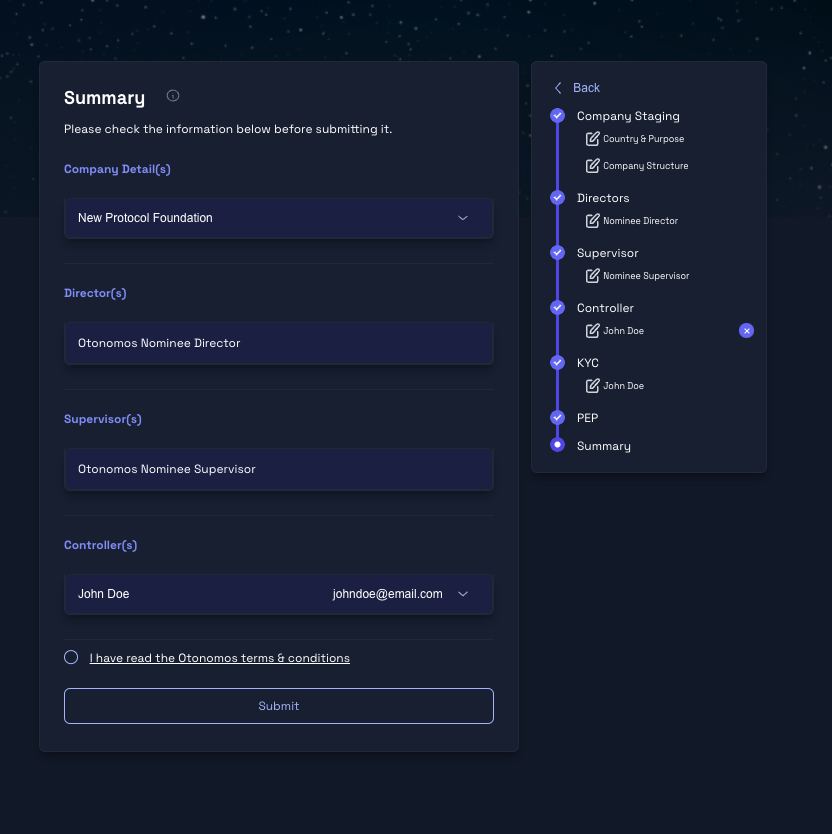

New clients who ordered a Cayman private Foundation or decentralized Web3 Foundation with Otonomos can now stage it fully online from within their user dashboard.

As with our British Virgin Islands staging module, our online activation steps build on each other rather than duplicating information already provided, aiming to make the activation of your new entity a more delightful workflow.

After you ordered and paid for your Cayman Foundation online, an interactive navigation menu on the right of the screen shows where you are in the activation process and makes it easy for you to cycle back and forth through the steps.

Remind me: why again do I need a Cayman Foundation?

On the occasion of pushing this online staging module live, we thought it would be helpful to recap why a decentralized, founderless Cayman Foundation is likely to eventually be part of your Web3 entity stack.

Before we do so, we first discuss the alternative, more traditional use case of a Foundation as an asset protection or philanthropic vehicle with a named Founder, similar to the common law trust which we’ll discuss in the last part of this post.

Wealthy dudes and dudettes

Foundations have traditionally been used by wealthy individuals and families to pledge part of their assets for the benefit of descendants or unrelated beneficiaries in the case of a charitable Foundation.

We are all familiar with the names of Andrew Carnegie and John D. Rockefeller who are credited with establishing the first modern Foundations (resp. in 1911 and 1913), and supersized modern non-profit Foundations such as the Bill and Melinda Gates Foundation, which had close to US$70 billion in endowment as of end 2022.

Irrespective of when they were established, these Foundations function in broadly the same way, applying the business corporation model to the creation of "general purpose" foundations governed by self-perpetuating boards, with professional staffs and permanent endowments, and a wide mandate, such as Rockefeller's "to promote the well-being of mankind throughout the world."

The key characteristic of Foundations, preserved across all jurisdictions, is indeed their ability to extend grants, often referred to as “the venture capital of philanthropy”.

Found your own Foundation

In contrast with charitable Foundations, family (sometimes called “private”) Foundations are established with named beneficiaries and used for capital preservation and asset protection purposes across generations.

Their governance is generally much simpler with a limited Board, a named Founder and named beneficiaries.

