As I wrote in a testimonial for the our website, Otonomos in many ways is the way I felt I could contribute to the decentralized movement, which I have been part of as a spectator, critic, investor and builder (not always in that order…) more or less since the Ethereum mainnet launched.

Otonomos and OtoCo, its spin-off, is where for me it all comes together: the community's ethos of self-reliance through sharing, the knowledge I gained from the things I did before, and my belief that we can achieve autonomy and freedom through the permissionless tech we build together as an open-source movement.

First external capital

Today, Otonomos is looking after hundreds of entities around the world but we never raised outside money.

After a well-documented coup in Singapore in 2017 when I sued bad actor investors who tried to take control of Otonomos, we relocated the business to the Americas, with the brand intact but not much else.

For a number of years, gradually rebuilding its client base, I ran Otonomos as a lifestyle business, partly because its business model more than paid the bills, but also because I sort of had it with investors and the indignation of raising money the analog way.

Only more recently, in fact only in early 2022, did I decide to scale the business, hiring a seasoned corporate service professional out of the UK to help me with operations and generally adding to the team in both the Americas and Europe.

Up to that point, the business was month-on-month profitable but after we started to ramp up investment in the team and the tech, I’ve occasionally had to dip in my own pocket to cover cash-flow shortfalls, despite consistently growing revenue.

So at this point a first external round seemed timely. But we wanted to go about it in a different way.

Going about it slightly differently

We’ve seen countless clients raise by pre-selling or selling tokens (‘20-’21) and OtoCo itself probably caught the last crest of the token funding wave when it raised over US$1MM early 2022 and handed its governance over to the community.

From 2022 we saw most clients use SAFEs again (with token warrants almost as an afterthought) but didn’t like the lack of transparency in the process (with some investors getting discounts of over 50% and others 15% in the same SAFE round!).

Now it seems the pendulum has swung back towards centralized capital, with L1 chains and dApp builders being funded by VC on fairly traditional terms (Preferreds), in a traditional company setup (a C-Corp in the US) and via a very analog process (MS Word term sheets, bilaterally-negotiated terms, and reams of wet-signed legal documents.

It seemed to me the space had gone full circle and that indeed all we got out of the ICO days was a lousy T-shirt!

Surely equity funding could be done better by bringing it online and using blockchains?

A controlled experiment

That’s when we started to work on the idea of an online funding module and try it for our own fundraise first, before possibly shipping it out.

We came up with Ten Commandments (see Part I) on the basis of which we started development work earlier in this year. By late April we managed to incorporate most of the design requirements, though further development work is necessary to make our online funding solution a 10x better solution.

We then did an announcement back in May and soft-opened our online round over summer in a first tranche to a limited group of pre-existing Otonomos contacts, but so far the traction has been modest.

We always knew the experiment was going to be risky but I like to think we just didn’t explain the deal and the portal well enough, so this post seeks to address this.

In what follows, we highlight 3 aspects of the Otonomos fundraise:

A. What do investors get when they invest?

B. On what terms do they invest?

C. How do they use the portal we built to invest?

A. What do investors get when they invest?

In our May newsletter, we listed 8 reasons why - as long as they agree with most of them - investors should take a stake in Otonomos.

We’re reproducing the list here:

1. We’re seeing an unprecedented wave of entrepreneurs in Web3 and AI who will all need legal wrappers ✔︎We’re seeing an unprecedented wave of entrepreneurship in Web3, compounded by an acceleration in AI startups. More projects and ventures coming to this space means a growing demand for entity setup and maintenance, Otonomos’ core business.

By investing in us, you get “pick-and-shovels” exposure to a new tech ecosystem, without direct risk from investing in individual ventures or buying project tokens.

2. Company formation and corporate services is a big market ripe to be eaten by software ✔︎At an estimated annual spend of US$ 100 billion, the current market for company formation and corporate services is twice the size of the global music market (be it less glamorous…).

However, anybody who serially forms companies will recognize corporate services as one of the last bastions of paper-based ritualism, screaming to be dragged into the 21st Century, in the same way so many other analog processes have become digitized.

Incumbents in this space have zero tech and that is where our opportunity lies.

3. Otonomos is best placed to become the go-to name for doers and investors in blockchains and wider tech ✔︎Web3 and tech companies expect digital solutions to remove analog friction, which is why our tech appeals and why we focus on this early adopter market.

Our thesis is that even though there may always be a “last-mile” manual filing component, 90% of the process of company formation, funding and governance can be digitized and automated:

- Our e-commerce style homepage allows users to order entities à la carte by simply adding them to a shopping cart and checking out using crypto or fiat.

- After checkout, users can instantly start assembling their company online in simple logical steps. As an example, check out how we recently brought the staging of a British Virgin Islands company fully online.

- Once formed, users can remote-control their entire universe of entities, with all additional entity-related services served up via our browser-based dashboard, allowing for continuous upselling by Otonomos.

Further down the line, once the use of wallets and blockchains is commonplace, we will be ready to form entities natively onchain and smart-contractify all business logic!

4. We’ve shown solid traction and further investment in our tech will allow us to scale our business from here ✔︎Our early traction is clear validation of product/market fit, with over US$1.6 MM in revenue in 2022, our first full year of operation, and the number of clients projected to double each year over the next years.

The automation and technology we bring to this space should allow Otonomos to scale much faster than incumbents. In essence, instead of being a corporate service provider with additive tech, Otonomos is first and foremost a tech company that applies its software solutions to the company formation and maintenance space.

5. The business model of a corporate services provider is powerful mainly thanks to its recurring revenue ✔︎

This translates in a powerful business model for Otonomos:

- Our initial cost of goods and client acquisition is immediately covered by the one-time payment users make when ordering a company. This means that every order is profitable from day one.

- In addition, our clients pay all the annual dues related to their entities upfront, resulting in an ever bigger payday for Otonomos as the number of companies we look after grows.

- Scaling through tech vs. adding headcount allows us to compress the marginal cost of every new entity we incorporate and do things faster, cheaper and more efficient.

6. Our team feels they were put on earth to do Otonomos (ask them!) ✔︎In our minds, investors should really only worry about one thing: will the team stick with it.

Our core team has seasoned business builders, technology talent and domain experts in equal measure. We all plan to be at it for a lot longer still!

7. Otonomos has been a favored child of the crypto community since the early days ✔︎We started coding on Ethereum before the launch of its mainnet and were there to help the Ethereum Foundation itself and early Ethereum projects such as Maker, Gnosis, Status, etc. with their legal stack, before we decided to build Otonomos into a business.

So far all our sales have been inbound and we still do not have a marketing effort. It is the community that carries us and that is why we want to give it a carry in us.

8. There is no household name (yet!) in the company formation and corporate services space ✔︎Legacy players are fragmented and have zero tech. New players may do a subset of what Otonomos does but nobody brings it all under one roof. There is no household name in this space.

Otonomos therefore has a chance to become the first name doers and investors in tech think of for their company formation, funding and governance.

Arguably, Otonomos’ total addressable market is the 4 billion or so people on the planet who are within the working age bracket!

We also reproduced the above list in our Investor Deck which can be accessed after logging to our online funding portal.

Equity on the table

From the deck, it is clear that our round is clearly an equity round. The way investors participate however is novel.

Instead of subscribing for shares directly, we used a structure which has been tried and tested in the fund world where a “feeder” entity feeds into a “master” fund.

Such feeder then bundles together all the investments of a specific group, typically US-based investors, for whom for a number of reasons it is more advantageous to invest via the US feeder, rather than buying shares directly at the offshore Master fund level.

In a fund context, this feeder is typically an LLC which then acquires shares in the offshore Master using the combined subscriptions made by its Members.

In almost all aspects, the Otonomos structure resembles the above, with two exceptions:

- There is no Master fund, but instead there is Otonomos’ main holding, Otonomos Holdings in the Cayman Islands, where all its revenue ultimately accrues and which is ultimately set to exit. The feeder LLC then buys shares in Holdings with the proceeds it raised from its Members (and its Operating Agreement make it very clear that the feeder can only ever buy shares in Holdings) so the feeder is more of a special acquisition vehicle in the case of Otonomos.

- Second, we tokenized the LLC’s membership interests and added legal wording in the online funding portal to the effect that by buying the token, investors automatically subscribe for Membership in the LLC pro-rata their contribution, without the need for any signatures.

The Otonomos Mirror Token as cryptographic proof of Membership in the LLC

The LLC in which investors become a Member when purchasing the token was created using OtoCo and is a multi-Member Series LLC, registered in Delaware (File Number 7502485).

We called it Otonomos Funding Club, LLC (the “Club”) because it is governed as an investment club in which Members can use the OtoCo dashboard to connect their wallet and vote on matters related to the LLC onchain.

As can be seen from the diagram above, the Club is the issuer of Otonomos Mirror Tokens (“OMTs”), for which it filed its Form D to notify the SEC that it is conducting a Reg(D) offering.

