We have used the month of May at Otonomos to diagnose why setting up an investment fund is still such a difficult delivery. In a first post, we are showing how OtoFunds, the dedicated funds portal we developed, is changing all that. We also share what we have seen works as possible DeFi entity stacks, and talk about KYC in the context of crypto.

Enjoy the onset of Summer!

Han, Founder and CEO

PRODUCT UPDATE

OtoFunds: Dragging Investment Fund Formation into the Digital Age (Kicking and Screaming…).

We have used the month of May at Otonomos to diagnose why setting up an investment fund is still such a difficult delivery. Crypto funds in particular need forceps!

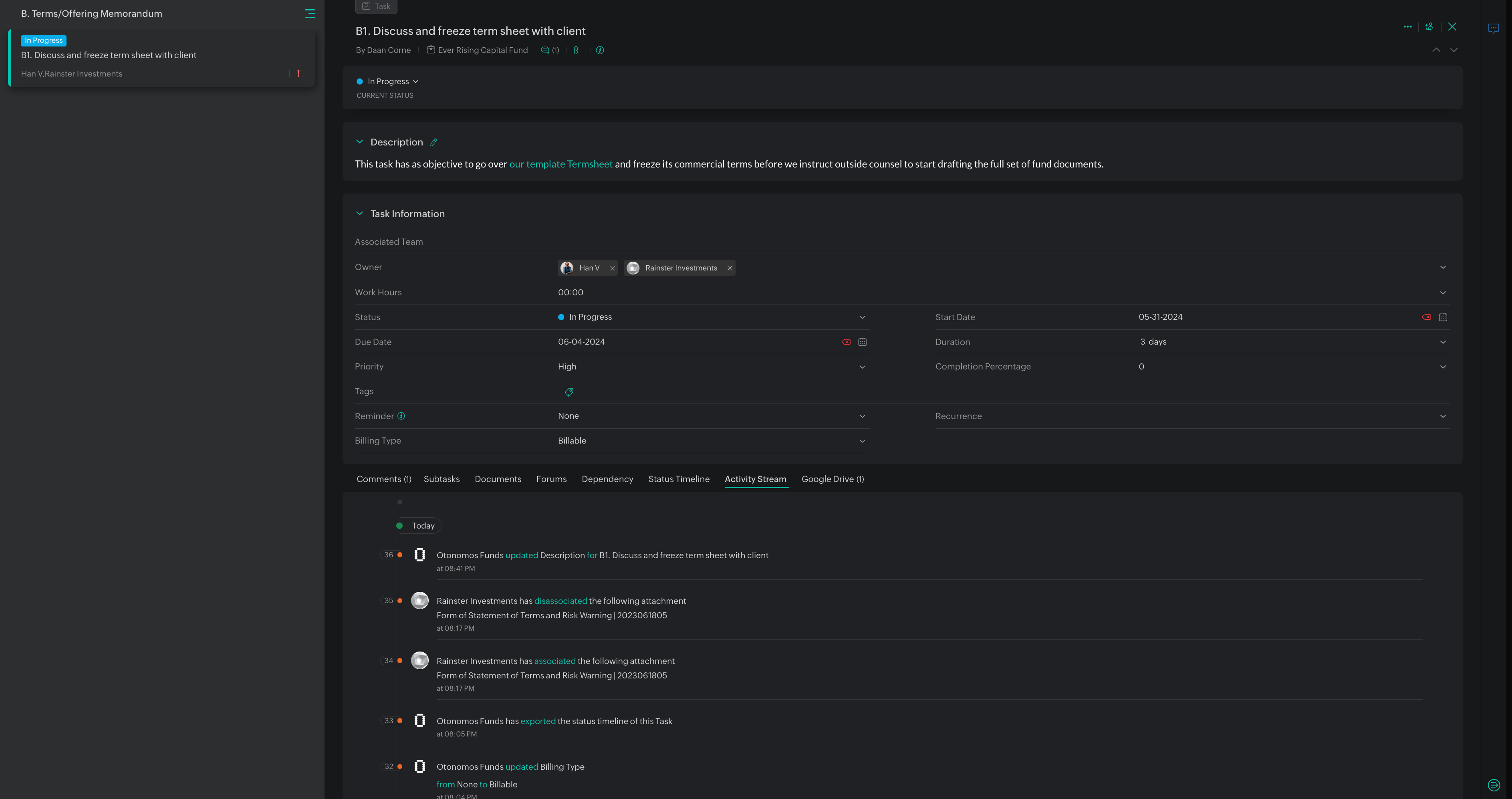

Lots has to do with the fact that a number of service providers have to be choreographed: outside counsel, fund admin, custodians, auditors (if required) and Otonomos who ultimate files for your fund’s incorporation and looks after it.

Managing this process is an ungrateful task as a result of the interdependencies of various tasks by various people.

However the key culprit is not people as such but their inertia to use tech tools: Service providers, with outside legal counsel being the worst offenders, keep using email threads and MS Word attachments, rather than project management tools and shared document folders.

