This one is on you

The Fund Termsheet is the document aspiring Managers should spend most time at, not only in terms of the information such as bios etc. they will need to provide, but also to think through the commercial variables they will need to define which, if not parametered correctly, could be to the detriment of the Fund.

Clients often expect the terms to be decided on their behalf and submit a half-completed document with lots of the commercial variables left undefined. This results in delays and extra lawyer involvement, adding to the Fund setup costs.

Realistically, neither legal counsel nor Otonomos as your Fund coordinator are in a position to define the commercial variables in relation to your Fund, in the same way we cannot determine your investment strategy.

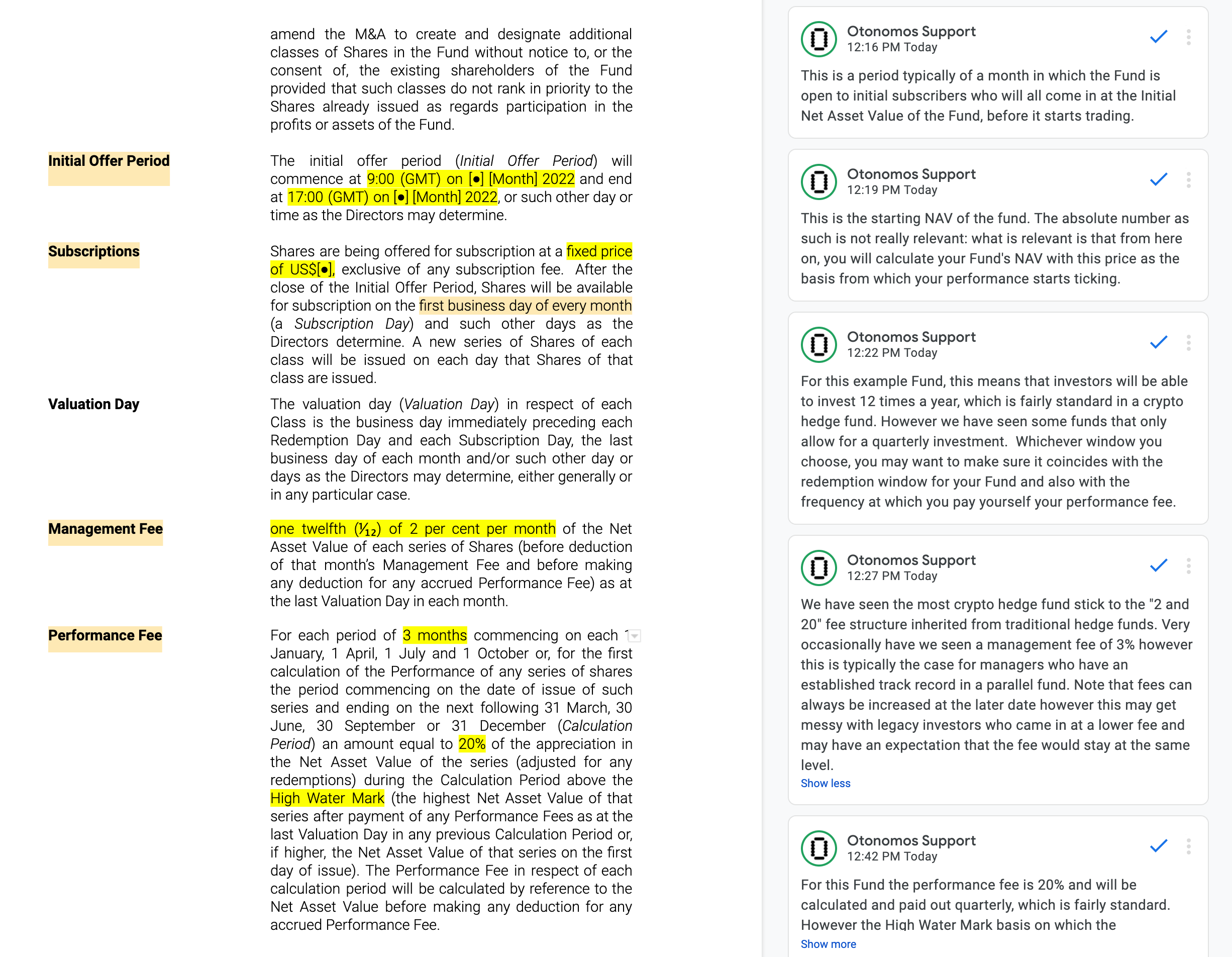

A point of comparison

On the basis that investors will largely rely on the Terms Sheet when making up their minds whether or not to invest, you want it impeccable.

To help you on the way and make sure your Termsheet is in the best possible shape before we review it together with BVI counsel, we have provided a template Termsheet on an “as is” basis and added comments for each sections that we hope will force you to think through each of its most pertinent terms.

These comments are largely based on observations we made across all our crypto hedge fund clients and which we hope may prove useful to compare your proposed Terms with others’.

To make commenting and finalizing the Termsheet easier, we have provided the Termsheet as a shared Google document, of which we can then simply create an editable version to finalize it for your Fund once we are under assignment.