as an outstanding manager.

- Legacy hedge fund fees, too, have come under pressure in the least years, with the standard 2% management fee and 20% performance fee negotiated down. Besides, seasoned traders who recently started their fund have to content themselves with lower initial seed money.

- You will typically only have a very short track record if any. Most likely, it will be a non-audited Excel spreadsheet showing transactions from your Coinbase or FTX account together with some back-tested results. Hence you may have to be flexible on initial fees or rebate early investors.

2. Performance fee calculation

Your performance fee in itself is a meaningless number unless you indicate how you calculate it.

If you charge, say, 20% on absolute performance, then only when you have a down month or quarter will you *not* be able to charge your investors performance fees.

This makes your 20% performance fee look high since they are calculated on absolute performance. Such fee structure can offend investors since a 20% performance over the month may look good in of itself, but if the broader crypto market gave 40% why should you still get paid to underperform?

By contrast, if you only charge fees on outperformance over some previous performance record (the so-called “high-water mark”), you can go fee-less for a long time until you do better than your past record. This can come back to bite you, and some stellar funds have died as a result.

However, investors like high water marks since they don’t have to pay you when you “climb out of a through,” a scenario in which you lost them say 40% in one quarter and charge them performance fees while you’re making your way back over the next quarters.

Instead of a high-water mark, we typically ask clients to consider a hurdle rate. This is simply a rate of return over a defined period (typically monthly or quarterly), below which no performance fees can be charged.

For example, if you expect a passive BTC holding to return 20% over the year and use that as your hurdle rate, you would only be able to collect quarterly performance fees on returns that exceed 5% per quarter. At that point, you can either charge fees over the hurdle rate or get paid for the entire performance.

In summary, fees require careful consideration, and it is good to pulse with your early investors if they have a preference.

Your performance fee structure will also very much be a function of your investment strategy: a hurdle rate is perhaps irrelevant if you passively track a basket of the majors, but very relevant if you have an active strategy that seeks to outperform the broader market.

3. Redemption rights

Redemption notices and terms can work to their detriment of the fund when markets seize up.

As a money manager, you want to be able to hold on to people’s money as long as you can to avoid fickle investors, a.k.a “hot money” that jumps ship as soon as the markets are jittery and/or you have a period of weak performance.

Investors, however, want liquidity: ideally, they want to be able to get their money back at the shortest notice.

It is these two interests that need balancing, and this balance is reflected in redemption notices and, secondarily, gating and side-pockets.

Most crypto hedge funds have monthly instead of quarterly redemption notices, on the basis that the fund’s positions are all assumed to be liquid. If, say, you require an investor to give you notice latest by end July to come out of your fund on 31 August (minimum 30 days), you should have enough time to adjust and rebalance your fund.

Still, if that investor holds 40% of your fund’s AUM and wants out, good assets will have to be sold to meet this significant redemption request. This will impact other investors, possibly leading to a downward spiral. Some funds, therefore, “gate” redemptions by imposing a limit on how much any single investor can redeem per notice. Investors typically frown upon such gates, but most funds have them.

More frowned upon still is when the fund documents allow for “side-pockets”: assets that the fund manager can declare illiquid or hard-to-value (e.g., when markets are in free-fall or seize up) and that are held in a separate account. Existing investors usually cannot ask for liquidation of such side-pocket. They may only get their money back after all assets have been sold, and the proceeds disbursed, effectively denying them their redemption right.

As a general point, it will be more difficult for you as a crypto hedge fund manager to justify long redemption notices, gating, and side-pockets than in the traditional hedge fund space: crypto is all about tokenizing everything to create new markets. Liquidity and ease of transferability are touted as one of the main advantages of such tokenization. This creates the expectation with investors that they can easily trade in and out of crypto funds, and traditional redemption terms may be controversial.

We talk about redemption terms in more detail in Part III about the Term Sheet, which is where ideally you want to be upfront about not only the redemption notice period and frequency but also the minimum and maximum levels of redemptions, and in Part IV when we look closer at the Fund’s Constitution, where the devil many hide in the detail of some residual redemption terms.

F. Should you tokenize your fund?

Before we conclude, some observations on tokenization.

We have seen that most of our clients who initially considered tokenizing the shares of their fund— or create a token that gives exposure to their fund’s net performance —ultimately decided against.

Whilst technologically doable and intellectually appealing, tokenization is not trivial from a commercial and operational point of view and on the whole may act as a complexifier.

First, we are not convinced that giving investors extreme exit rights will benefit the fund as a whole and is in the best interest of the manager.

Second, we are not sure if, in this early stage of crypto investing, investors demand or even expect a token to represent their ownership in a fund. This may change as the space develops and institutional investors become more familiar with the use of digital wallets, but unless you think your fundraiser will benefit from tokenization, why bother?

That said, accepting crypto as a means of payment for investor subscriptions makes total sense. However, this is simply an alternative or additional payment facility you give your investors, not a token.

Finally, you may want to be careful what you wish for when spinning up a token. Once it is traded on the secondary market, your token will start leading its own life and show its own price. This price may have a disconnect with your fund’s NAV and may attract hyper-speculation.

On balance, as a fund manager, tokenization may be more distractive than accretive. For investors, it may discourage them from subscribing directly to your fund and seeking indirect exposure instead via a tradable token.

If one day we will use a token to gain exposure to the performance of an investment fund, let it be the day we have transformed the way we pool capital in the first place and smart-contractified how such pooling is governed. That day may still be some time away, but in Part V we share some ideas of how this could be achieved.

Until then, we expect investors to seek the safety of the familiar, even when they seek exposure to the very asset class that will ultimately change everything!

Conclusion

Back in April, when we first pushed our piece on “How to Become the Next Michael Burry”, the markets were a lot less exuberant.

At the time. we urged people to start preparing their fund setup if they were serious about managing money for other people, quoting John Templeton’s famous aphorism to “invest when everything is depressed”.

As we edge towards year-end 2021, crypto is booming with most digital assets at or near their all-time highs.

Still, the case to trade as a fund remains intact: A fund vehicle is the sports gear of the investment pro, and without a fund, your trading remains a chess game against yourself, your track record unacknowledged, your ammunition limited.

Every private banker we speak with tells us their clients are looking to put some money into crypto, but they lack credible funds by dedicated managers.

If you’ve been trading crypto over the last years, you already have an edge over a myriad of legacy investment managers in traditional asset classes. What they have and you don’t is a fund.

With this in mind, we hope this posting helps you towards setting up your own fund as the natural next step. Do contact us support@otonomos.com when you’re ready to take it!