Inevitably, the major offshore jurisdictions got in on the action and adopted a Foundation structure, which in the Cayman Islands is modeled on the Limited Company, with a Board, shareholders (called Members) and Beneficiaries.

At the same time, these Foundation Companies can make grants (rather than pay dividends) to named beneficiaries (rather than shareholders) and are established with a specific purpose in mind.

This ability to grant assets including to non-members (shareholders) does set Foundation Companies apart from standard companies, which can only ever pay dividends to shareholders out of profits.

This means your own Foundation, with you as Founder bringing in assets (including crypto), can make pledges to your named beneficiaries either whilst you are alive or after you die. In this respect, private Foundations operate quite similar to trusts.

Taxation may be triggered at the moment of a Founder pledging assets and Beneficiaries receiving grants, but (at least in Cayman) there is no taxation at the Foundation level itself.

Cayman “private” Foundations can be ordered online via otonomos.com and are widely used in crypto by holders of digital assets who are concerned about asset protection and inter-generational transfer of wealth.

And with an initial one-time setup cost of just over US$5k, you don’t have to be a Carnegie or Gates to establish your private Cayman Foundation holding your crypto, either directly or via subsidiary holding companies.

Decentralized, founderless “Web3” Foundations

As seen above, private Foundations compete with other asset protection and wealth planning vehicles, most prominently trusts.

However, when refurbished for Web3 purposes, the Cayman Foundation does not have any real competition.

Such refurbishing is possible thanks to Cayman law allowing Foundations to be established without founders and without members.

In addition, Otonomos together with other crypto practitioners pushed for recognition of token holders as “indetermined” beneficiaries of a Cayman Foundation.

This allows token holders to receive benefits out of the Foundation, first and foremost voting rights but also monetary benefits, without being members or named beneficiaries, which would trigger KYC on each threshold individual token holder.

In a decentralized project with liquid democracy, such KYC would be impractical and for all intents and purposes redundant, as token holdings are dissipated to the extent that nobody can claim actual control over the project.

Cayman Web3 Foundations too can be ordered online from otonomos.com and once ordered, our new staging site only needs the details of the project leads, the Foundation’s Director and its Supervisor. The latter are typically provided by Otonomos as Nominee.