You electronically subscribe to the Club by purchasing OMTs, which can be paid for in crypto or fiat from within the online funding portal. The OMTs represent investors’ percentage ownership in the Club and acts as cryptographic receipt of their subscription(s).

Crucially, OMTs only get minted in return for actual money invested and to compensate for base and volume boosts or referral bonuses, if applicable. There is no founder allocation, and no extra mint above and beyond what is minted in return for subscriptions made for Membership in the LLC. To keep things easy, every OMT buys US$1 worth of shares in Otonomos Holdings.

This mechanism guarantees that, irrespective of how many other Members join the Club and how much Otonomos ultimately raises at the LLC level, the amount of OMTs in your wallet will always translate into an equivalent dollar amount of shares in Otonomos Holdings.

E.g. if you purchase say 80,000 OMT (and do not benefit from base and volume boosts, which are triggered by how early you come in and the size of your investment), your subscription will buy US$ 80,000 worth of shares in Otonomos Holdings, under the terms of the termsheet.

We’ll talk about those terms in more detail below.

B. What are the terms of investment?

Strip away for a moment the funding vehicle and its token and think of yourself as an angel or VC coming into the Otonomos round.

Typically, your investment would be on the basis of a Termsheet that we at Otonomos would have received from you, after we met or talked on the phone.

We may also have received other term sheets from other investors and start engaging in parallel discussions, playing you against other investors to get the best terms.

Such “best terms” however have over the years pretty much been frozen and most VCs (at last the self-professed Founder-friendly ones) will be using a template that has become quite standard.

Those standard terms are broadly reflected in our Termsheet which can be accessed here and on the basis of which the LLC will invest in Otonomos Holdings:

- Series Seed Preferreds: whilst we have seen some termsheets (e.g. those from U.S. accelerator programs) remove Preferreds and issue Ordinary shares of the type Founders and employees hold, our terms maintain the extra rights investors have traditionally enjoyed as holders of Preferred shares.

- The raise is for up to US$ 2MM at a pre-money valuation of US$24MM.

- There is a 20% option pool post-dilution under standard Valley terms (1 year cliff, 4 years vesting).

- Super-founder stock (12 votes per share) under standard Valley terms with 2 years accelerated vesting upon close and monthly vesting over the remaining 2 years.

- 1x liquidation preferences for Preferreds.

- Standard protective provisions, follow-on, right of first refusal and co-sale rights.

- One board seat for the Preferreds, two for the holders of Common stock.

Importantly, the above terms apply to the LLC as an investor in Otonomos Holdings and hence everybody who is a Member of the LLC after purchasing OMTs will benefit from them, creating a much fairer and more transparent process compared to one investor carving out special rights.

In this light, Otonomos Funding Club, LLC truly enables investors to club together as peers and act like a collective VC in Otonomos.

C. How to use the funding portal to invest?

From the above structure, it is clear that in order to participate in the Otonomos round you need to become a Member of Otonomos Funding Club, LLC and the way to become a Member of Otonomos Funding Club, LLC is by purchasing the OMT token it is issuing.

The online portal now essentially removes all friction in purchasing the token by approved investors by automating the entire purchase process.

In this last section, we walk you through this process and share screenshots of how to invest.

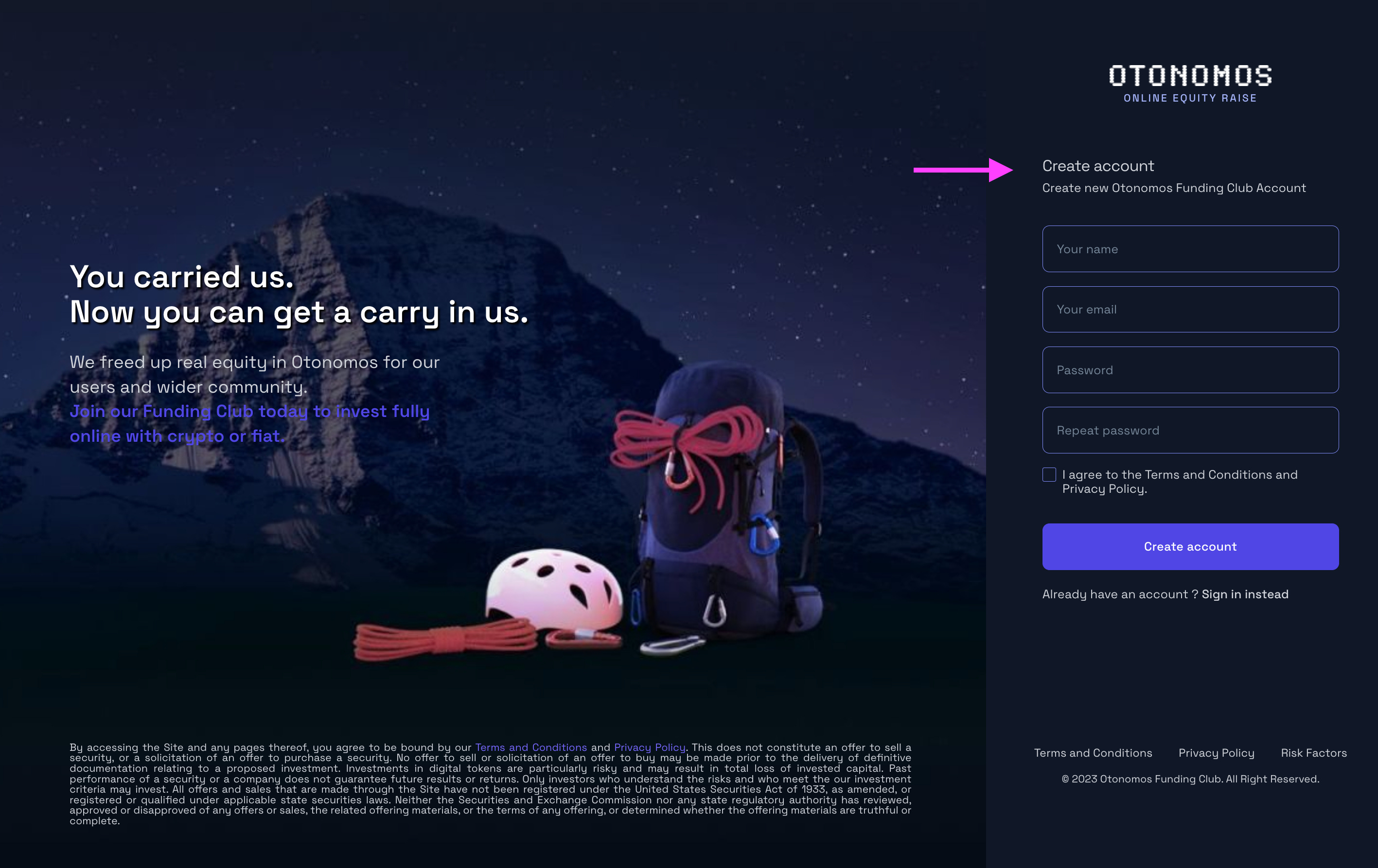

Create account

First, go to fundingclub.otonomos.com to create a new account (or login with existing credentials).

