We live in strange times, with bank runs caused by the very Government actions that caused banks to lose money.

While the full backstop of all deposits may ultimately result in the implosion of fractional reserve banking and accelerate the mainstream adoption of crypto, crypto projects and investors face the clear and present danger of being cut-off from fiat on- and off-ramps.

Whether a deliberate rerun of Operation Choke Point or a knee jerk reflex by TradFin paranoid about losing access to the Fedwire system, the practical result is that crypto businesses are facing real challenges in opening and maintaining fiat bank accounts.

In what follows, we report from the field with what we see happening. We then share some tips and tricks on what worked for Otonomos clients who got banked.

I. Report from the trenches

A. Animal Farm

We see a dynamic in which the big boys manage to maintain fiat banking relationships and open new accounts because they are either historically cozy with banks (e.g. crypto hedge funds as part of a broader hedge fund group) or because the sheer size of their account (e.g. Swiss banks who treat crypto whales as private banking client and expect at least 1 million in fiat on account at all times).

More generally, institutional-type players in the crypto space, such as the bigger funds including VC, regulated OTC desks, but also the Tier 1 crypto exchanges and some major infrastructure projects, still seem to be able to bank undisturbed, but may have had to do some extra plumbing work after the closure of Silvergate and Signature.

Most of this plumbing activity has been a diversification away from one or two banks in an effort to reduce counterparty risk. In this sense, CeFi is trying to save itself from TradFin…

In the case of Circle, the issuer behind the USDC stabelecoin, after the faithful Friday 10 March when its wire for over US$ 3bn out of Silicon Valley Bank didn’t clear, resulting in USDC losing its parity with the USD over the weekend of 11-12 March, Bank of New York Mellon stood by Circle and is now reportedly holding most of its fiat bank deposit collateral.

Only in January, its collateral banks included Signature, Silvergate and SVB together with 4 more banks including BNYMellon.1 This means that, assuming the remaining banks mentioned in Circle’s January report still hold USD collateral as of the time of this post, its number of collateral banks is now down to four, though Cross River Bank seems to have been added in the last days.