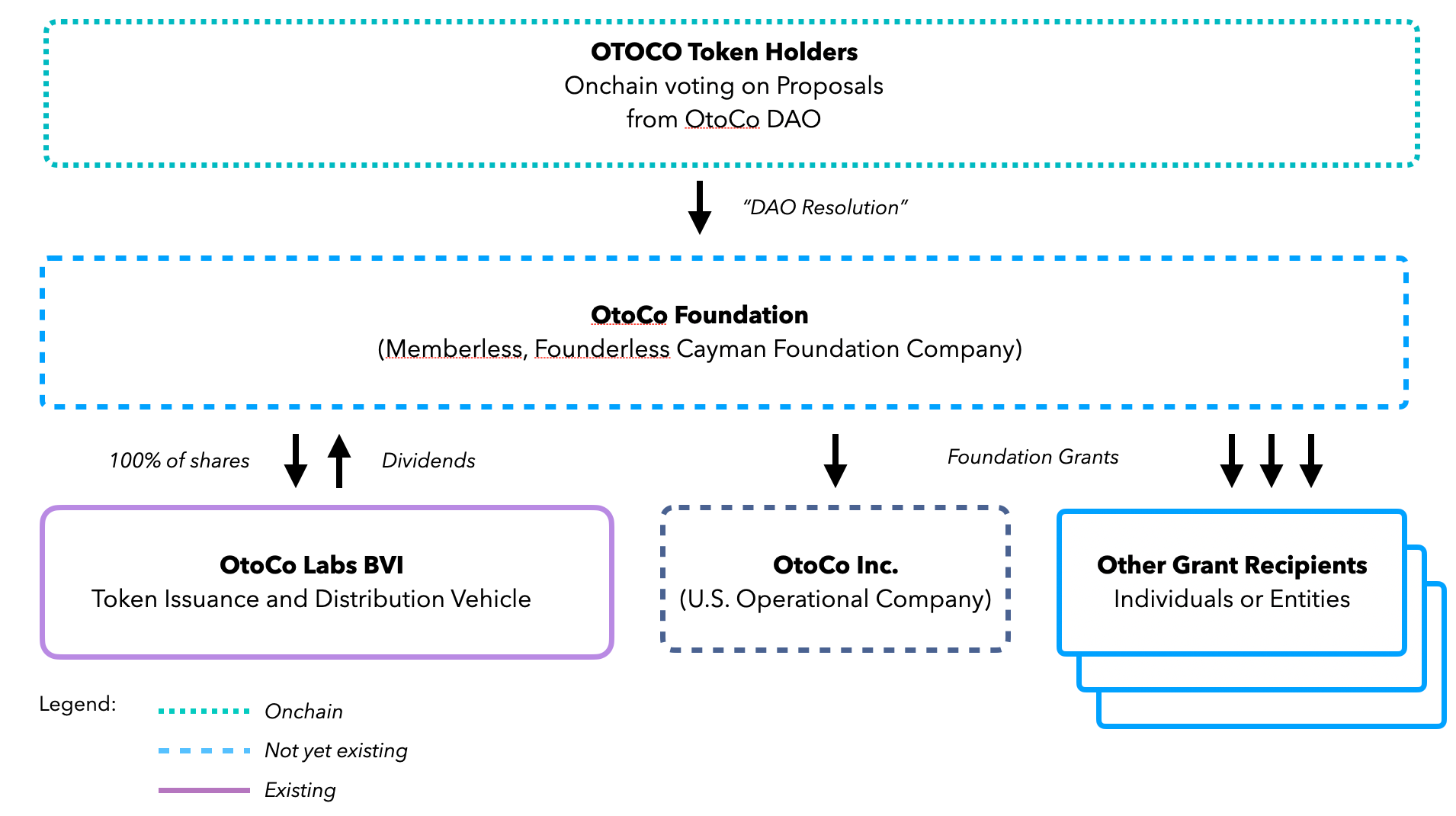

An illustration of a decentralized stack including a Foundation

To illustrate the typical Web3 Foundation setup, the diagram below outlines the decentralized stack of OtoCo, a spin-off of Otonomos that forms legal entities onchain and is governed by its community of OTOCO token holders.

As with most decentralized projects, the OtoCo Foundation is founderless and memberless and is used to manage the project’s Treasury of native tokens and other digital assets, with the ability to extend grants to anybody who helps further OtoCo’s goals.

When maximally decentralized, Foundations such as OtoCo’s subject all decisions to an onchain vote by token holders. In such setup, the Director - a mandatory role in Cayman - merely executes the outcome of a valid onchain vote, and appointed Treasurers are made responsible for all crypto transactions, typically from a multi-sig wallet that legally belongs to the Foundation.

The result is a governance and treasury entity that can act as the genuine steward of a decentralized project, which is no longer depending on the efforts of a few but instead is managed by the many.

Anybody who helps the Foundation achieve its goals can be made recipient of a grant, including the project’s operational entity, which is typically a standard development company (“devco”) owned by the leads, such as a U.S. C-Corp or LLC, a UK Ltd, a UAE entity, etc.

Grants to such operational entity are typically made in crypto and can co-exist with more traditional ways of funding the devco, such as equity.

Conversion from crypto to fiat to cover fiat expenses then typically happens at the operational company level, which means the Foundation can stay fully in crypto and does as such not need a bank account.

Transmitting the wishes of your community

Foundations are controlled by a DAO, not “legal wrappers” around a DAO.

At the origin of all major decision making is the “wish of the people”: the community of token holders who vote onchain on proposals, according to the governance protocol of your DAO (not of the Foundation itself).

This governance protocol is in essence a suite of smart contracts at the DAO level that govern how Proposals can be tabled, how voting takes place, the majorities required, etc.

When a Proposal is adopted under the rules of the DAO, it becomes a “DAO Resolution” which is then passed on to the Foundation for further execution.

To make this transmission legally possible, OtoCo uses a Special Resolution by the initial Directors of the OtoCo Foundation which essentially functions as a mandate given by the token holders to the Foundation’s Director(s) to execute the DAO Resolution.

This means a Director’s powers are strictly limited to what’s been validly voted on at the DAO level, removing possible centralized vulnerabilities.

The Foundation’s Bylaws are an internal document that needs no filing

This special Director resolution in turn refers to the Foundation’s Bylaws, essentially the “legal software” of the Foundation.

These Bylaws are an internal agreement that governs how the Foundation will operate. It is a cornerstone document as it contains the operating manual on how the Foundation’s Directors can be appointed, how grants get paid and how the Foundation’s Treasury generally is managed, etc.