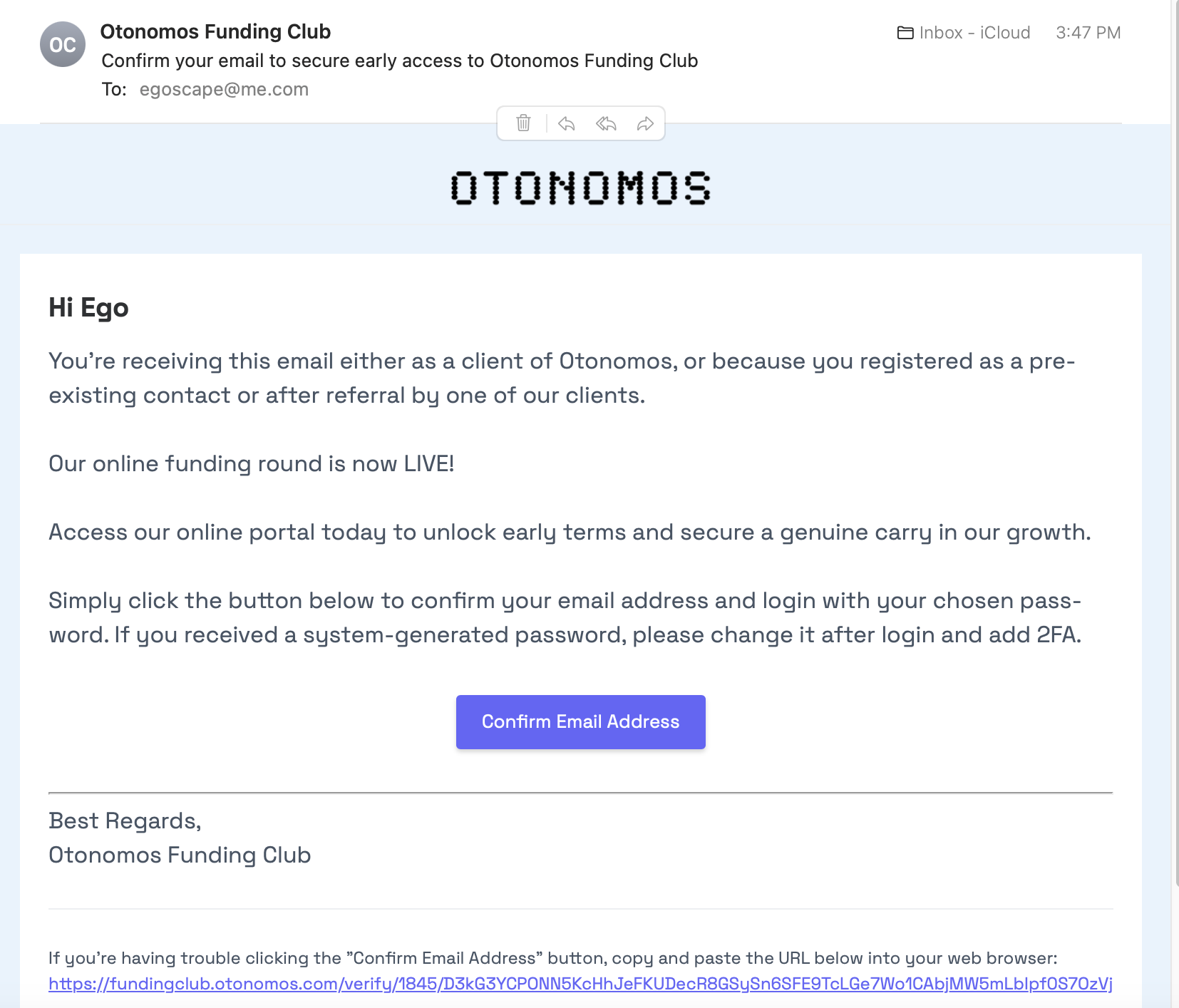

You will receive a system email from admin@otonomos.com that asks you to confirm your registered email address. All email related to our round will come from this Admin address.

After you confirmed your email, you will receive a second email inviting you to login and complete your investor profile.

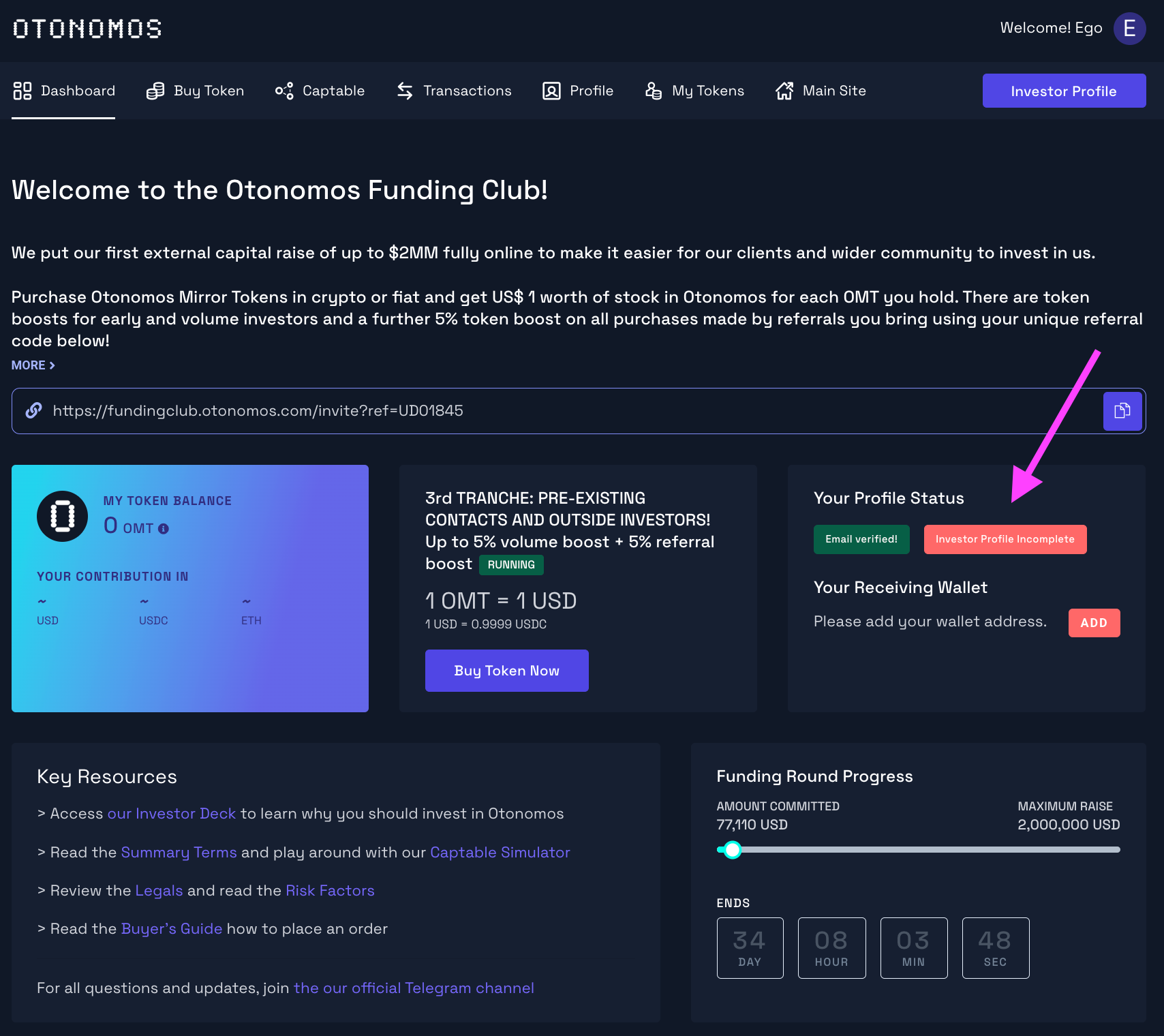

When you first log in, you will see a screen like this showing your investor profile is incomplete:

Complete investor profile

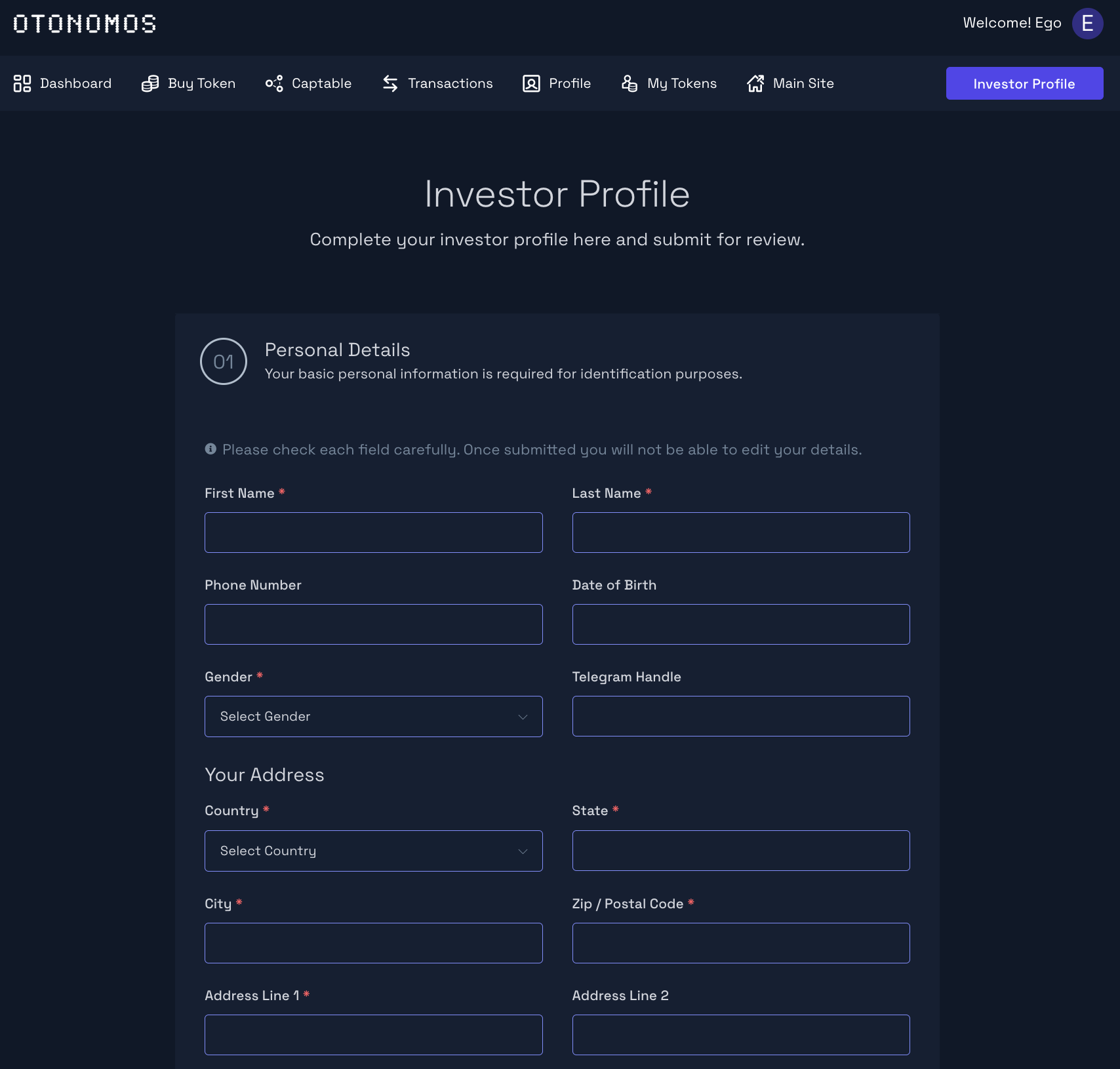

Click on the red button or go to “Profile” in the top level menu to complete your profile. You will be asked to submit personal details and upload information we need from you in a three-step process:

Step 1: Personal details

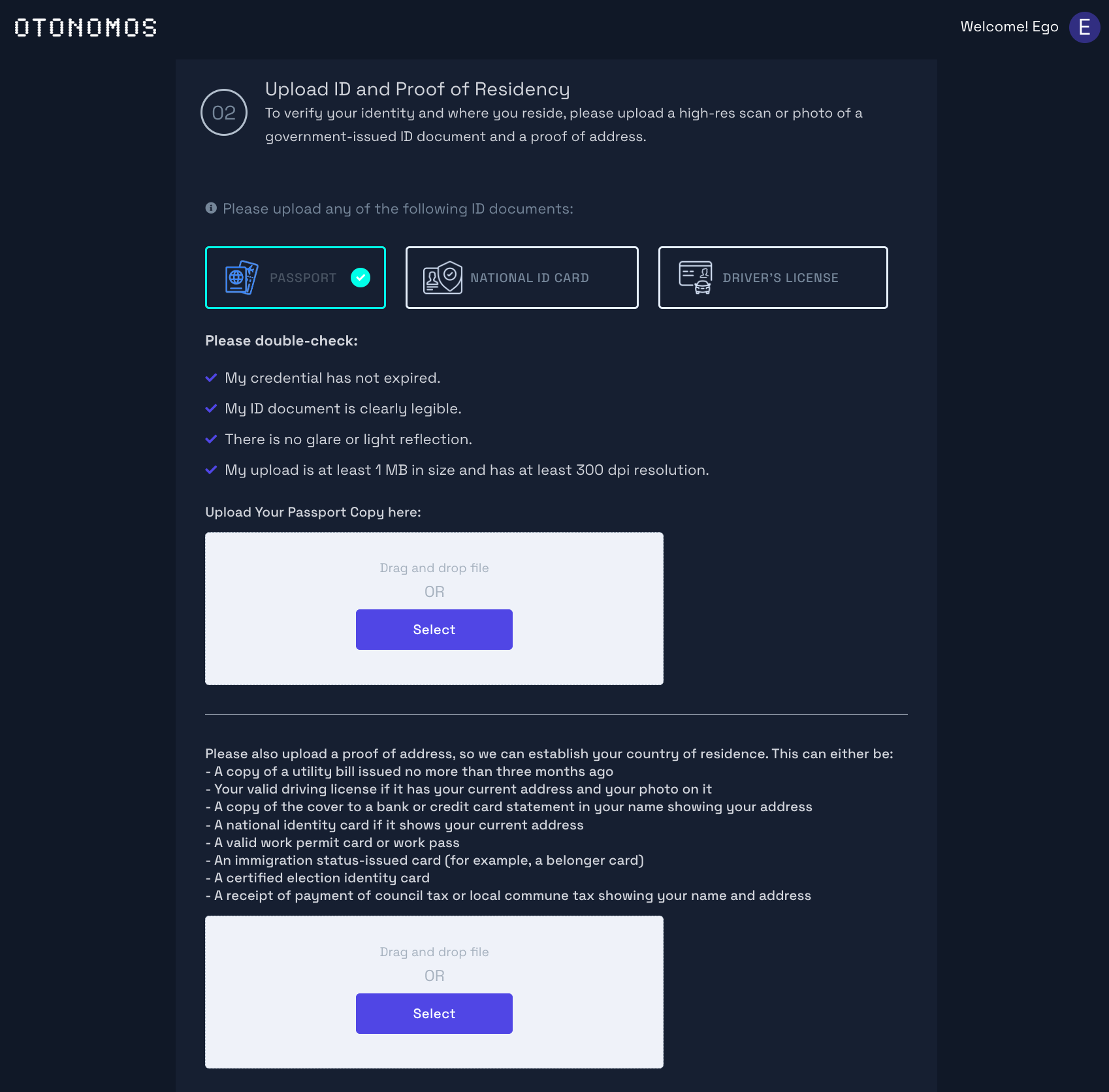

Step 2: Document upload

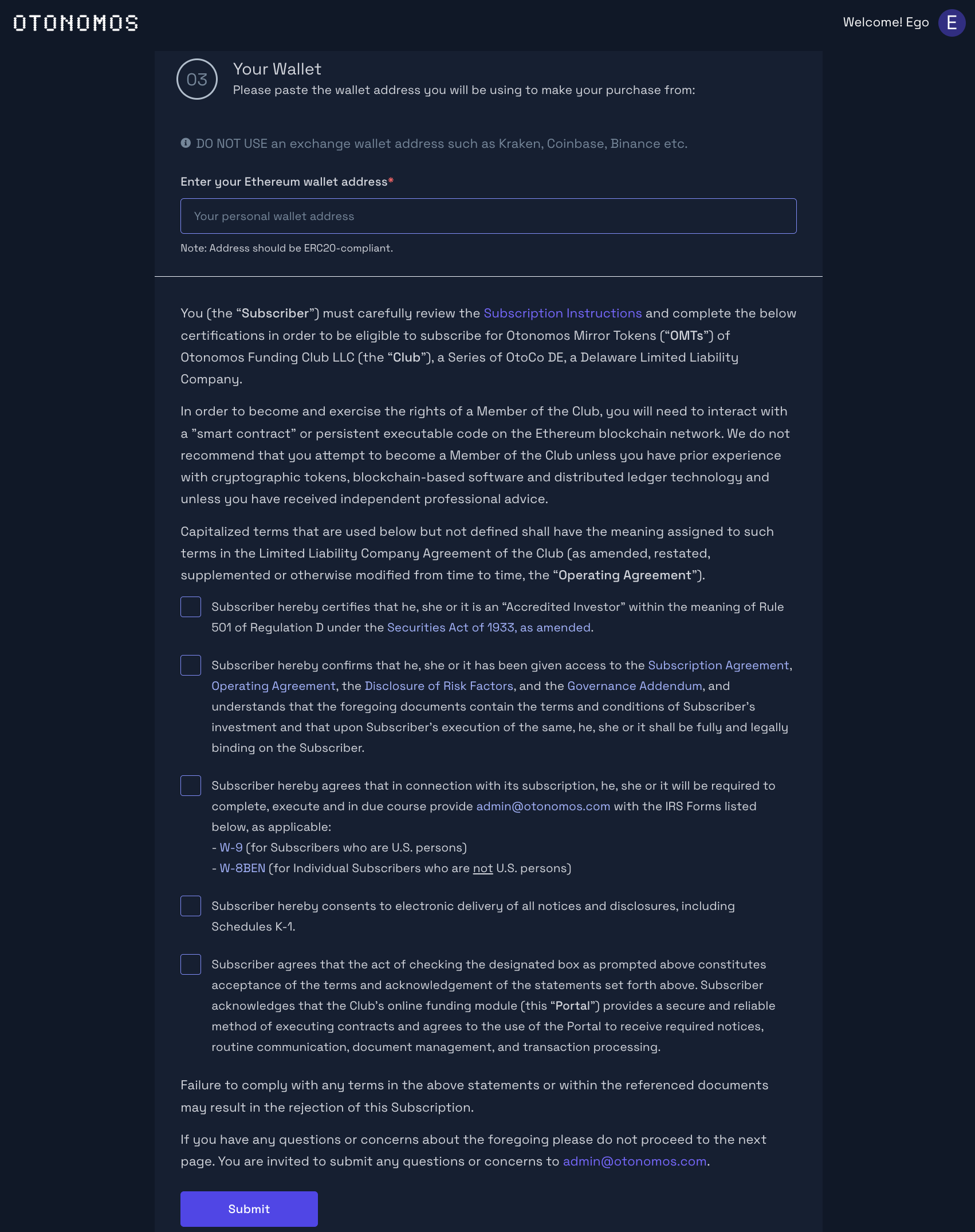

Step 3: Wallet and certifications

The 3 steps above should not take more than 3 minutes. When done, click “Submit”.