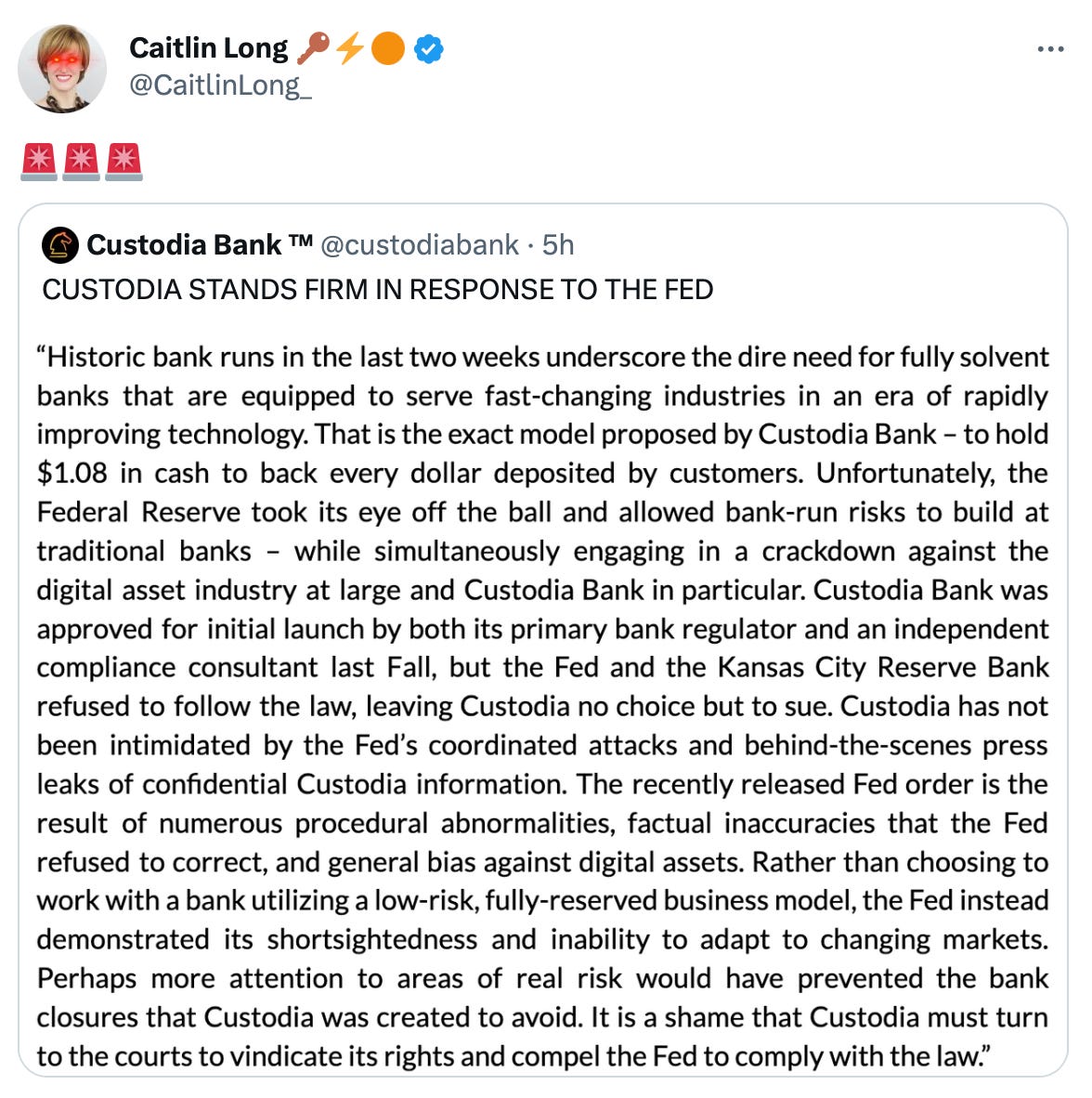

Overcollateralization is unsafe and unsound, according to the Fed

Ironically, the first fully-collateralized Special Purpose Depository Institution applying for a Federal banking charter, Caitlin Long’s Wyoming-based Custodia Bank, saw its application rejected by the Federal Reserve as potentially “unsafe and unsound” despite its legal obligation to hold cash equal to 108% of deposits, whilst fractional banks that only hold 6% in deposits in cash are considered safe and sound.

In the Animal Farm world of banking regulators, it seems not only are some pigs more equal than others, some candidate banks don’t even have pig status and are banned from the farm.

B. Buidlers are made to suffer

The above “accredited” approach, in which institutions still seem to get banked but smaller players and startups are not, risks strangling the bottom-up Web3 innovation from which ultimately a lasting crypto economy will emerge.

Unless we find a way to cater to unbanked crypto projects, we will see further financialization of crypto similar to what happened in TradFin, leading to zero value-add to the real economy.

As with the real economy, it is the smaller crypto businesses that create most of the value, do most of the innovation, grow faster and employ more people than all of the big players taken together.

Computer says no

However it is also those projects that now feel the brunt of the recent developments, as they typically still depend on fiat payments for day-to-day payments such as domain registration, email hosting, cloud server space, contractor invoices and payroll.

Typically, their online bank account application is rejected as soon as they use the C-word for crypto.

This is why, when Otonomos helps its crypto developer clients open a bank account, we use the more generic “software development” when asked to describe the client’s activity.

In addition, when prompted what type of software, we specify “distributed ledger technology” to get round banks’ apparent disgust for crypto (see Section II below).

Such description doesn’t in any way misrepresent, since developing on DLT actually is what crypto devs do!

TradFin hastening its own demise

However there may also be a silver lining in TradFin and the Establishment trying to choke-off retail crypto.

It would only take one “Too Big To Unbank” player such as Amazon, Apple, Google, Microsoft, or Walmart etc. to accept digital currencies as payment - perhaps starting with stable - for the system to become a closed-circuit in which everything can be paid for in crypto.

If the big household names were to start taking payment in digital currencies for all the stuff we currently still need fiat for, then we may wake up one day and see everything priced in crypto, since the risk they’ll be choked off from the fiat system is minimal.

In such scenario, fiat access for end users incl. entrepreneurs becomes less relevant: everything can be paid for in crypto, from your email hosting service to your AWS.

C. Infantilization by banks

A third observation related to banking services is how patronizing banks are vis-a-vis risk takers generally and crypto entrepreneurs in particular.