It speaks for itself that changes to the Bylaws themselves are subject to an onchain vote and can only be made pursuant to a DAO Resolution (See Article 13 of our Draft Bylaws).

When drafting OtoCo’s Bylaws, we paid particular attention to the so called “Material Adverse Exception Events” or “MAEE”) which may prevent the Foundation from deferring to the OtoCo DAO code and the DAO Resolutions.

These so called Qualified Code and Material Deference in Article 12 strikes a balance between ensuring continuity for the project and the limits on human intervention in case of a code breakdown.

As part of its engagement with Foundation clients, Otonomos works with you to guide you through the key clauses of the Bylaws and point out areas where you as project lead will need to make choices, most prominently on the degree of decentralization you seek to achieve from day one.

> Use our Calendly link to schedule a FREE 30 mins call to talk about your entity needs, including the use of a Foundation for wealth planning or decentralization purposes.

How does a Foundation compare to a Trust?

Can a Trust achieve the same goal as a Foundation?

The answer is nuanced:

Decentralized Foundations, as described above, for a number of reasons that go beyond the scope of this post, would need substantial rethinking of the trust instrument and the powers of the trustee to replicate the “facelessness” of a decentralized Cayman Foundation and its “indeterminate” beneficiaries.

However, private Foundations are much more suitable to take the form of a trust, be it that their legal mechanics are dramatically different:

A Founder who pledges assets to a private Foundation would still legally be considered the Foundation’s Beneficial Owner if such Founder is also a Member (shareholder) above a certain % threshold, or even without being a Member if such Founder retains the power to change the Foundation’s beneficiaries, which is typically the case. By contrast, in a Trust the settlor who pledges assets to the Trust would not be considered the Trust’s UBO unless named as a beneficiary. KYC of the Trust is therefore quite often limited to the KYC on the Trustee.

A Trust is not a separate legal persona: it is the Trustee who acts on behalf of the Trust, vs. a Foundation which can act on its own as a body corporate.

Trust are more centralized and sometimes entirely circular

From the above, it should be clear that control of a Trust is very much centralized in the hands of the Trustee, which is one reason why Trusts would be difficult to decentralize.

So who would want to give away control over their assets by pledging them to a Trust and then rely on a third party Trustee to look after them?

To answer is that in some jurisdictions, i.a. in Wyoming and the British Virgin Islands, the Trustee legally does not have to be a third party but can be controlled and even directly owned by the very Settlor (Grantor as they are known in the U.S.) of the Trust.

This level of control is achieved by way of a Private Trust Company (PTC) which puts the settlor in control of the Trust by allowing Settlor to become the Trustee of their own Trust.

It is this circularity we will now examine closer in two key trust jurisdictions, Wyoming and BVI.

The benefits of setting up a Trust in Wyoming and BVI

By way of refresher, Trusts, which are a staple of common law, have 3 main components:

- The Settlor: This is the creator of the trust; the Settlor decides what assets will be “held in trust”.

- Trustee: The Trustee has the legal title to the trust assets but is under an obligation imposed by the trust to administer the trust in a specific manner; their level of discretion may vary between different types of trust.

- Beneficiaries: As suggested by their title, these individuals (or entities - or even animals!) receive the benefit of the trust; in some jurisdictions, they are known as beneficial owners of the assets, but hold no legal title over them.

Although trust law in the BVI is based upon English Common Law, whilst Wyoming trust law is based upon centuries of US trust case-law and precedent, they still share similarities in the benefits they offer:

- Self-settled Trusts: Wyoming is only one of a few states that allows someone to form a Trust and list themselves as a Beneficiary, as does BVI.

- No income taxes: both jurisdictions impose no income taxes or Trust income taxes, and any capital gains earned by the Trust asset will not be taxed at the Trust level in either jurisdiction.

- Privacy: Both jurisdictions offer strong privacy in regard to your Trust instrument, which is considered a private document with no requirement to disclose it to the public or registering it. However, Wyoming holds a key advantage in this regard for non-U.S. nationals or U.S.-resident taxpayers: whilst the BVI is fully compliant with exchange of information regimes between tax authorities such as FATCA and Common Reporting Standards, the US isn’t a signatory of the CRS, and thus doesn’t automatically exchange financial account information to tax authorities of the jurisdictions where the Settlors and Beneficiaries of a Trust are tax residents.