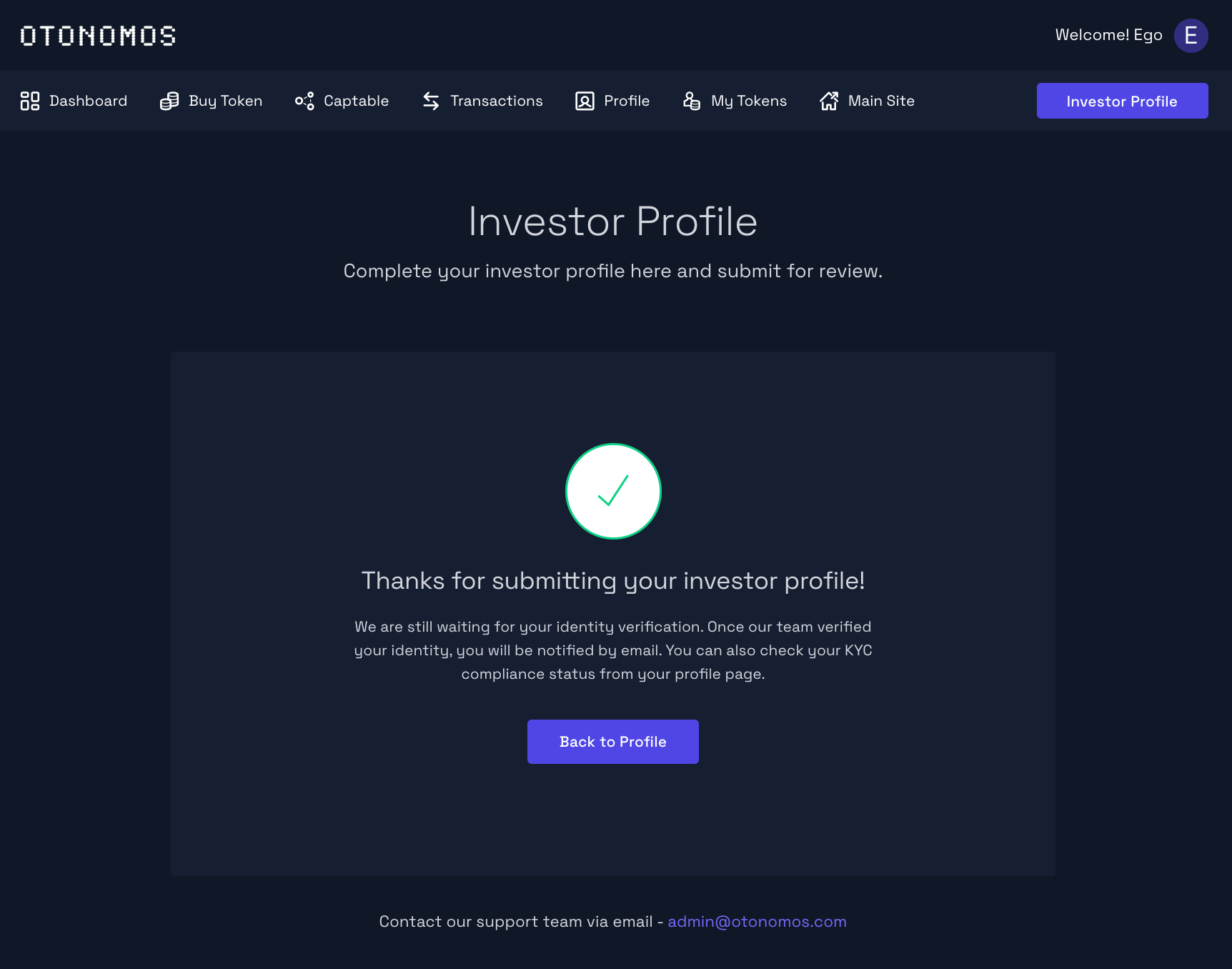

You will see a confirmation that your profile was submitted:

You will also receive an email that looks like the one below:

Approval

Typically our approval takes a lot less than 10 hours! If we need further information, you will receive an email with the reasons why your status could not be approved at this stage and what to do next. If it is approved, expect an email like the one below.

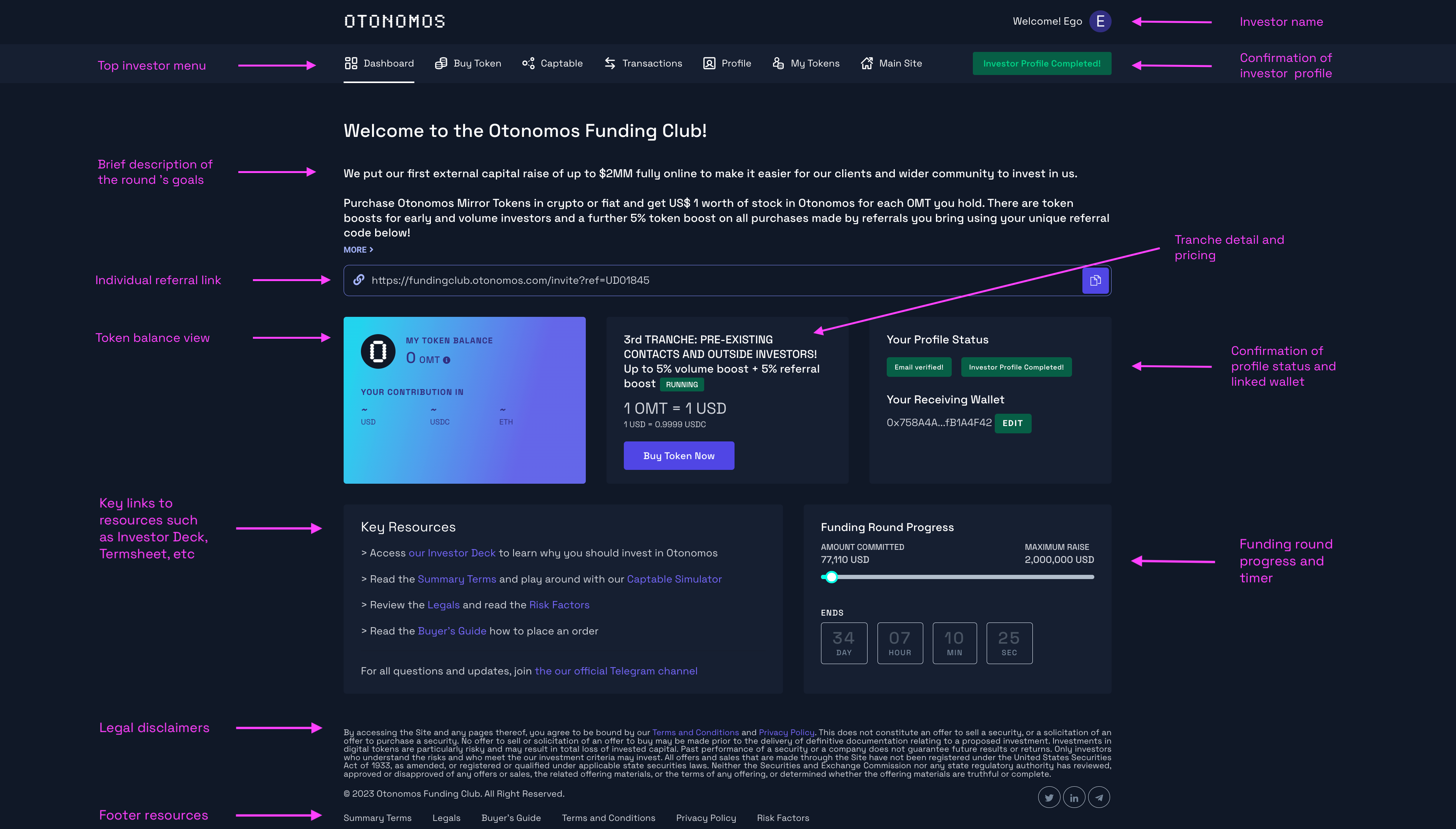

Log back in our refresh your browser and your welcome page will show your investor status as completed.

Here is the screen you’ll be looking at, which we enlarged and annotated to make it easier for you to find your way round:

Key resources

The key resource section allows you to fully read up on the raise and its terms.