Singapore

Supposedly crypto-friendly Singapore allows for a royal SGD 100 per month to be sent from your exchange account into your bank account. That buys you about two Negronis in expensive Singapore.

Previously, if you held an account with Coinbase Singapore, you could not offramp any of the crypto you sold for SGD into your Singapore bank account. You were basically forced to first send your crypto from Coinbase to another local exchange which in turn gated how much you could offramp, with commissions accumulating at every point so you end up with 4% less money.

This has changed since Coinbase was granted a payment services license in Singapore but the on- and offramp limits are still low.

At the heart of all this is the Monetary Authority of Singapore which basically doesn’t trust its citizens and has been very patronizing with regards to crypto for retail.

U.K.

But even the UK infantilizes its citizens instead of treating them like grown-ups, and has done so pretty much since 2021, well before the collapse of Silicon Valley Bank and the closure of Signature and Silvergate in the U.S.

More recently, UK banks seem to have hardened their stance, with increasing complaints on Twitter that U.K. banks have been banning transfers to and from crypto exchanges for retail users.

- NatWest began limiting customer payments to crypto exchanges to 1,000 British pounds (US$1,232) per day and 5,000 British pounds ($6,161) over a 30-day period, to protect consumers from “crypto-criminals,” according to a recent announcement.

- Nationwide and HSBC both announced similar restrictions.

- Spanish bank Santander, which has U.K. branches, limited transactions to crypto exchanges last year to 1,000 British pounds per transaction, while U.K.-based Starling bank said it no longer supports the buying and selling of cryptocurrencies by debit card or bank transfers.

- Revolt and Wise have provided some relief to consumers but they too are now increasingly surveilling customer activity.

- Only TAPGlobal reportedly allows for smooth crypto on and off-ramps for individual customers.

For U.K.-based crypto businesses however, it is now nigh impossible to get a bank account:

- Starling has never directly banked crypto companies.

- NatWest came out with a recent statement saying the bank does not “currently offer banking facilities to businesses [that] buy or sell cryptocurrencies”

- Standander UK issued a deadpan statement saying that “all decisions about onboarding new bank accounts for businesses are on a case-by-case basis based on the specific details of each business”.

What this basically means is no crypto, thank you.

This has prompted CryptoUK, an industry group, on 21 March 2023 to write a letter to the U.K. Treasury expressing its concerns about the introduction of blanket bans and restrictions of transfers from UK banks to crypto asset platforms, pointing out that:

[T]he introduction of these measures will have the effect of fundamentally undermining the Government’s ambition to become a crypto asset hub and its mission to maximise the potential of Web3 to spur UK growth and innovation.

The fear is now that Payment Services Providers in the U.K. may follow suit and impose similar blanket bans.

Wise already asks business clients if they have any direct crypto-related activities, not just in the U.K. If so, you won’t get a Wise account.

U.S.

The U.S. is arguably the epicenter of the recent tremors as a result of the closure of two banks that majorly catered to crypto clients, Silvergate Bank in San Diego and Signature Bank in New York, in what many see as an unwarranted regulatory action at best and a concerted effort to choke off crypto from the fiat banking system at worst.

There is also a stubborn narrative that Silicon Valley Bank, the losses of which were caused by exposure to boring bonds which fell in price when the Fed started to raise interest rates, somehow imploded because of crypto.

Whether preemptively or deliberately, there seems little doubt that it will be harder for crypto doers and investors short-term to find reliable banking services in the U.S. as a result of recent events.

Whilst (helpfully) there is no legal blanket ban, we’re seeing more intrusive questioning in practice about a business’ activities, and especially smaller companies and retail platform are being turned away.

There’s also anecdotical evidence of startups seeking solutions via community credit unions and crypto credit cards.

Crypto concentration

Some of the allergy banks have vis-a-vis crypto and why a next Signature or Silvergate may be some time coming is that no bank wants to be exposed to a particular industry, especially a light-footed one such as crypto.

But no doubt it is the regulators’ tone and its scaremongering around deposit concentration and liquidity risks that has banks look the other way.

With hindsight, the statement issued by the joint U.S. bank watchdogs of 3 January 2023 in this respect could as well have pre-announced the closure of Silvergate and Signature Bank.