Introducing the OtoFunds portal

We too at Otonomos have been complicit to this analog entropy, but for the last months have been speccing a digital solution which we firmly believe will save our fund clients time, money and aggravation.

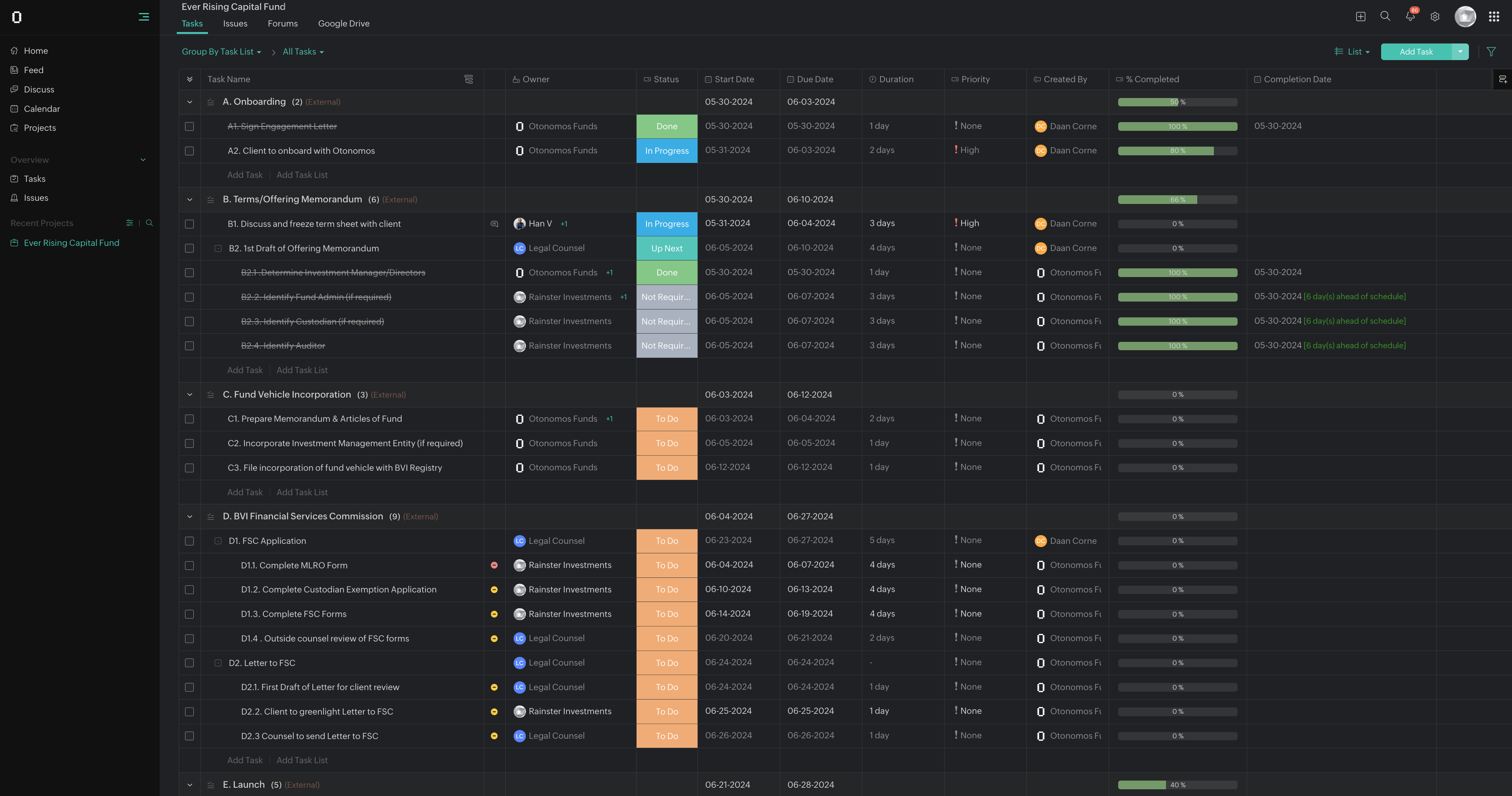

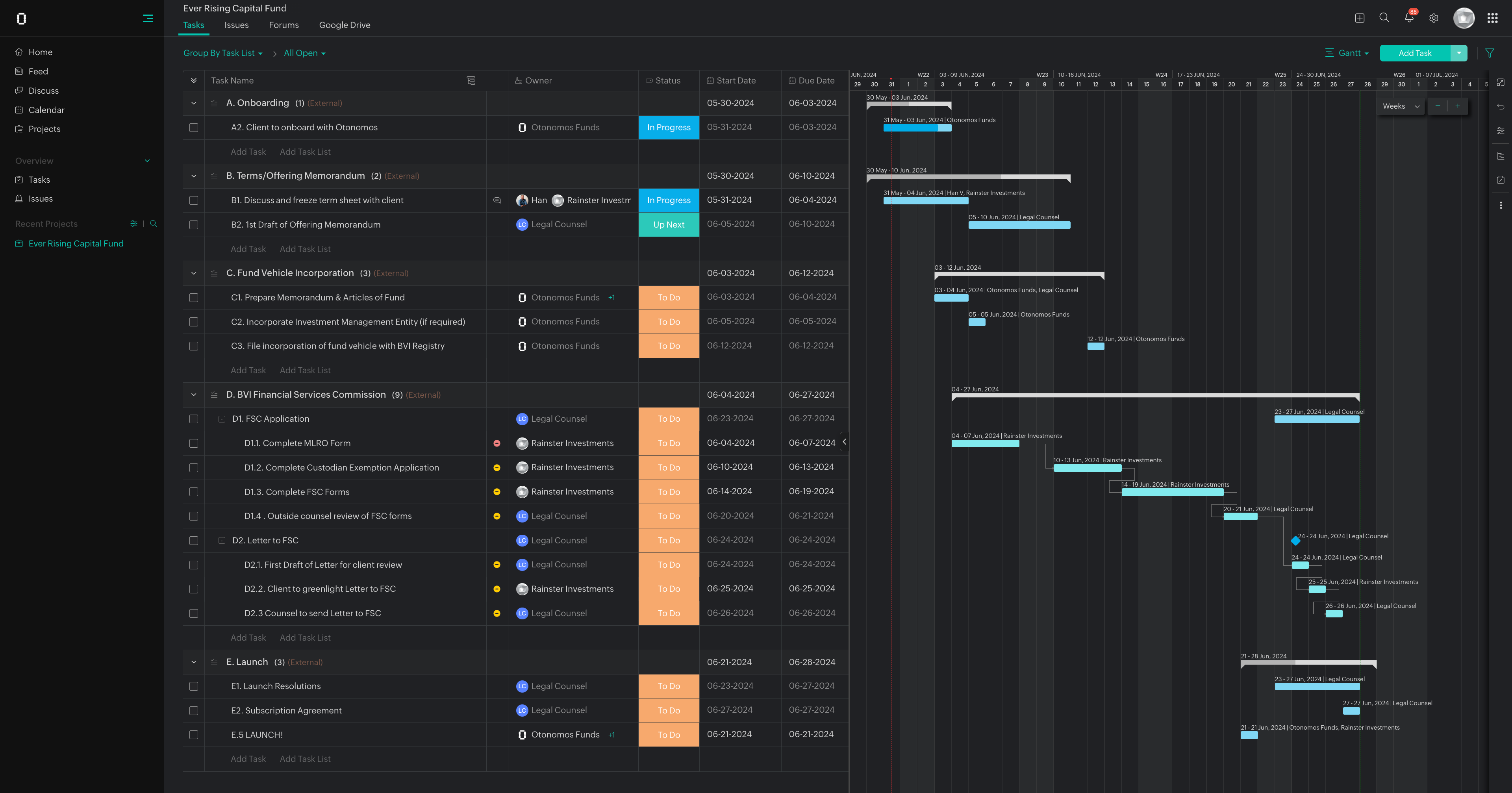

The result is a first version of the OtoFunds portal: a full digital workflow tool that lets everybody involved with the setup of your fund, including you as our client, see the cascade of tasks, their corresponding timelines, and who is owner of each.

It comes with a shared document library for all documents related to your fund, accessible for real-time online editing, including by outside legal counsel. Users can double-click on each task, comment, mark its status and adjust its timeline, which OtoFunds aims to compress to 21 days from order of your fund to launch.

Our funds roadmap: A triptych of fund solutions

The OtoFunds portal is the first panel of what will ultimately become a triptych that brings fund incorporation, capital formation including by way of tokenization (1Q2025), and fund administration (3Q2025) all under one digital roof.

> Reach out to otofunds@otonomos.com to find out more about our fund offering or schedule a FREE initial call about your fund setup.

KNOWLEDGE SWAP

Possible Permutations for Your DeFi Entity Stack

Failure to get some basics right for your DeFi project can lead to hefty fines, project shutdowns, or even worse, jail time.

While the latter is uncommon (and won’t prevent you from running for U.S. President if you are a naturally born U.S. citizen and over 35 years of age), the regulatory gray zones of DeFi governance pose a significant risk.

In this post, we look at some possible permutations for your DeFi entity stack, starting by asking the most obvious question: what are you trying to build?

REGULATORY CORNER

To KYC or Not to KYC: What it is, Why it is Important, and How to Get it Right for Your Web3 Project

Know Your Customer protocols have become essential to Web3 projects.

While never a delight, new tools at least have made KYCing less of an irritant.

In this post, we discuss what you need to know to get the right KYC tools in place for your business.

Next month in The Otonomist: We plan a special June issue on how to fund your project and the fundamental trade-offs between equity or token funding, with plenty free templates including SAFEs, SAFTs, Token Warrants and Termsheets. We also share some thoughts on how we see capital formation evolve from how it is currently done. As always, in your inbox on the last day of June.