It has:

- A link to the Investor Deck

- A summary of the Terms and a Captable simulator

- Links to the underlying Legals and the Risk Factors

- A Buyer’s Guide explaining how to participate

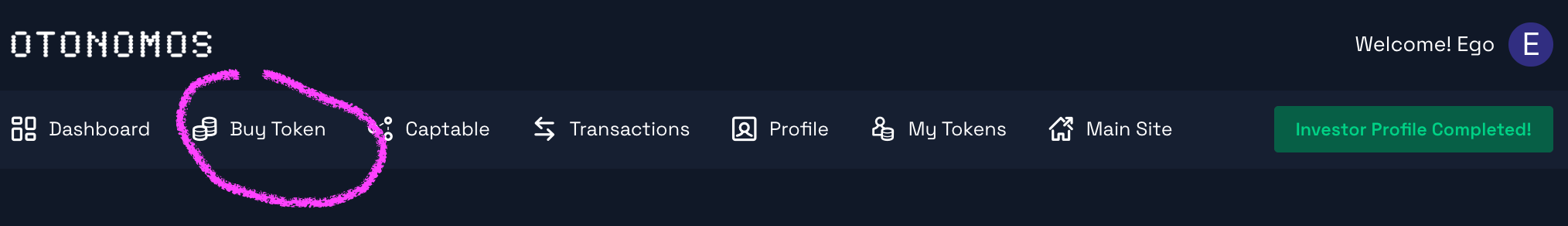

Buy token

Once you have familiarized yourself with the materials and you’re ready to invest, simply click “Buy Token” in the top level menu:

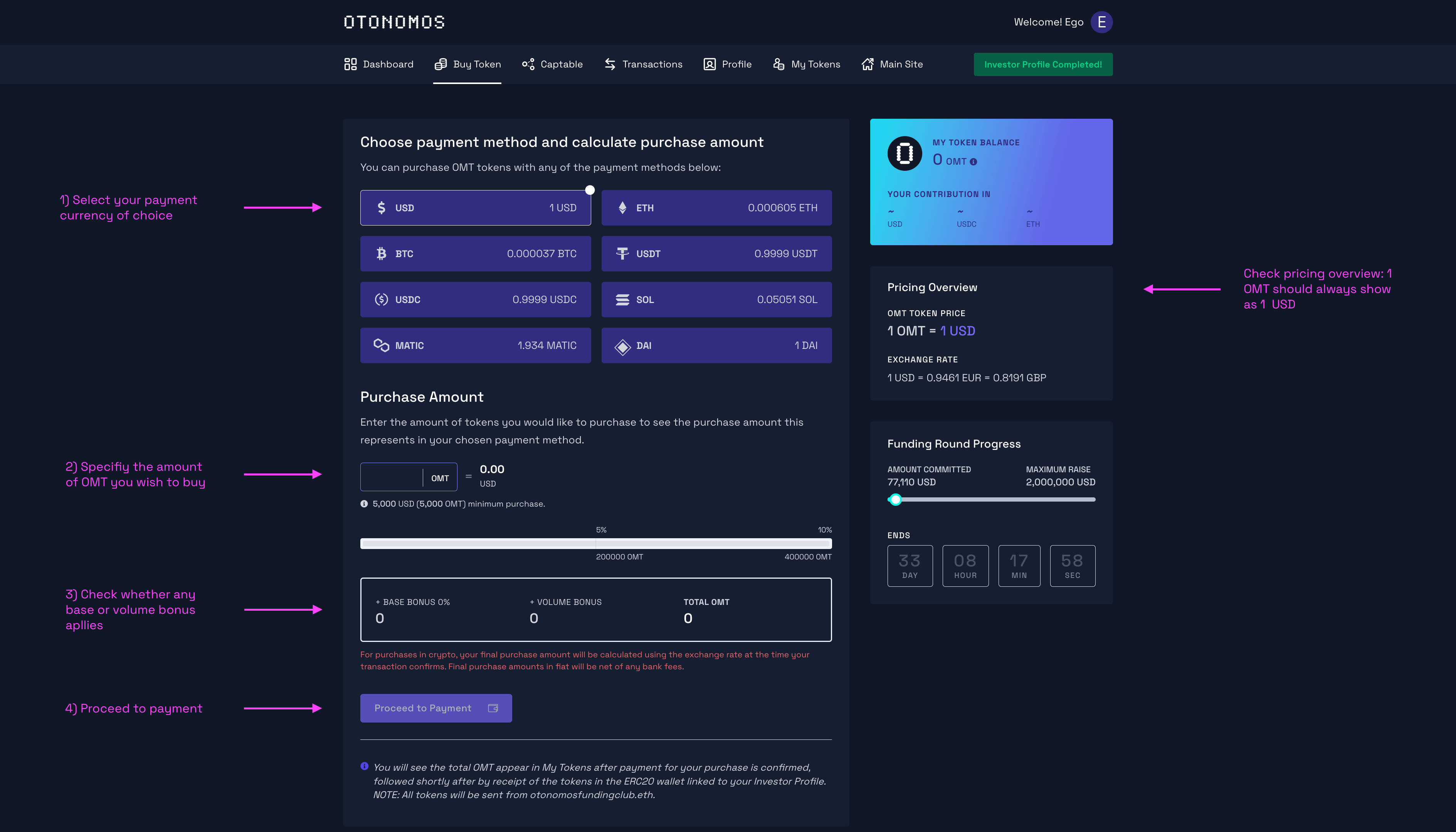

A new screen opens like this, which we’ve enlarged and annotated for ease of navigation:

Step 1: Choose payment method

This will let you choose between 7 crypto currencies in addition to USD:

- Bitcoin (BTC)

- Ether (ETH)

- USDC (USDC)

- ERC20 Tether (USDT)

- MakerDAO DAI (DAI)

- Polygon Matic (MATIC)

- Solana (SOL)

FX oracles will show you the fixed price of USD 1 per OMT for each of the above currencies at the then applicable exchange rate.

Step 2: Specify the amount of OMT you wish to purchase

Specify the amount of your contribution by entering the amount of OMT you wish to purchase. In the current tranche, the minimum is 5,000 OMT and the maximum is 1MM OMT per transaction.

You will see the equivalent purchase amount in the currency of your choice next to the amount of OMT you entered.