Nonetheless, there is a widely held perception in the industry that banking is still possible for crypto firms that are registered as money-services businesses with FinCEN and maintain state money-transmitter licenses.

Such state money-transmitter licenses are not the most arduous to get, depending on where you apply, and may be one of the failsafe conduits between crypto and fiat in the U.S.

Another conduit are custodian firms, such as Etana which is the offramp solution used by i.a. Kraken. Etana Custody is a chartered trust company regulated by the State of Colorado’s Division of Banking and have so far continued to processes off-ramps from Kraken without hiccups.

Trust the market

More generally, we believe U.S. citizenry culturally doesn’t like to be infantilized and even though Otonomos has recently seen a significant increase in enquiries about offshore entities and banking for U.S.-based clients, the opportunity is just too big in the U.S. for crypto-friendly players to not emerge, perhaps with a more diversified deposit base compared to Silvergate’s and Signature’s.

Banks such as Mercury.com for instance seem quite foresighted in onboarding U.S.-based blockchain development companies (but less so for trading outfits), including LLCs controlled by non-U.S. Members.

Some big institutional players, such as Franklin Templeton and Fidelity, are headed by rather hardcore crypto fans with resp. Jenny Johnson and Abigail Johnson as CEOs (no relationship, and both woman CEOs!).

Within a couple of years, octogenarians such as Warren Buffett and Charlie Munger who relish dumping on crypto will probably have died out and a nouvelle garde of investment professionals will oversee massive pools of money that will not be able to afford not to be exposed to crypto as a new asset class.

So whilst we’re short-term a bit gloomy, medium term we trust the market to drive solutions.

D. The offshores: Shady banks in sunny places?

In the petro-dollar days of open-top cars, flared trousers and cigarette smoking on airplanes, one could open a bank account for any offshore entity pretty much anywhere, including in the offshores centers themselves.

Those days are gone, perhaps an indication of how much our financial freedoms are being curtailed and surveillance of our lives has increased, because all evidence points to an actual increase in the component of dirty money in the financial system, despite all the KYC/AML/CDD intrusiveness we have to cope with everyday.

Even Singapore, arguably built on corrupt money from adjacent countries and other neighbors further north, now no longer opens accounts for offshore entities, with limited exceptions.

The offshores themselves have a dwindling number of banks (most still using fax machines…), with some not even able to make international wire payments, and others only reinforcing the image of shady banks in sunny places - europacbank anyone?

However we have seen some openings with BVI-based banks especially in the fund management space and for holding companies. We also have contacts with Bahamas and Bermuda based banks.

The main issue however is that offshore companies are not good operational entities: you can’t really do payroll, lease offices where people are actually working from, and get a working tech infrastructure incl. SaaS subscriptions in place with an offshore entity, so the utility of a bank account for your offshore entity may be limited.

The exception is perhaps Panama which we consider more of a “mid-shore” jurisdiction in which a company can have both a holding and operational use, similar to a Singapore Pte. Ltd.

Panama also does have a number of local banks that - if you have local representation - will open an account for your company, including for the right type of crypto business.

Otonomos has people on the ground in Panama who constantly asses which banks consider what activity of the right type. Panama has therefore become on of our key focus areas when clients need a company + bank account.

Switzerland

Switzerland has traditionally offered refuge to anybody who needed banking services, but its approach to banking is decidedly private client-focused so most banks prefer to cater to individuals rather than working companies, let stand startups.

Two crypto friendly banks, Sygnum and SEBA, are resolutely institutional in focus.

Liechtenstein has VP Bank (which has a branch in i.a. BVI ) and of course Banque Frick, but each expect high account minima at all times (from US$250k up to $1MM with Frick).

Switzerland is however no longer the place to bank confidentially since it acceded to the OECD’s Automatic Exchange of Information on the basis of the Common Reporting Standard (CRS), and recently lost a fair bit of its lustre when it let the slow accident that was Credit Suisse happen overnight.

The CCP to the rescue!