Private Trust Companies

As mention above, one key concern when creating a trust in any jurisdiction is the degree of control that is lost by the creator: Once a Settlor settles the Trust, the legal title of their assets is passed onto the Trustee.

Although the Trustee is under an obligation to follow directions laid down in the Trust instrument, this doesn’t guarantee legal compliance: if a Trustee were to take a legal action contrary to their obligations to act in the best interest of the Trust, third parties would most likely be unaware of such Trustee acting outside their fiduciary obligations. If the Trustee’s act is irreversible, then the Settlor or Beneficiaries would have to pursue other means of compensation.

Although there exist forms of combatting rogue Trustees in both Wyoming and the BVI and there are of course professional Trustees who look after third-party Trusts for a living as licensed institutional Trustees, a Private Trust Company (“PTC”) is the most effective way to rid oneself of these control worries, as it removes the middleman completely.

Such a PTC is a company created by the Settlor in order to act as Trustee to the Settlor’s very own Trust.

They’re typically used by high net-worth families who want greater familial control over their assets as opposed to leaving them in the hands of a corporate Trustee acting on their behalf.

PTCs are beneficial for a number of reasons:

- Control: The Settlor can retain a high degree of control and involvement without prejudicing the legal validity of a Trust structure.

- Familiarity and continuity: The PTC will be more familiar with the circumstances involved in the creation of the Trust than an institutional Trustee. This means that the Trust assets are less likely to experience disruption caused by potential turnover of staff, often seen with institutional Trustees.

- Flexibility: Due to being in control of the PTC (whether as a director or manager), the settlor is able to tailor the scope of the role and powers of the Trustee.

- Individual liability: A PTC avoids the risk of personal unlimited liability which can arise in instances of individual trusteeship.

How to setup a PTC

Although the benefits are the same, the methods of creating a PTC are different in Wyoming and BVI, and their relative differences can either be an advantage or disadvantage depending on the type of Trust which the PTC is to manage.

- BVI

The Banks and Trust Companies Act 1990 (BTCA) generally prohibits ‘trust business’ within the BVI without a valid license. However, The Financial Services (Exemptions) Regulations 2007 provide an exemption for PTCs to obtain a trust license, meaning companies acting as PTCs in the BVI can conduct ‘trust business’ (acting as a trustee) free from most common restrictions.

In order to meet these exemptions however, the company must still be a limited company (whether by shares or by guarantee), and must be on the BVI’s Register of Companies. Its trust business can only consist of ‘unremunerated trust business’ or ‘related trust business’, and so any trust business solicited from members of the public is prohibited.

- Trust business is “unremunerated” if no remuneration is payable/received by the PTC or any person associated with it (this includes individuals with a legal or beneficial interest, a (former- ) director or (former-) employee of the PTC)

- “Related” trust business simply means business related to the trust in question or a group of related qualifying trusts (a trust where each beneficiary is a ‘connected person’ e.g. spouse, descendants, in laws)

A BVI-based Registered Agent is vital to the PTC: without one, a PTC cannot be created in BVI. Otonomos, when acting as its clients’ Registered Agent to their PTC, has the following role:

As your local agent, we complete the PTC’s formation process by filing for its registration in BVI. Apart from its name and formation date, no record related to a BVI PTC are publicly available. The formation process includes:

Naming: The chosen name shouldn’t be misleading or imply a link to governmental bodies, public institutions, or imply that the company carries business as a public trust company.

The name cannot include the terms ‘trust’, ‘trust company’ or ‘fiduciary’ and instead must have the abbreviation ‘PTC’ placed immediately before the ‘Limited’ or ‘Ltd’ in the company name.

The Memorandum of a PTC must include the following information:

Company name

A statement declaring it is a PTC

Company type e.g. limited by shares

Address of the first registered office of the company in BVI, which Otonomos provides

The name of the first registered agent of the company. Agents to a PTC must hold a Class 1 trust license under the BCTA

The duration of the company

The powers and restrictions of the company e.g. the sort of business the company is limited to

In addition, we provide the PTC with Articles of Association which includes information as to how the internal affairs of the company will be managed. Note however that due to the confidential nature of a PTC, the Articles do not have to include information typically found within standard Article of Association, such as directors names.

Registration:

A PTC is in of itself not a Trust, and so requires registration like any normal company, though as already mentioned the trust itself does not

Registration involves an application to the BVI’s Registry by filing the PTC’s Memorandum signed by the Registered Agent.