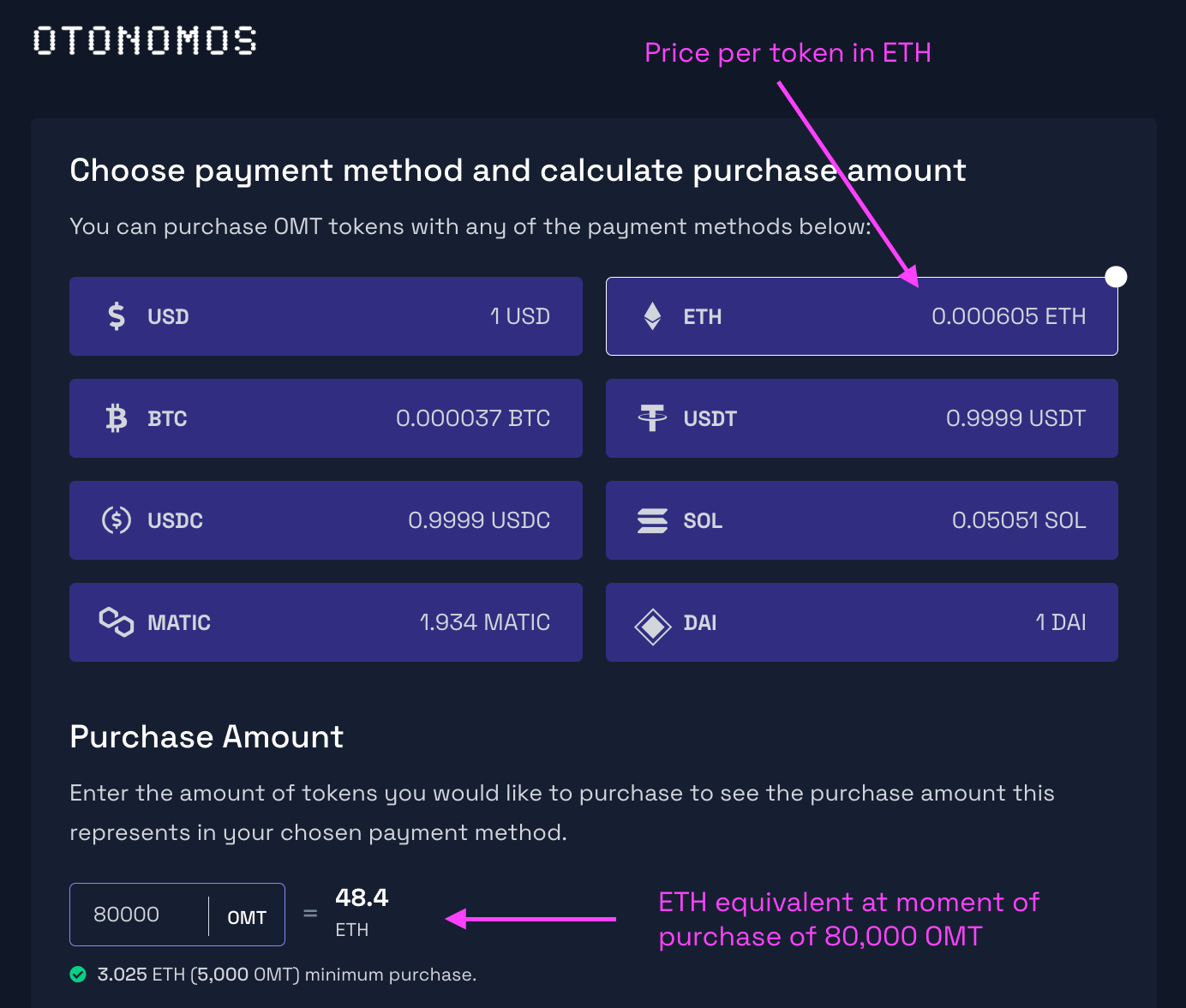

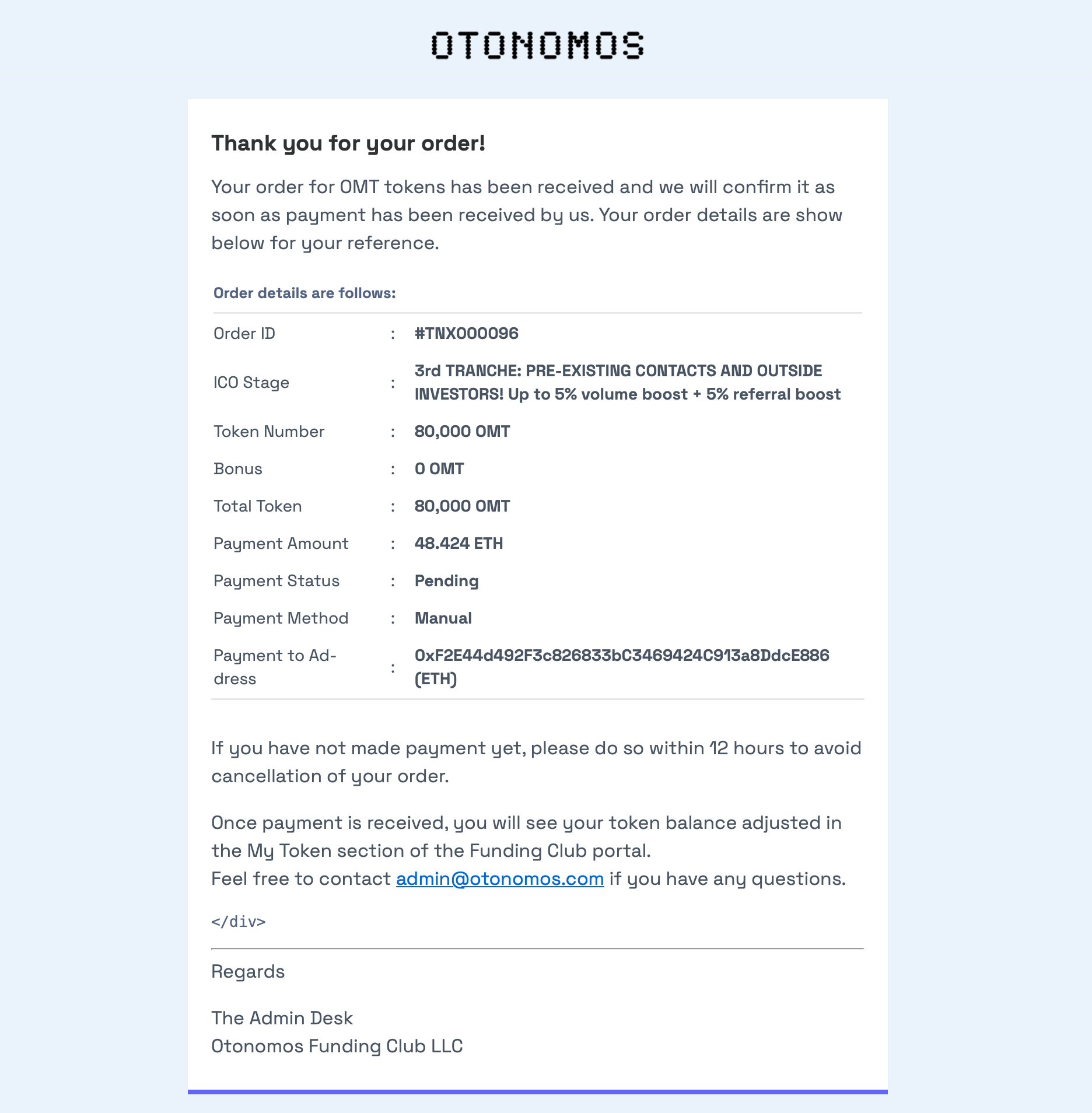

For instance, 80,000 OMT paid for in ETH would be 48.4 ETH at the time of writing (28-Sep-23):

Step 3. Check applicable base and volume bonus

The token boost bar will automatically calculate the Purchase Volume Bonus that applies to your Purchase Amount, in addition to the Base Bonus that applies to the Tranche you come in.

The table below summarizes the bonuses that apply per Tranche:

In the current third tranche, there is a 5% volume boost for amounts over US$400k invested.

Click on “Proceed to Payment”.

Step 4: Payment

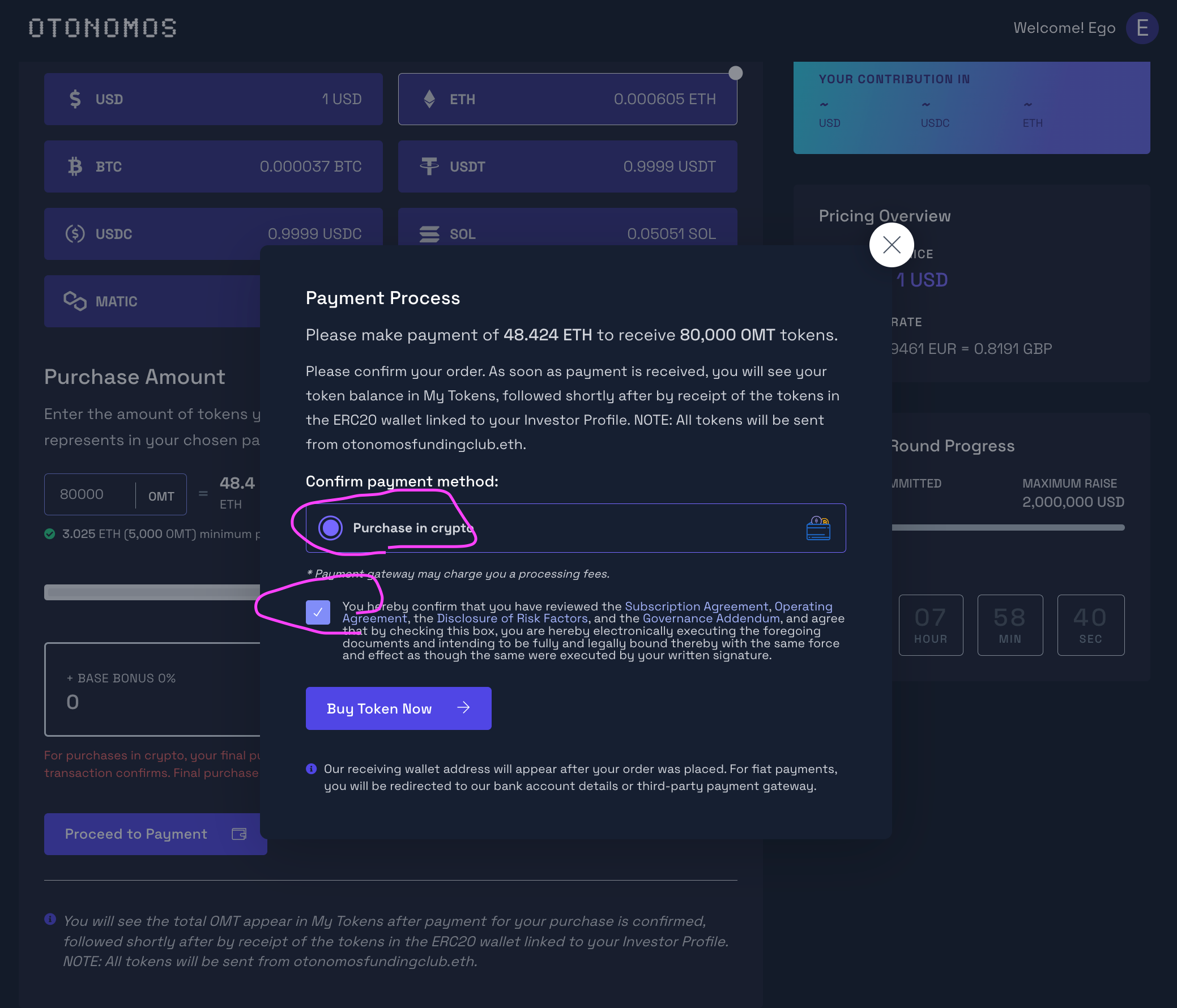

You will now see a pop-up as follows:

Enable the radio button to confirm you wish to pay in crypto.

Next, tick the box below to make the necessary representations confirming that you have have reviewed the Subscription Agreement, Operating Agreement, the Disclosure of Risk Factors, and the Governance Addendum, and to agree that by checking this box, you are electronically executing the foregoing documents and intend to be fully and legally bound by them with the same force and effect as though they were executed by your written signature. Without this representation, you will not be able to proceed.