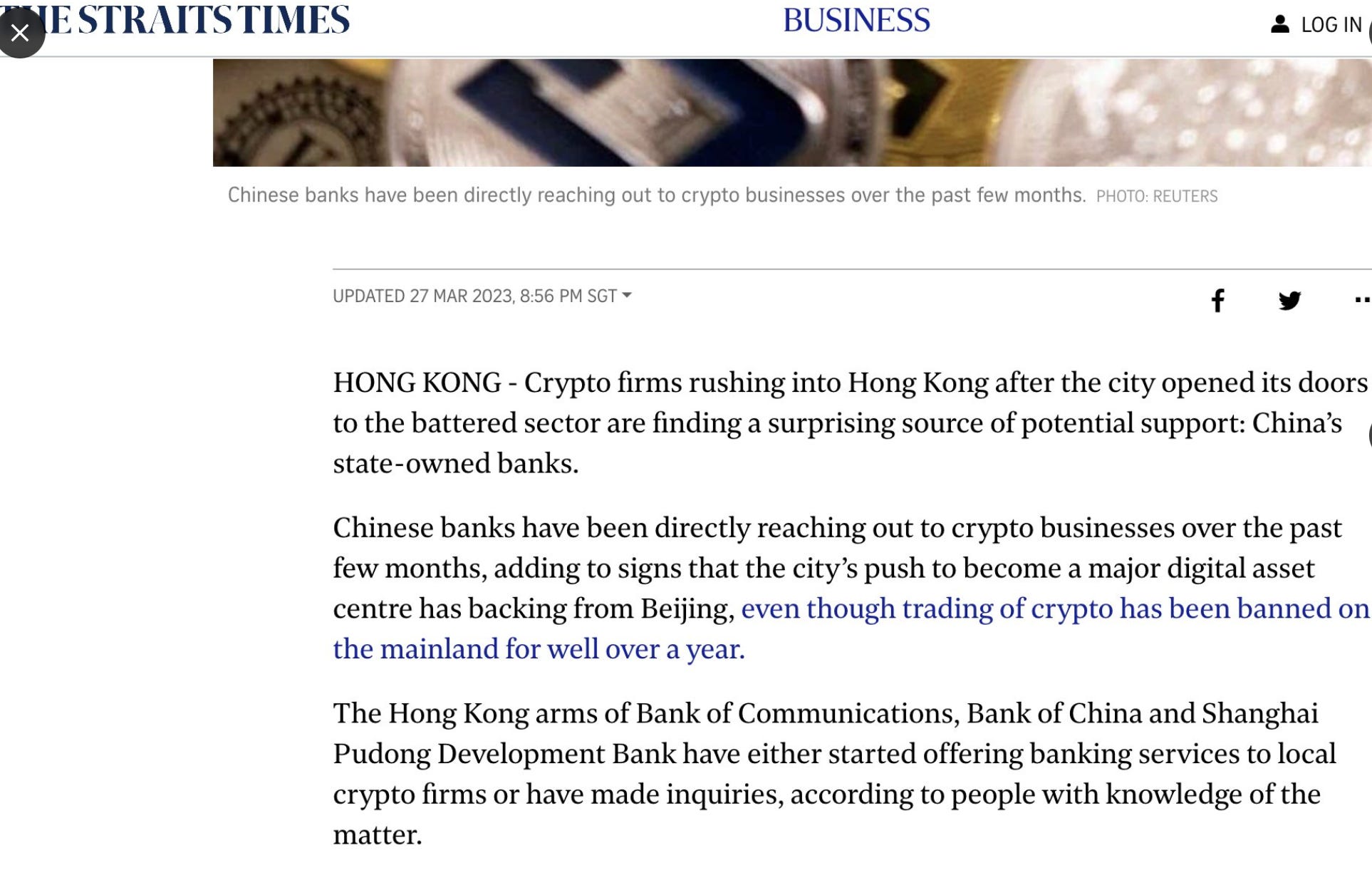

Post-COVID, Hong Kong is desperately trying to (again) gain top place at the table of the world’s financial centers and recently made all the right noises to seek to attract the crypto crowd.

Now China’s State-owned banks are reportedly luring Hong Kong-based crypto companies to bank with them, despite Mainland China’s ban on crypto.

We’re still waiting the outcome of a trial opening (or a post on our official Otonomos intel swap Telegram channel that somebody has successfully opened an account for their crypto company in Hong Kong with one of the State-owned banks there) so we’re holding our judgment on whether it’s a viable route.

