Despite the events of this month, we didn’t think readers needed one more opinion on FTX in this Otonomist, however we do share some observations. Further, under our Intel Swap header, we share actionable knowledge about where to optimally set up your Web3 entity, and invite you to try our new wizard on otonomos.com. Finally, we take a closer look at the latest governance drama at MakerDAO.

Let’s sit tight, we’ll come out of this stronger!

Han, CEO

FOUNDER’S NOTES

CeFi’s Savior Syndrome

Post FTX, amidst calls to “let crypto burn” on the one extreme and chants for more regulation on the other, people forget that conmen and charlatans are of all times.

So is humanity’s capacity to fool itself: the belief that some investments are so good they are true, that there are shortcuts to value creation, and that there are saviors with a magic formula how to become grotesquely rich in less than 3 years.

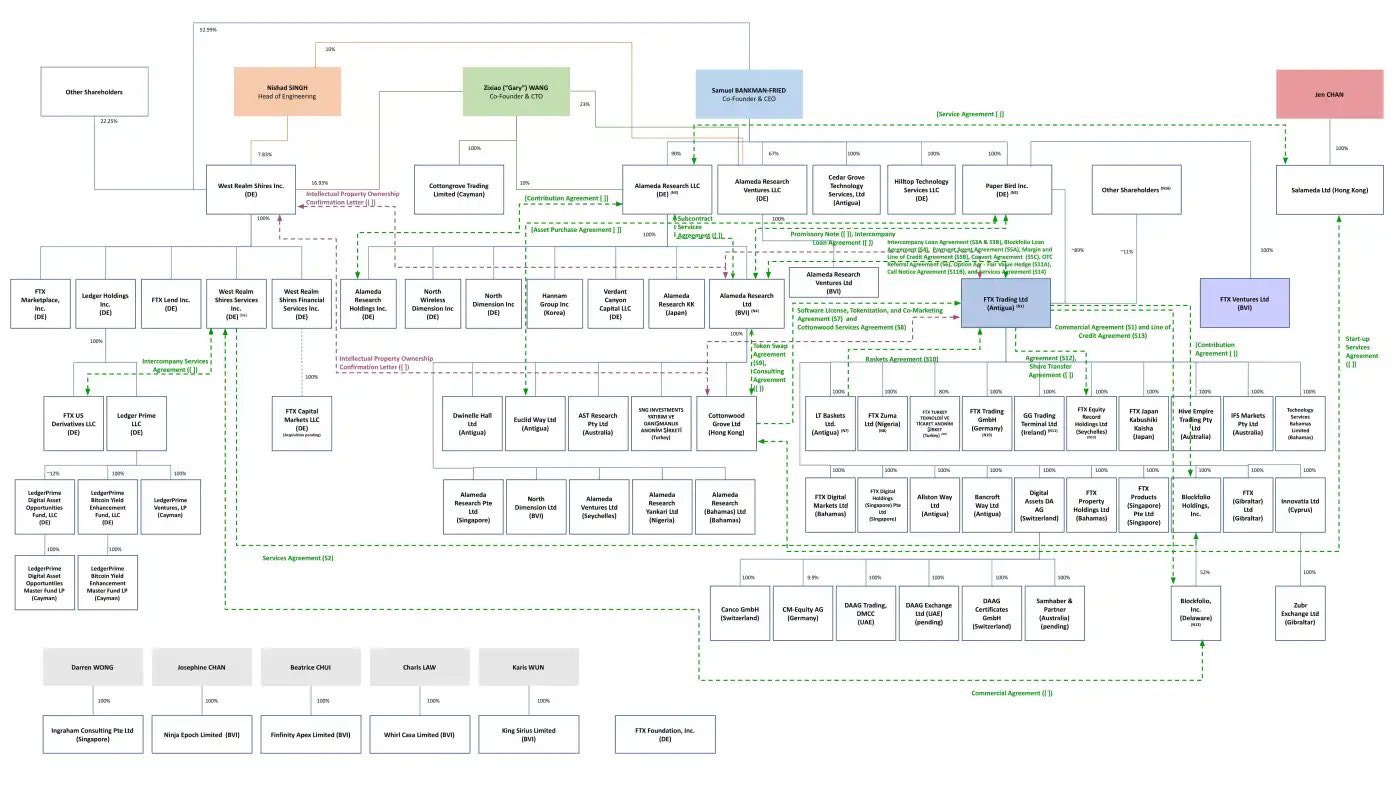

Back in June, we reported the arrival of “Wall Street mutants” in crypto, against the background of Three Arrows Capital’s collapse. Since, FTX is gone and more CeFi dominoes have fallen or are falling.

We then wrote:

Despite the fawning over Sam Bankman-Fried or CZ by a large part of the crypto crowd, centralized exchanges such as FTX or Binance and related proprietary trading outfits and market makers such as Alameda Research or Genesis are not champions of DeFi but rather mutants of the worst viruses of Wall Street.

CeFi is a grotesque caricature of finance by Wall Street sorcerer-apprentices whose greed can roam freely in a largely unregulated space.

Meanwhile in Defi…

Meanwhile in DeFi, major protocols, despite steep price falls, kept finalizing transactions, asset-backed stable coins kept their peg, and open-source smart contracts underpinning key blockchain primitives such as multi-signature wallets and decentralized domain name registrations have proven unstoppable and unperturbed.

DeFi is the groundswell movement happening right in front of our eyes, unless you’re waiting for that crypto savior.

PRODUCT UPDATE

Find Your Bearings In Blockchainland With Our Free Wizard

This month, we introduced a new feature on otonomos.com that helps doers and investors in Web3 find their bearings across jurisdictions and entity stacks.

Our free wizard triages structures by use case, based on hundreds of data points we gathered from previous client work, to suggest a workable setup.

Try it out today or help us make this better by sharing your experiences, from ease of formation to bank account opening to general crypto-friendliness, via the Otonomos Intel Swap Telegram group.

INTEL SWAP

Ten Dos and Don'ts for Web3 Entrepreneurs Deciding If and Where to Incorporate

Going free solo without legal entity is always an option, but DAOs have their limits and liabilities. Here are 10 dos and don'ts to help you decide if and where to incorporate:

1. Don’t “wrap” your DAO in a legal entity

2. Don’t participate in DAOs as a natural person

3. Don’t optimize for tax before you have revenues

4. Decentralize ASAP

5. If you want to offer your token in the US, you know what to do

6. Distribute your project tokens from a special purpose vehicle

7. Decentralize your project by having your token holders control a Foundation

8. Incorporate your DevCo early

9. Coders should revaluate business skills

10. Document everything

Read the full post on each of the above to help you decide on an optimal setup.

UNBOUND THINKING

The MakerDAO Telenovela: Governance Drama Serialized

MakerDAO was one of Otonomos’ first clients when back in 2014 Rune came to see us and explained MakerDAO’s use case for its overcollateralized stablecoin DAI.

Two years later MakerDAO launched and today, it is still one of the leading decentralized stablecoin issuers.

In addition to an economic experiment, from the outset Maker has also been a governance experiment.

However many would argue that whilst it succeeded at the former, it failed at the latter.

This post is not meant to retell MakerDAOs governance telenovela. Rather we want to use the case of MakerDAO to illustrate how difficult decentralized governance actually is, and invite readers to think how scaling and decentralization could coexist.

We will use late December and early January to read and reflect so the next issue of The Otonomist will be on Thursday 24 January 2023, as usual brimful with intel, unbound thinking and product updates. See you then and happy holidays!