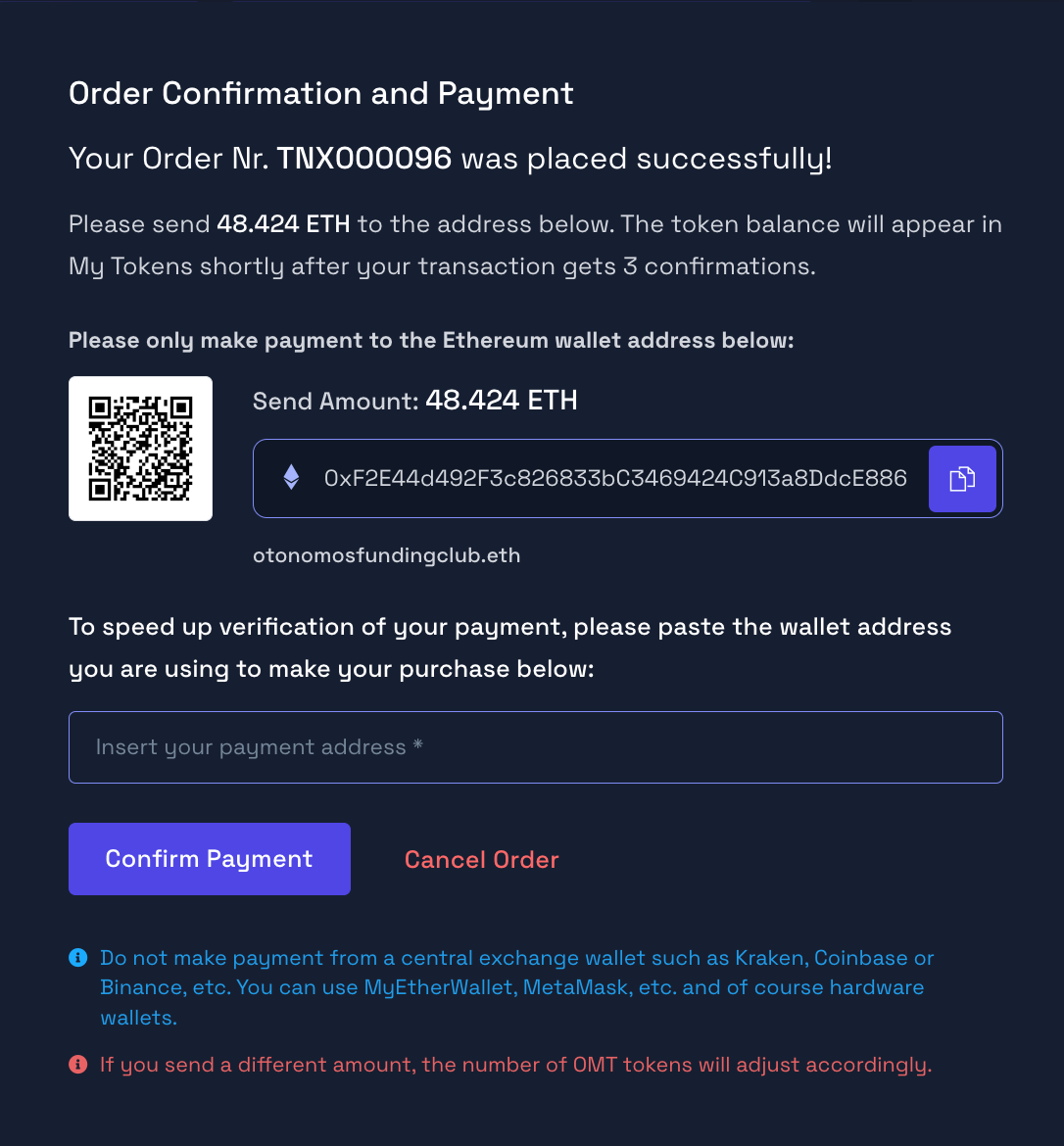

Click on “Buy Token Now”. You will see the following screen (for our purchase of 80,000 OMT at today’s ETH/USD exchange rate, as per our example above):

Paste in the wallet address you will be making the payment from and click “Confirm Payment”. You can also still cancel at this stage.

You will see a pop-up that we will confirm your payment within 6 hours.

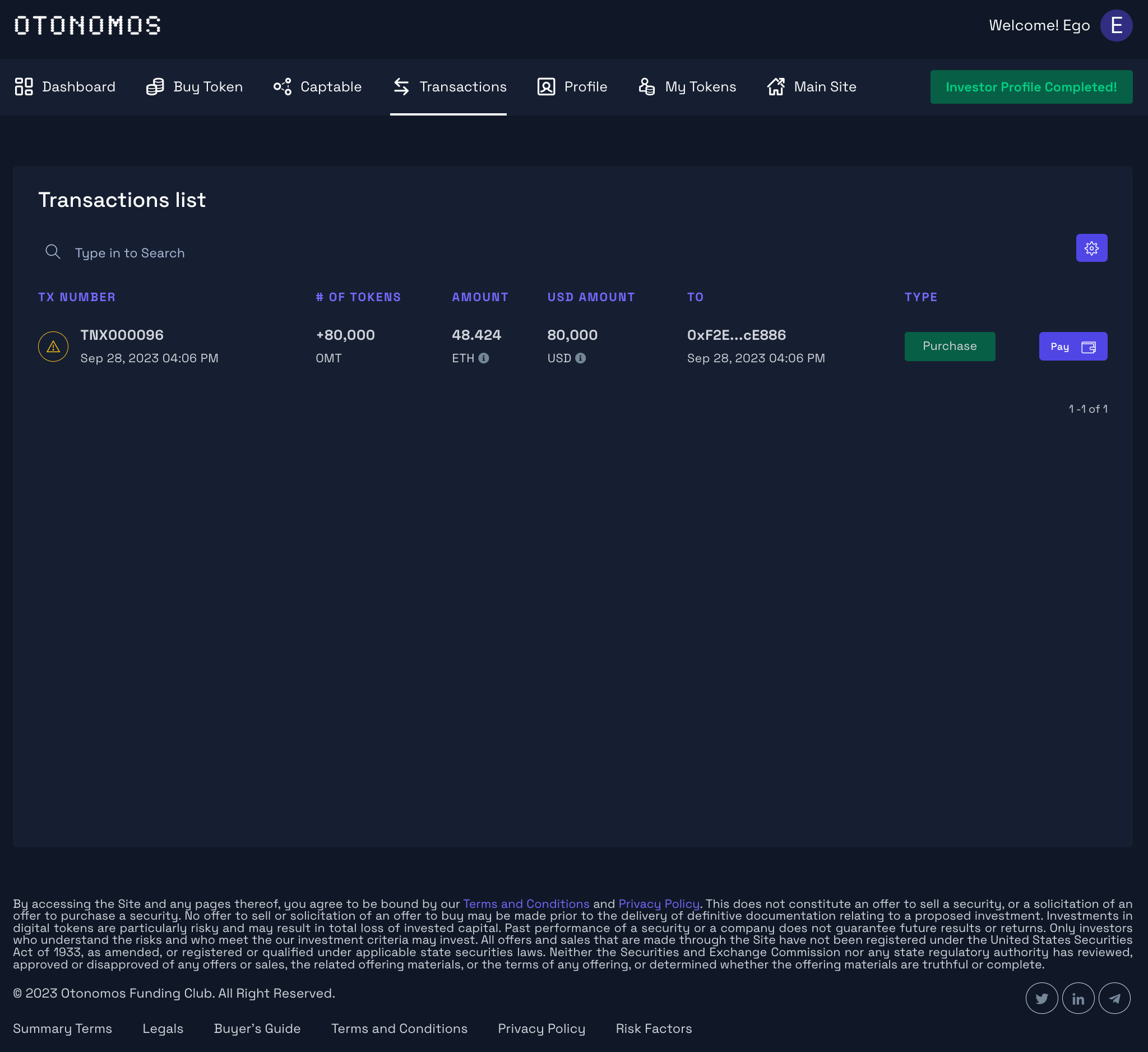

You can also click “View Transaction” to check its status, or access it via “Transactions” in the top level menu:

Shortly after confirming the payment from your side, you will receive an email with your order confirmation:

Payments in fiat

Payments in fiat typically take longer to confirm. When selecting USD as your preferred payment method in Step 1 above, you will see our fiat bank details displayed onscreen after placing your order, and you will receive your OMT as soon as your subscription monies credit our bank account.

You’re in!

As soon as we receive your subscription monies, you will receive the corresponding number of OMT tokens in your designated wallet.

Once the round closes, your subscription monies will be used to purchase 1 dollar worth of shares in Otonomos Holdings for each OMT you hold. These shares will be held in the name of the LLC of which you are now a Member by virtue of your purchase of OMT.

> Create and account and get approved today on fundingclub.otonomos.com to participate in Otonomos’ first external capital round set to end on 30 November at midnight PST.