However, as we know, the CCP giveth and the CPP taketh away.

II. Tips and tricks

In this second section, we share some tips and tricks on what has increased our success rate when opening bank accounts for our clients at Otonomos.

Before we get into the details, two disclaimers:

- None of these “tricks” in any way trick banks in the sense that we would knowingly tolerate or purposefully encourage clients to misrepresent to a financial institution about any of the sections of the account opening process.

- Bank account opening has truly become an arduous and document-heavy task. Otonomos has from the outset adopted a policy that we will not take referral fees for introducing clients to financial institutions who offer us inducements to do so. As a result, not only can we be truly independent in our guidance, we charge for our bank account services in an independent, transparent way on the basis of the work we do. The ultimate decision on account opening is of course always the bank’s.

1. Stack it right

Many of our clients want a bank account for the wrong entity.

Foundations

For instance, you don't need (coz you most likely won’t get) a bank account for your decentralized Cayman Foundation, if all the Foundation does is extend grants in crypto to core units and development companies - including your own - around the world.

Rather, set up a simple software development company (devco) even in a high-tax place, and most definitively where you actually want to live and incur expenses, make yourself its shareholder so you can easily be KYCd locally, and open a central exchange account together with a bank account in the same jurisdiction of your devco.

You then convert the crypto grant you receive from the Foundation into your company’s wallet via your centralized exchange account into fiat and send it to the company’s bank account linked to the exchange.

Once it credits your company’s bank account, you can cover all project-related fiat expenses, add payroll if necessary, get a little debit card to pay for meals and travel, etc.

By all means do not make the Foundation the shareholder of your devco. And if asked where your devco’s revenue comes from: you are being granted working capital the same way legacy charitable foundations can grant funds to anybody who they deem furthers their goal.

Token issuance vehicle

Likewise, there is really no need for you to get a bank account for a special purpose token issue vehicle that only exists to issue your project’s token, for instance a BVI limited company.

In the absence of an airdrop, any sale of your token will be in exchange for crypto. Even a pre-sale under a Simple Agreement for Future Tokens (SAFT) should be structured such that contributions are made in crypto rather than fiat.

The way to then eventually turn the token sale proceeds into fiat is via the devco after the Foundation grants out the token sale proceeds, or in absence of a Foundation, by having your devco invoice the token issuance vehicle in crypto and then do the conversion from crypto to fiat at the devco level as discussed above.

2. Stick to the right script

As indicated earlier, you are not misrepresenting when answering that your devco is engaging in software development when a bank asks what exactly your company does.

When further asked about the type of software, you are not misrepresenting when you specify that you are developing on distributed ledger technology.

Often, we do some research on the bank where we submit your application and in most cases, they will have some internal distributed ledger project running (probably on a permissioned ledger…) which we then refer to to legitimize your tech: if the very bank you apply with uses the tech you’re working on, surely your blockchain tech can’t be the reason why they’d reject your account!

If specifically asked whether you are in crypto, we explain that cryptography is a set of protocols that is being use to keep transactions secure, the same way banks process our card payments or protect our login to our online account with cryptography.

The whole idea is to make the tech you work on sound less esoteric. The bank account application isn't a good place to show off about the zkSNARKS Layer 3 ring signature cryptography you’re developing for a decentralized exchanges automated order matching engine.

Remember that all the poor compliance person (or the algorithm!) on the bank’s side is asked to do is filter your application for activities on the bank’s banned list.

3. Bigger sums

Once open, bigger sums will trigger audits. If such transfers come from centralized exchanges or their offramp conduits, it will likely (though lots depends on the exchange or conduit) be flagged.

Over-The-Counter desks can provide a solution, provided they are established players that have bothered to get regulated, which means you will need to get your company fully onboarded with them.

4. Diversify

If your company account with Bank A is the next mole to be whacked, make sure you have a fallback account with Bank B and ideally a couple more accounts in place.

Also consider using pure virtual banks. For instance, Wise offers virtual bank accounts for businesses based in most onshore jurisdictions, provided they are legit and within their parameters. Once you have the Wise account open, you will be able to have multi-currency accounts with actual wire details and it’s easy to get a debit card on your account, all controlled from their app.

Reports on Wise are mixed and some business accounts get refused or shut down so it is not a permanent solution, but then no fiat solution for crypto startups ever is.