Once approved, the Registry will issue the PTC’s Certificate of Incorporation.

Once operational, Registered Agent must be satisfied that the PTC complies with the requirements of the Regulations (see above);

In addition, we ensure that up-to-date records in respect of the PTC and the Trust are kept at the Registered Agent’s office in the BVI. These include:

Trust deeds or any documents evidencing the Trust (and any documents which vary the terms of said Trust)

A register of directors

A register of members

Any documents which show that the PTC hasn’t solicited trust business from the public and is only carrying out ‘unremunerated trust business’ or ‘related trust business’

Hasta la VISTA, baby

Following enhancements to the Virgin Islands Special Trust Act (“VISTA”) in May 2013, the range of trusts for which the PTC can act as a sole trustee for has expanded to include BVI “purpose” or “VISTA” trusts.

VISTA trusts are an innovative trust designed to hold shares in a BVI incorporated company which allows the Trustee to disengage from management responsibilities in relation to the company’s affairs. This allows the company and its business to be retained and run as its directors see fit.

In order for a VISTA regime to apply, its existence must be specified in the Trust instrument.

The Settlor of a VISTA Trust can be (and typically is) a non-national and non-resident.

Importantly, you do not require a BVI trust license to be a co-trustee as long as one of the trustees is a PTC. This means all that’s required locally to form a VISTA Trust is the Registered Agent of the PTC.

In order to settle a Trust itself, you must either have a ‘Settlement of Trust’ signed by the Settlor and Trustee or a ‘Declaration of Trust’ which only requires the Trustee to sign.

Wyoming: The State that often goes its own way, also in its Trust laws

Wyoming is a second jurisdiction that allows for Private Trust Companies. Arguably it is even easier to setup a Wyoming PTC compared to BVI, as the PTC is often a Wyoming LLC which are instant and fast to incorporate:

PTCs in Wyoming are governed by the Wyoming Chartered Trust Company Act. Pursuant to the act, a PTC can participate in Trust company business for family members but may not provide services to the general public.

Unlike in BVI, there are two forms of PTC in Wyoming:

A regulated PTC tasks the Wyoming Division of Banking with examining the ‘condition and resources of the chartered family trust company, the mode of managing the company’s affairs and conducting its business, all records […] and such other matters as the commissioner may prescribe’.

By contrast, an unregulated PTC is a self-governed entity akin to the PTC found in BVI, though subject to conventional fiduciary rules and the duties and powers set forth in its Operating Agreement.

In Wyoming, PTCs can also be created as two different companies, unlike in BVI. It can either be a corporation, governed by a board of directors; or an LLC, managed by member/managers.

Whilst a PTC is formed under the State laws of Wyoming, its members and/or managers can be from anywhere, including from outside the U.S. In fact, Wyoming Trusts settled by non-residents are common, as not only can Trusts in Wyoming be settled with a high degree of privacy, the Trust and its underlying holding companies are not considered U.S. entities (despite being registered there) which means most assets they hold and invest in - even U.S. assets - will be outside of the scope of the IRS (with very limited exceptions) on the basis that the Settlor is not based in the U.S.

No capital contribution is required to form a PTC and there is no upfront KYC at the point of formation. This means that especially if the PTC is formed as an LLC, it will take at most 72 hours.

The operation of a PTC is governed by the Operating Agreement or the Bylaws in case of a Corporation.

A PTC will typically have 3 committees, though the structure is flexible to each situation:

An Investment committee

A Distribution committee

An Amendment committee

Conclusion: New use cases for old entities

Otonomos is further digitizing the company formation and corporate services space by bringing the staging and activation of entities whose setup was traditionally very analogue online.

In doing so, we gradually go from Blockbuster to Netflix, digitizing entity setup and maintenance in an industry with zero or very low tech.

With our online staging module for Cayman Foundations, we removed a pain point for our clients who use Foundations either for their individual asset protection needs or as part of the legal stack of a decentralized project.

In the former use case as a vehicle for cross-generational asset protection, the Cayman Foundation competes with the age-old trust, which when properly refurbished, can fulfill a similar role.

In addition to setting up and looking after private and decentralized Cayman Foundations, Otonomos can help in settling your Trust in both the BVI and Wyoming, including the formation and maintenance of your PTC.

> Please use our Calendly to schedule a FREE 30-mins call.