Revolut, despite its name, is less revolutionary than they make you believe and more restrictive in account opening.

5. The U.S. is still the easiest place…

LLCs in the U.S. are still the easiest way to get a bank account for your business, if you play it well.

If you form your company’s LLC via Otonomos, you will have all the corporate documents available for download in your company dashboard on otonomos.com.

At the time of placing your online order, you want to make sure you add the bank account resolution to your basket (only US$80 extra) and, unless you are based in the U.S., the EIN application (US$180).

The latter is an Entity (aka Employer) Identification Number issued by the U.S. Inland Revenue Service (IRS) which any bank will expect you to have before you can apply for an account.

U.S. residents can instantly get this EIN from the IRS website, however for non-U.S. residents the process is very antiquated and requires you to fax form SS-4 correctly filled out, so it is better to let us take care of that. Note: as such the form SS-4 does not have to be signed by you as Member of your LLC, as long as it is signed by a physical person who is happy to act as your company’s contact with the IRS.

If you’re in the U.S. you can now walk into any bank of your choice after making an appointment with a commercial banker and get the application processed then and there.

You will most likely walk out with a bank account and routing number in hand. However it is a good idea to have some proof of U.S. address for your business at hand before you walk in: banks prefer businesses that have some physical operating address (different from the registered address we provide you with in the State where your business is registered). Try with a T-Mobile bill in your name at a local Regus office address first before you start splashing out on a dedicated desk space: most banks don’t seem to really care as long as it is a U.S. address.

Once you have all this done, you can rejig the ownership of your LLC and replace yourself as Member with e.g. a holding entity, but best not before the bank account is open.

Expect this process to become less straightforward when the U.S. register of Beneficial Owners kicks in, which will be maintained by FinCEN, and once banks are required to provide proof that the businesses they bank are actually operating from the U.S.

However for now, foreign-controlled LLCs and of course LLCs with U.S. Members can still quite easily get access to fiat banking.

The same goes for Canadian companies: Banks in Canada will give you full USD banking in addition to a CAD account for your Canadian entity, however you will need to be physically present in Canada for the account opening process, whilst in the U.S. remote account opening is still possible.

For such pure online applications, you will typically be asked for a website for your business. If your company is a devco, you should be able to whip up a quick site that shows its activities as a software development company, its lead developer(s), its address details etc., and some statements about what you’re doing.

In summary, opening a bank account for your company in the U.S. is not as easy as getting a gun as a minor there, but it is doable!

… but Americans can’t bank abroad

While the U.S. may be easiest to get an account for (qualified) U.S. businesses especially when controlled by a U.S. resident or passport holder, the reverse - a bank account outside the U.S. for a company controlled by a U.S. national or resident - is nigh impossible.

Simplified, this is because of rules the U.S. imposes on all foreign banks when Americans look to bank abroad, which hold the banks themselves accountable if their U.S. customer doesn’t report the account back home.

So most banks won’t bother, unless the entity is a fund e.g. a hedge fund entity in BVI which as such is not considered "owned” by its American managers but by the investors in the fund. Such fund entity can then e.g. also benefit from a non-U.S. centralized exchange account and access products such as derivatives that otherwise are not available in the U.S.

CONCLUSION

In summary:

- Start with the right entity stack.

- Identity what entity in the stack actually needs access to fiat.

- Use licensed intermediaries if you plan to take customer money or have a need for big ticket transactions.

- Consider a U.S. LLC you personally control as your fiat solution which can later be made a subsidiary of a foreign holding company.

- For non-U.S. entities, speak to us about what options you have with what banks. We have good contacts in all major banking jurisdictions and our bank account opening service includes all document gathering, the completion and submission of the account application form, and arranging the necessary follow-up with the bank including the appointment for a physical meeting if required.

Otonomos can help you being choked off from fiat banking if you’re a legit builder or investor in crypto, despite everything that’s going on.

> Contact us today for a 30-min call to explore your options.

Note 2 on last page: “Cash held at U.S. regulated financial institutions: Bank of New York Mellon, Citizens Trust Bank, Customers Bank, New York Community Bank, a division of Flagstar Bank, N.A., Signature Bank, Silicon Valley Bank and Silvergate Bank.” ↩